Please use a PC Browser to access Register-Tadawul

Is Tesla’s 2025 Price Justified After Latest AI and Self-Driving Expansion News?

Tesla Motors, Inc. TSLA | 417.97 | +1.67% |

- Ever wondered if Tesla stock is a bargain or overpriced hype? You are not alone. Investors keep asking if today's price truly reflects the company's future potential.

- Despite a dip of 5.9% over the last week, Tesla shares have climbed 13.2% so far this year and an impressive 33.7% over the past twelve months, showing both volatility and potential upside.

- Recent headlines have focused on Tesla's continued expansion in international markets and updates around its AI and Full Self-Driving efforts. These developments have stirred excitement and controversy, keeping the stock in the spotlight and helping to explain the recent swings.

- On our valuation checks, Tesla scores a 0 out of 6 for being undervalued, suggesting caution for value-focused investors. In the next sections, we will walk through how this score is reached and hint at an even smarter way to understand what Tesla is truly worth.

Tesla scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tesla Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and discounting them back to today’s value. This approach gives investors a sense of what the business is worth right now based on its future earning power.

For Tesla, the current Free Cash Flow stands at $6.40 Billion. Analysts provide projections for the next five years. Looking further into the future, Simply Wall St extends these forecasts to cover a full ten-year horizon. According to these projections, Tesla’s Free Cash Flow could reach $59.68 Billion by 2035, showing aggressive growth assumptions over time.

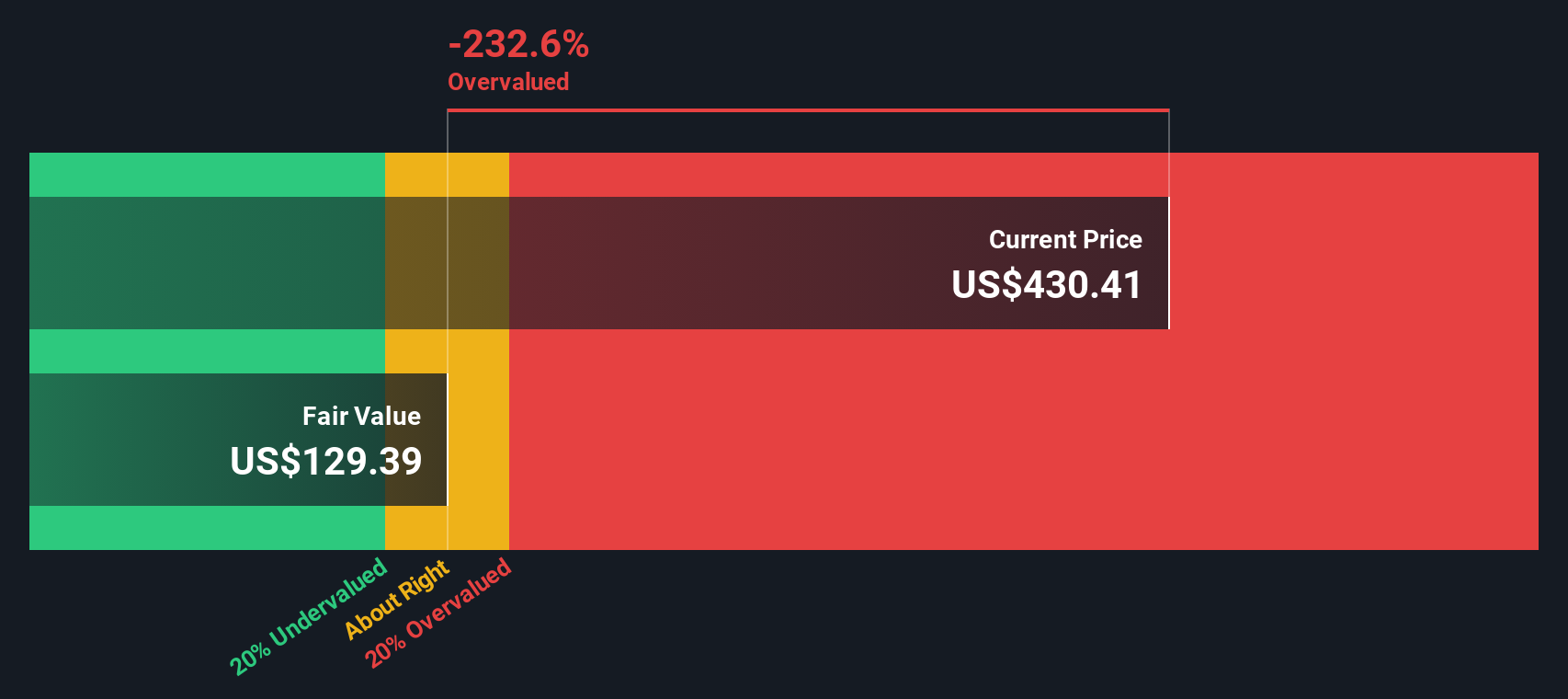

These cash flows are all expressed in US dollars, as reported by Tesla. The model employed here is the 2 Stage Free Cash Flow to Equity, which incorporates higher initial growth followed by slower, stable increases in later years. Using this method, the DCF model puts Tesla’s intrinsic fair value at $154.34 per share.

Comparing this to Tesla’s actual share price, the model suggests the stock is 178.3% overvalued. This means the current market price reflects far more optimism than the company’s projected cash flows can justify using standard discounting methods.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tesla may be overvalued by 178.3%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tesla Price vs Sales

For profitable companies like Tesla, the Price-to-Sales (P/S) ratio is a useful valuation tool. It compares a company’s stock price to its revenues, offering insight not just into profitability but also into the market’s expectations for growth and scalability. Companies with high growth prospects or unique advantages often command higher P/S ratios, while riskier or slower-growing firms trade closer to the industry average.

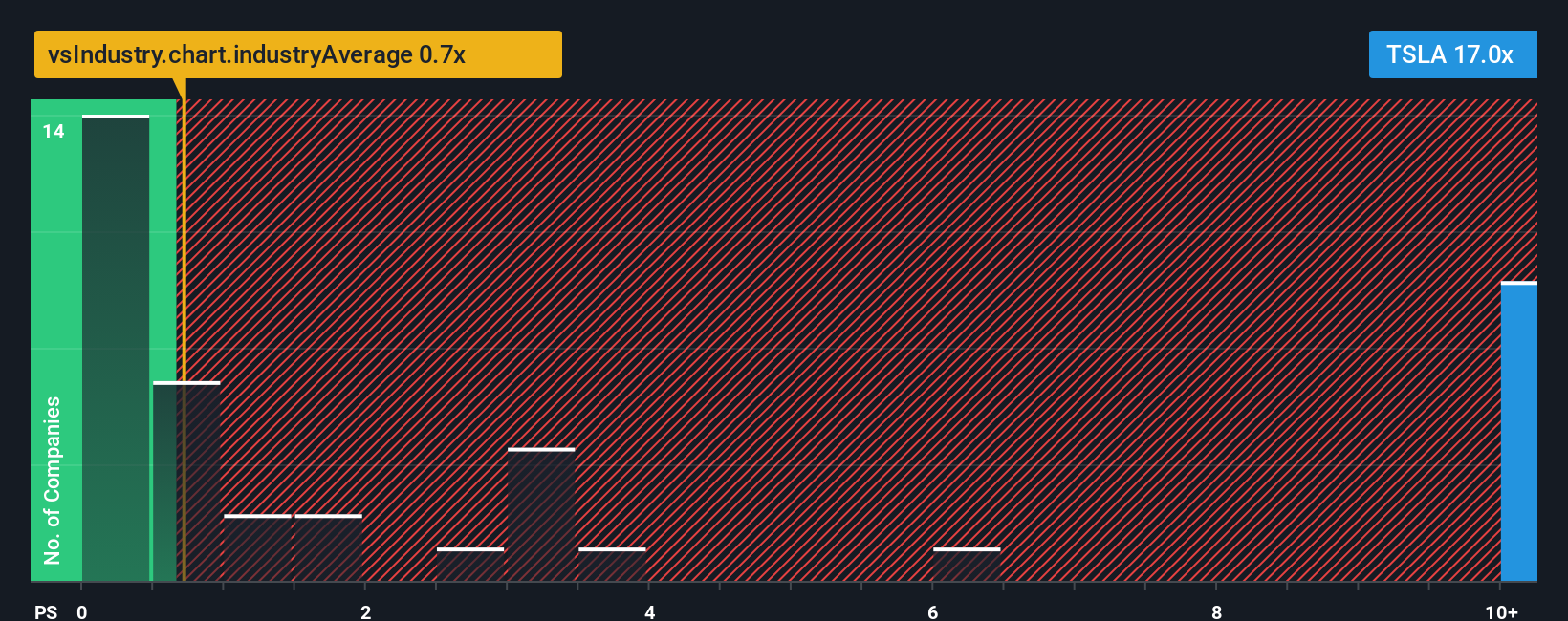

Currently, Tesla trades at a hefty P/S ratio of 14.94x. This stands out sharply compared to the auto industry average of 1.06x and even its closest peers, which average around 1.22x. Such a premium suggests that investors expect Tesla to deliver substantially higher growth or profitability than the typical automaker.

Simply Wall St’s proprietary “Fair Ratio” is especially useful in this context. It factors in Tesla’s earnings growth outlook, profit margins, industry trends, company size, and its unique risk profile to calculate what a reasonable P/S multiple should be for a business like Tesla. This holistic measure goes beyond simple peer or industry comparisons by focusing on a company’s true fundamentals and forward-looking prospects.

Based on these considerations, Tesla’s Fair Ratio is calculated at 3.49x. With the current P/S at 14.94x, the valuation far exceeds the fair level, indicating that the stock is significantly overvalued relative to its fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tesla Narrative

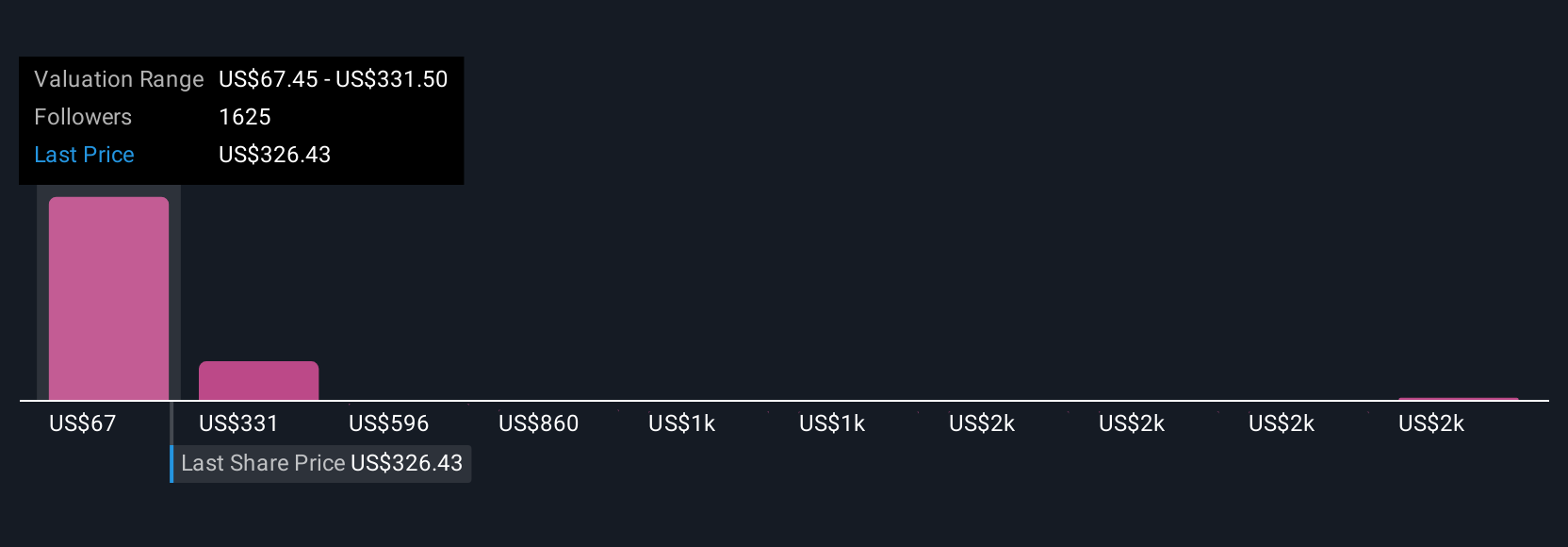

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to define the “story” behind the numbers by connecting your personal expectations about Tesla’s future, such as revenue growth, margins, and innovation, to a fair value estimate. Instead of just relying on formulas, Narratives help you align Tesla’s story with your own financial forecast and make your investment decision clearer and more personalized.

Narratives are easy to access on Simply Wall St’s Community page, where millions of investors outline their outlooks and valuation logic. With each Narrative, you can instantly compare the fair value implied by the author’s scenario to the current price, helping you decide whether to buy, hold, or sell. Because Narratives are dynamic, they automatically update as new news, earnings, or market factors are introduced, so your decision is always guided by the most relevant view.

For example, some investors think Tesla is worth as little as $67 per share based on skepticism about AI and tougher competition, while others set fair values above $2,700, forecasting dominance in robotics and significant profit increases. Narratives empower you to invest according to the future you believe in.

For Tesla, we'll make it really easy for you with previews of two leading Tesla Narratives:

Fair Value: $2,707.91

Current Price vs Narrative: 84.1% undervalued

Expected Revenue Growth: 77%

- Projects Tesla’s 2030 revenue to reach $1.94 trillion, with net profit of $534 billion driven by AI, robotics, and energy business lines.

- Discounted cash flow suggests a fair value above $2,000 per share today. This view sees the current price as a dramatic underestimation if Tesla achieves its targets.

- Recognizes high upside but also notes key risks including competition, execution, and regulation.

Fair Value: $332.71

Current Price vs Narrative: 29.1% overvalued

Expected Revenue Growth: 30%

- Highlights upcoming products from Cybertruck to Optimus robots and FSD, but flags ongoing risks related to supply chain, competition, and regulation.

- Sees revenue potentially reaching $150 billion by 2030 with profit margins around 20-22%. Competition and market factors are expected to limit upside.

- Estimates fair value significantly below the current price, suggesting the market's expectations may be too high given execution and regulatory risks.

Do you think there's more to the story for Tesla? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.