Please use a PC Browser to access Register-Tadawul

Is Pool Corp (POOL) Pricing Aligning With Mixed Returns And DCF Versus P/E Signals?

Pool Corporation POOL | 221.62 | +1.49% |

- If you are wondering whether Pool's current share price still reflects its underlying value, this article will walk you through what the numbers are saying about the stock today.

- Over shorter periods, Pool's return has been close to flat, with a 0.1% move over the last 7 days and 0.2% over the past month, while year to date it is up 15.7% and the 1 year result sits at a 21.5% decline.

- These mixed returns set the backdrop for assessing whether recent news and sentiment shifts have pushed the stock away from what its fundamentals might justify. We will use that context to see whether market expectations and business reality are currently aligned or out of sync.

- On our valuation checklist, Pool scores 2 out of 6 on undervaluation tests, giving it a value score of 2. Next we will look at how different valuation approaches interpret that score, and we will hint at an even more holistic way to think about value at the end of the article.

Pool scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Pool Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business might be worth today by projecting its future cash flows and then discounting those back to a present value. For Pool, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections rather than reported earnings.

The latest twelve month Free Cash Flow is about $396.6 million. Analysts provide specific Free Cash Flow estimates for the next few years, for example $399.3 million in 2026 and $456 million in 2027, with Simply Wall St extending those projections further out, such as $482 million in 2028 and over $600 million in 2034. All of these figures are expressed in dollars and remain below $1 billion, so they are considered in millions.

By discounting those projected cash flows back to today, the model arrives at an estimated intrinsic value of $317.01 per share. That is 16.1% above the current share price, which indicates Pool is treated as undervalued on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pool is undervalued by 16.1%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

Approach 2: Pool Price vs Earnings

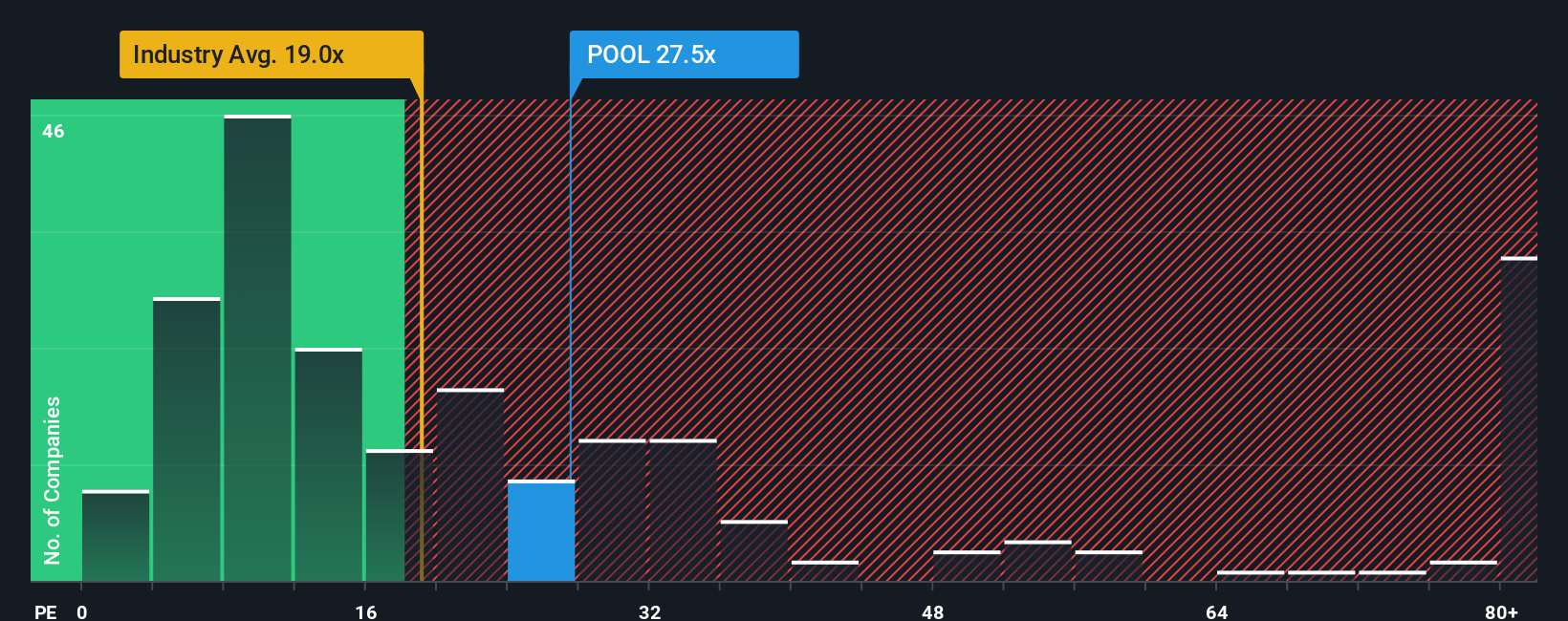

For profitable companies, the P/E ratio is a straightforward way to connect what you pay for the stock with what the business earns today. It tells you how many dollars investors are currently willing to pay for each dollar of earnings.

What counts as a reasonable P/E depends a lot on growth expectations and risk. Higher expected earnings growth or lower perceived risk can support a higher P/E, while slower growth or higher risk tends to point to a lower, more conservative P/E.

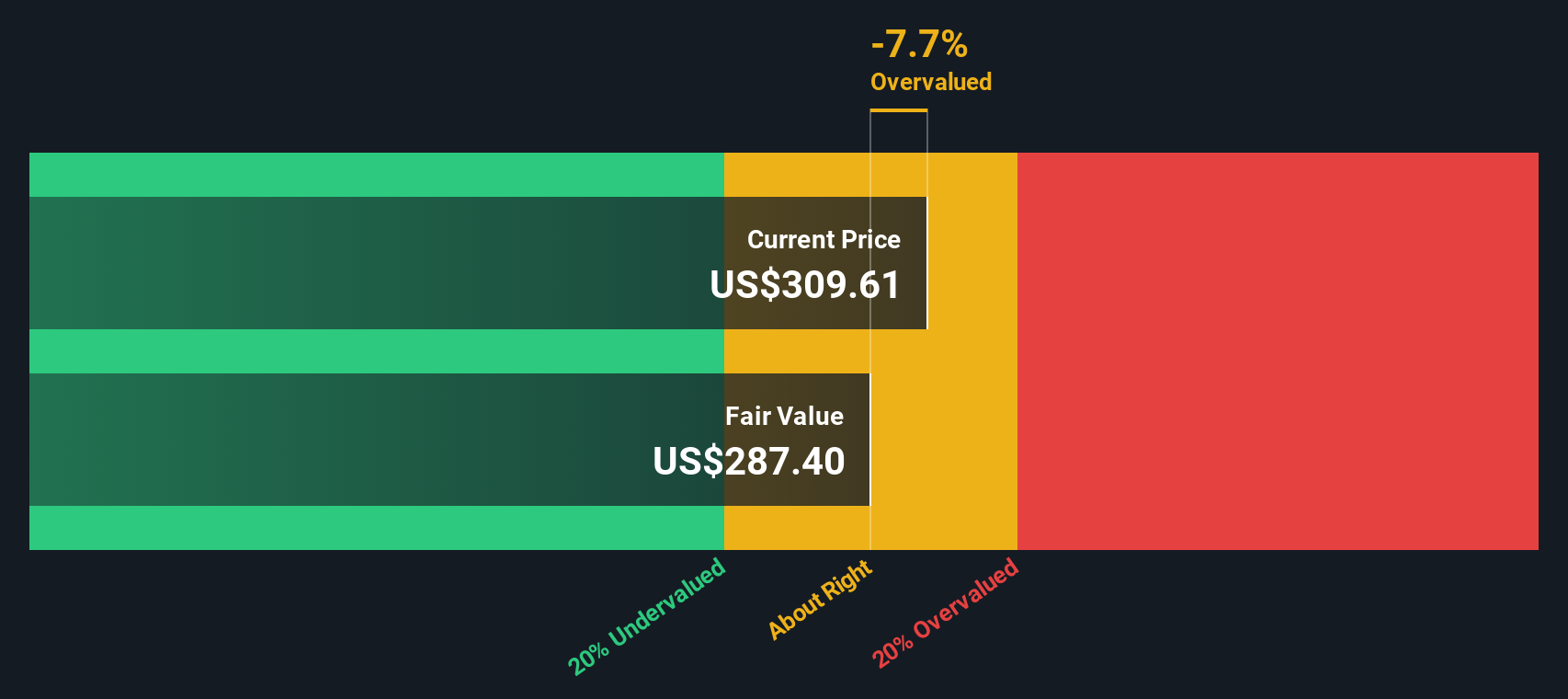

Pool currently trades on a P/E of 24.1x. That is above the Retail Distributors industry average of about 18.0x, yet it is below the peer group average of 46.3x. To refine this comparison, Simply Wall St uses a proprietary “Fair Ratio,” which estimates what Pool’s P/E might be given its earnings growth profile, industry, profit margins, market cap and risk factors. For Pool, this Fair Ratio is 15.7x.

This Fair Ratio can be more informative than a simple industry or peer comparison because it adjusts for company specific traits rather than assuming all businesses deserve the same multiple. With Pool’s actual P/E of 24.1x above the Fair Ratio of 15.7x, the stock screens as overvalued on this metric.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Pool Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories you build around Pool that link your view of its future revenue, earnings and margins to a financial forecast and a fair value. All of this happens within the Simply Wall St Community page that millions of investors use to compare their own fair value to the current share price. There, you can see that one Pool Narrative currently points to fair value of about US$375 per share, while another more cautious view sits closer to US$285. You can then watch those Narratives update automatically as new earnings reports, news or analyst revisions come through.

Do you think there's more to the story for Pool? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.