Please use a PC Browser to access Register-Tadawul

Is Rivian Stock Attractive After $100M Revenue Hit From Regulatory Credit Halt?

Rivian RIVN | 18.42 18.77 | +12.11% +1.90% Pre |

If you are weighing whether to hold onto Rivian Automotive stock or are considering jumping in, you are not alone. With so much buzz around electric vehicles and the challenges of scaling up, Rivian tends to keep investors on their toes. Even a quick glance at recent share price moves paints a picture of hesitancy. While the stock picked up 8% in the last day and just under 7% over the past week, the broader journey has been bumpier. Over the last three months, Rivian shares are down 16%. Year-to-date, the stock has slipped by just over 1%, and the one-year total return stands at -6%.

There is no shortage of headlines pushing and pulling investor sentiment. For instance, news of Rivian's $100 million revenue hit from a halt in regulatory credit sales put a spotlight on ongoing regulatory risks, and recent layoffs ahead of the upcoming R2 vehicle launch kept growth concerns front and center. On the policy side, looming auto tariffs from Canada have not helped, while costly new tariffs on China-sourced graphite, a key battery ingredient, could drive up production costs. Legal battles, such as Rivian’s lawsuit over Ohio’s ban on direct car sales, add another layer of uncertainty.

Still, some see the ongoing transformation of the auto industry as a major opportunity. To figure out if Rivian’s current price offers value, it helps to look at how the company stacks up against standard valuation checks. The bottom line is that the latest value score for Rivian is 0 out of 6, which means Rivian did not come up as undervalued by any of the common signals analysts use. But that is just the start. Next, we will take a clear look at how these valuation methods work, and, more importantly, explore if there is a smarter way to judge whether Rivian is a buy or a pass.

Rivian Automotive delivered -6.2% returns over the last year. See how this stacks up to the rest of the Auto industry.Approach 1: Rivian Automotive Cash Flows

A Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and converting those back to today’s dollars. DCF is useful because it cuts through the noise and focuses on long-term fundamentals.

Rivian Automotive posted a last twelve months (LTM) Free Cash Flow of negative $1.21 billion, indicating it spent more than a billion dollars over the past year to fund its operations and growth. However, analysts expect that number to gradually improve, with projections turning positive by 2029. Looking a full decade ahead, forecasts call for annual Free Cash Flow to reach $3.67 billion by 2035.

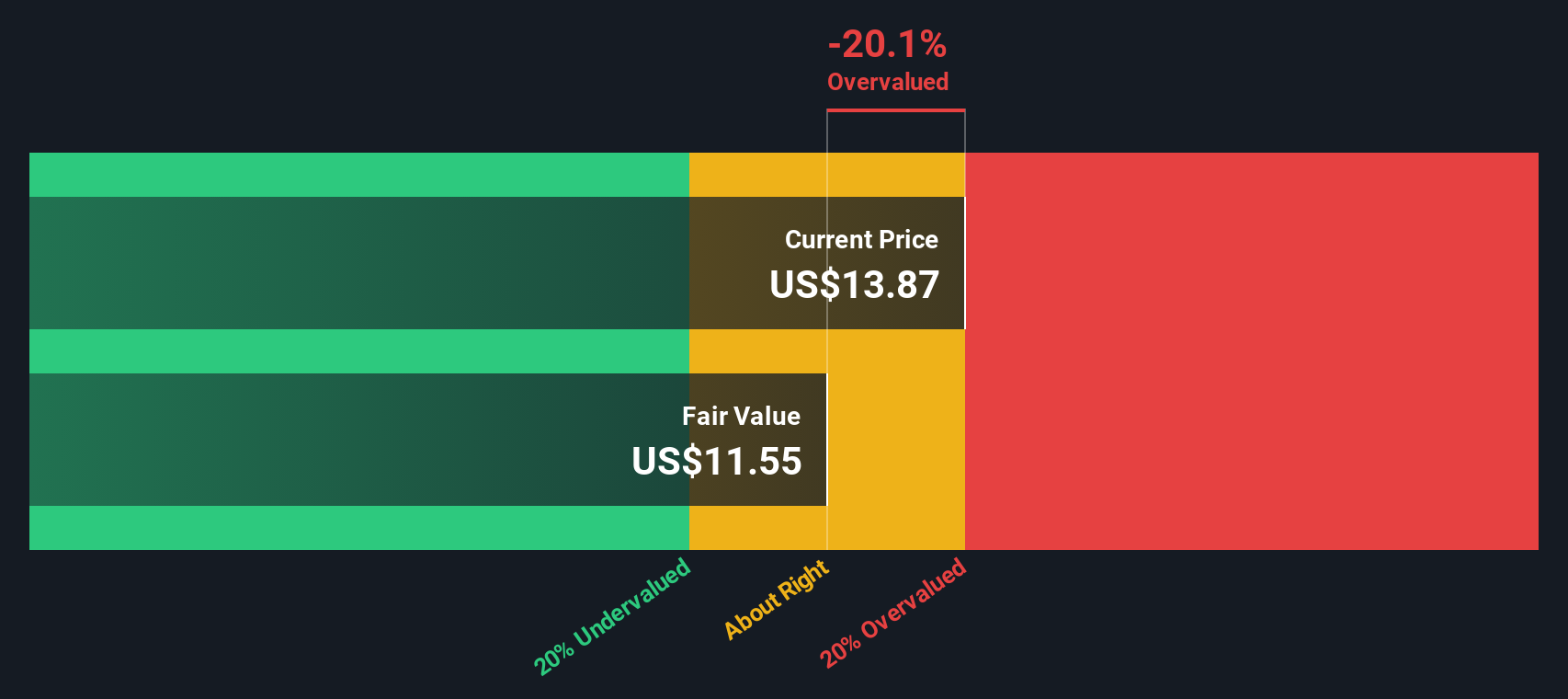

Using a 2 Stage Free Cash Flow to Equity model and discounting these projections, Rivian’s intrinsic value per share is calculated at $11.50. When compared to the recent share price, this suggests the stock is 13.8% overvalued.

Result: OVERVALUED

Approach 2: Rivian Automotive Price vs Sales

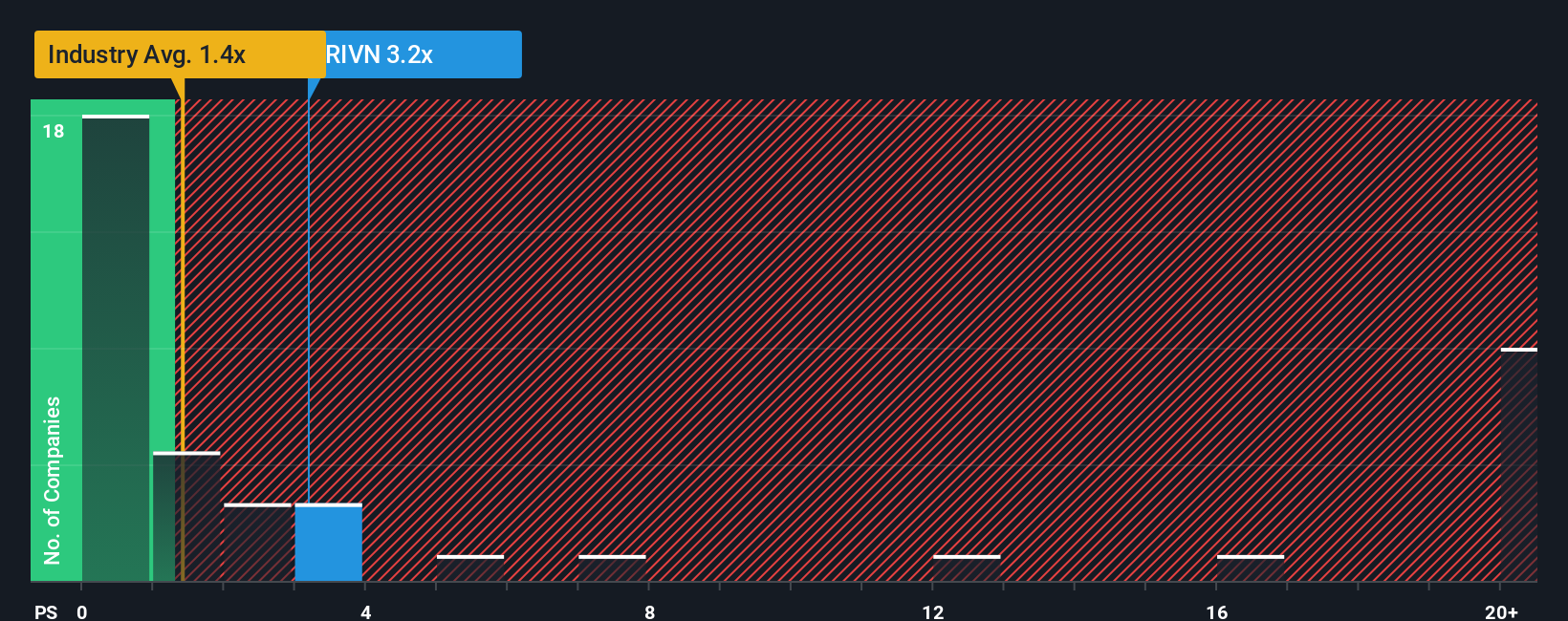

The price-to-sales (P/S) ratio is a straightforward way to value companies that are not yet consistently profitable. This makes it particularly useful for growth-focused players in the electric vehicle space such as Rivian Automotive. Since profits can fluctuate or even turn negative during a company’s expansion phase, evaluating revenue relative to the company's market value helps investors determine if the stock price is reasonable compared to the sales generated.

What constitutes a “normal” P/S ratio can vary with growth prospects, risk, and market sentiment. Higher growth expectations or lower risk typically justify a higher multiple. For Rivian, the P/S ratio currently stands at 3.08x, which is above both the auto industry average of 1.35x and the peer group average of 1.53x.

The Fair Ratio developed by Simply Wall St adds more nuance by adjusting for factors such as expected sales growth, industry trends, profit margins, company size, and specific risks. For Rivian, the Fair Ratio is 1.30x, which is well below the current multiple. This difference suggests that Rivian is priced higher than the fundamentals would indicate.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Rivian Automotive Narrative

A Narrative is simply your story or perspective about a company that brings the numbers to life by connecting your own estimates of things like fair value, revenue growth, and profit margins to a clear investment outlook.

Rather than just looking at traditional ratios, Narratives help you tie together Rivian Automotive’s business developments, financial forecasts, and market risks to build a big-picture view. This approach can make your investment decision more grounded, personal, and transparent.

Within the Simply Wall St platform and its large investor community, creating or choosing a Narrative is straightforward. You select the story that matches your outlook, see the resulting fair value estimate, and easily compare it to the current share price to decide if Rivian is a buy or a pass.

Narratives stay relevant over time because they update automatically as new news or earnings numbers come in, keeping your investment thesis in sync with reality.

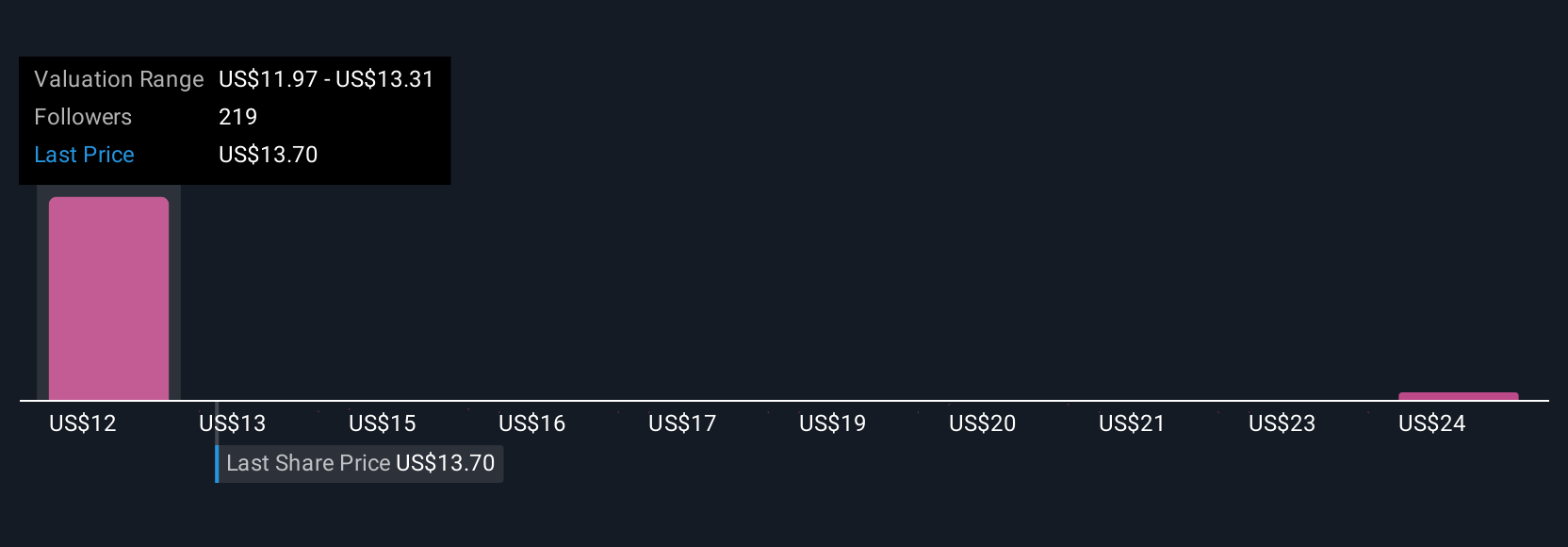

For example, when it comes to Rivian Automotive, some investors see huge future profits, projecting a fair value of $21.00 on rapid EV adoption and efficiency gains. Others are much more cautious with a target of just $7.55 due to continuing cash burn and competitive risks.

Do you think there's more to the story for Rivian Automotive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.