Please use a PC Browser to access Register-Tadawul

Is Now the Right Time for Snowflake After Shares Surge 74% in 2025?

Snowflake SNOW | 192.70 | -3.35% |

- Wondering whether Snowflake stock is still a smart buy with its share price higher than ever? Let’s break down what’s really driving both the excitement and skepticism around its current value.

- If you’ve watched SNOW lately, you’ve seen a remarkable run, with shares up 6.6% in the last week, 16.9% in the past month, and an astonishing 74.5% so far this year. This adds up to a 138.0% gain over the past 12 months.

- Behind these gains, buzz continues about Snowflake’s strategic partnerships in the AI and cloud data space, along with announcements of new product offerings and customer wins at tech conferences. These headlines have fueled optimism about long-term growth, but they have also put a spotlight on what investors are really paying for today.

- Our valuation checks find Snowflake is undervalued in just 1 out of 6 key areas, raising questions about whether now is the right entry point. Let’s explore how traditional and alternative valuation methods stack up and circle back to an even more insightful way to judge what SNOW is truly worth by the end of the article.

Snowflake scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Snowflake Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today’s dollar value. This approach helps investors understand what the business is worth based only on its ability to generate cash in the future, broken down year by year.

Currently, Snowflake produces $726.9 Million in annual Free Cash Flow (FCF). Analyst projections, which inform the model for the next five years, expect FCF to grow rapidly, reaching around $1.12 Billion by 2026 and $1.48 Billion by 2027. From 2028 onward, projections are extrapolated, with FCF rising to an estimated $3.17 Billion by 2030. All figures are in US dollars.

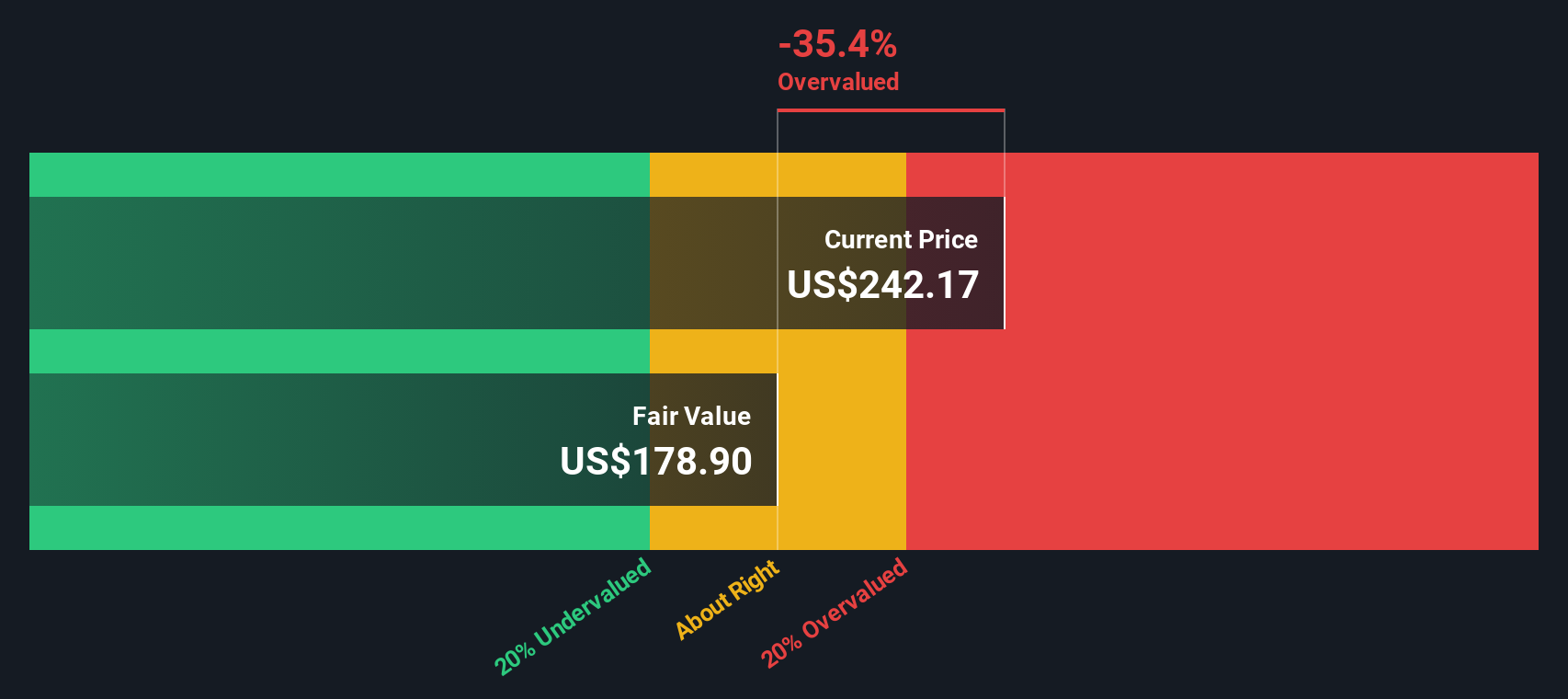

When we discount these future cash flow estimates back to their value today and sum them, the result is a fair value of $175.53 per share for Snowflake using the DCF method. However, this valuation points out that Snowflake’s current stock price is around 56.6% higher than what these fundamentals would suggest.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snowflake may be overvalued by 56.6%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Snowflake Price vs Sales (P/S Ratio)

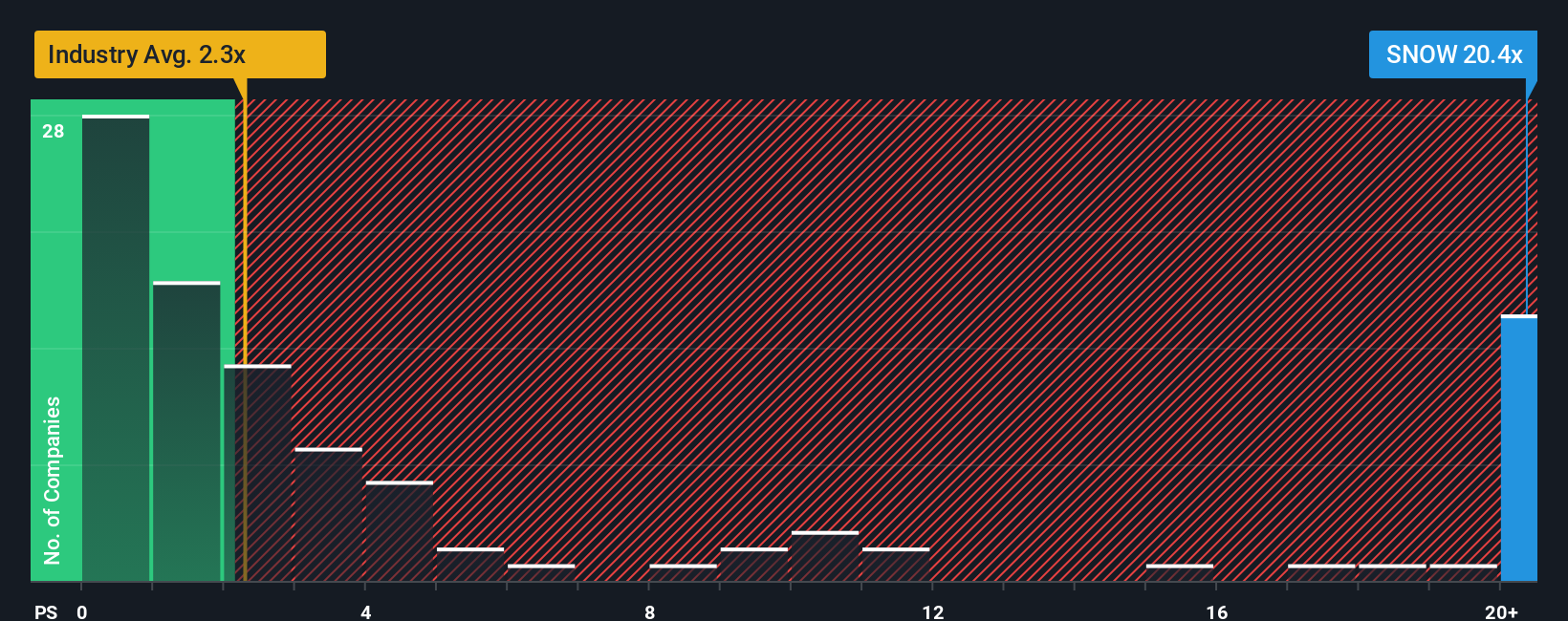

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for high-growth tech firms like Snowflake, especially when a company is not yet consistently profitable. This ratio is useful because it compares what investors are paying for each dollar of the company’s revenue, rather than relying on uncertain near-term earnings.

A company’s “normal” or fair P/S ratio depends heavily on its growth outlook, profitability, and the risks that could impact its future success. Generally, higher revenue growth or a dominant market position might justify a higher multiple, while weaker growth or more risk implies a lower one.

Currently, Snowflake trades at a P/S ratio of 22.6x. That is significantly higher than the IT industry average of 2.5x and also a premium to its peer group average of 24.9x. Simply Wall St’s proprietary “Fair Ratio” for Snowflake is 16.3x, calculated by factoring in not just revenue growth but also the company’s profit margins, industry conditions, market capitalization, and risk profile.

Unlike basic peer or industry comparisons, the Fair Ratio digs deeper and captures the nuances of Snowflake’s unique situation including its leadership in cloud data, rapid revenue growth, and risks from intense competition. Because of this, it provides a more accurate benchmark of what investors should rationally be willing to pay.

Comparing Snowflake’s actual P/S of 22.6x to its Fair Ratio of 16.3x suggests the stock is trading at a notable premium to what its fundamentals justify right now.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snowflake Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets you tell your story about a company by combining your opinions about its future revenue, profit margins, and business drivers into a single, tailored forecast and fair value. Narratives bridge the gap between financial fundamentals and real-world context, making it easy to connect the dots between what a company is doing, what you believe will happen next, and how much you think its stock is worth.

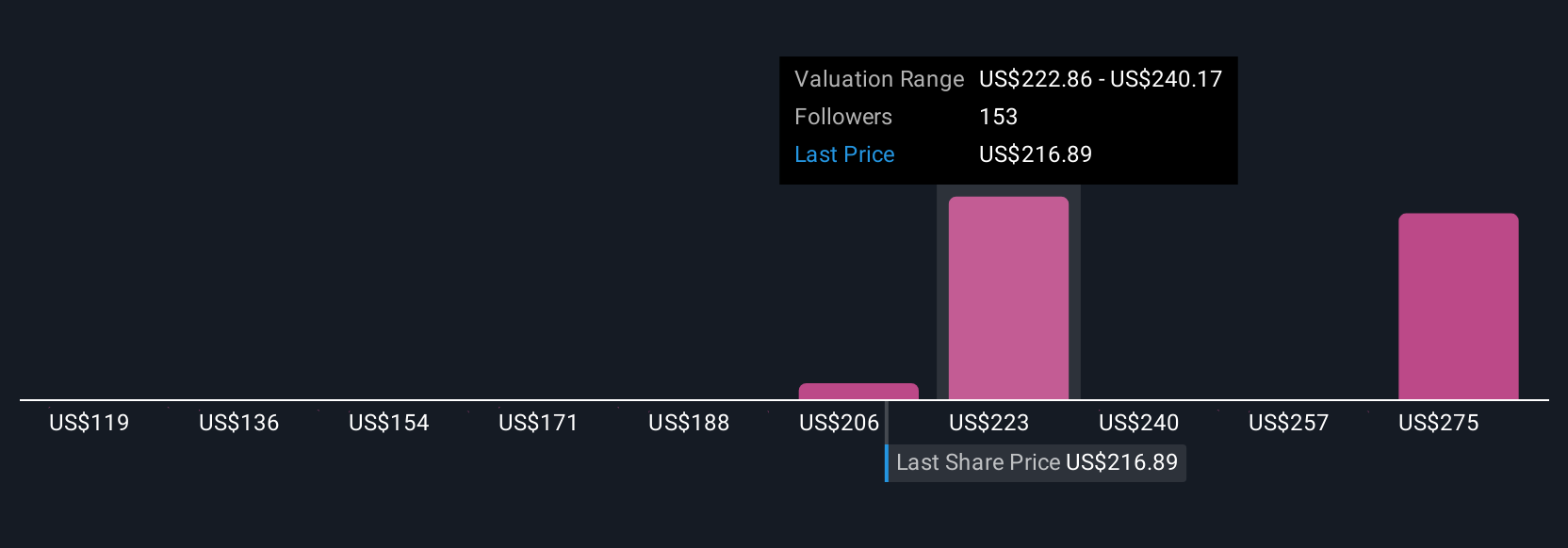

Available on Simply Wall St’s Community page, Narratives are used by millions of investors to make more confident buy or sell decisions by allowing you to compare your fair value directly to the current market price. As new news or earnings releases hit, these Narratives dynamically refresh and automatically update your valuation with the latest information. For example, one Snowflake Narrative might be highly optimistic, forecasting rapid enterprise growth and setting a fair value as high as $440, while another takes a more cautious view and values the stock closer to $170. Narratives put you in control by enabling you to weigh multiple perspectives, so you can decide when the price truly matches your own story.

Do you think there's more to the story for Snowflake? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.