Please use a PC Browser to access Register-Tadawul

Is the Fed Cutting Rates by 50 Basis Points Next Week? These Eight Rate Cut Trades Are Worth Watching! Gold Has Already Jumped 10%

20+ Year Trsy Bond Ishares TLT | 87.34 87.70 | -0.96% +0.41% Pre |

Real Estate Select Sector SP XLRE | 40.75 40.75 | -0.12% 0.00% Pre |

DJ US Home Construction Ishares ITB | 102.53 102.53 | -0.28% 0.00% Pre |

D.R. Horton, Inc. DHI | 156.45 156.45 | +0.81% 0.00% Pre |

Lennar Corporation Class A LEN | 119.37 119.37 | +0.18% 0.00% Pre |

Following last Friday's unexpectedly weak non-farm payroll data, which the Federal Reserve closely monitors, "rate cut speculation" is now driving the U.S. stock market. Investors are convinced that the Fed will resume rate cuts this month and may continue to cut rates in the coming months.

In terms of market performance, the long-term Treasury ETF 20+ Year Trsy Bond Ishares(TLT.US), which is highly sensitive to interest rates, has surged for four consecutive days, with a cumulative gain of nearly 5%, reaching its highest level since April. Traders are pricing in more aggressive rate cuts by the Fed.

As the Fed's September 17 rate decision approaches, key economic data will be released this week. Will rate cut expectations rise further? Which rate cut trades should investors focus on? This article provides insights.

Non-Farm Payroll Revision and Key Inflation Data: Will the Probability of a 50 Basis Point Cut in September Increase?

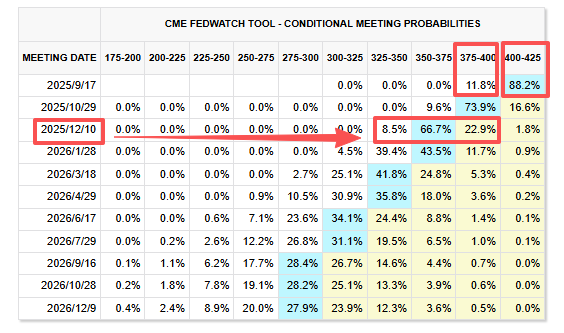

According to the CME Group's FedWatch tool, as of 1:00 PM Riyadh time on Tuesday, there is an 88% probability that the Fed will cut rates by 25 basis points next week. Approximately 12% of traders are betting on a 50-basis-point cut, with almost no expectation that rates will remain unchanged.

Looking ahead, crucial economic data will be released this week, including Tuesday's non-farm payroll revision, Wednesday's Producer Price Index (PPI), and Thursday's Consumer Price Index (CPI). The market broadly anticipates these will bolster expectations of a significant Fed rate cut.

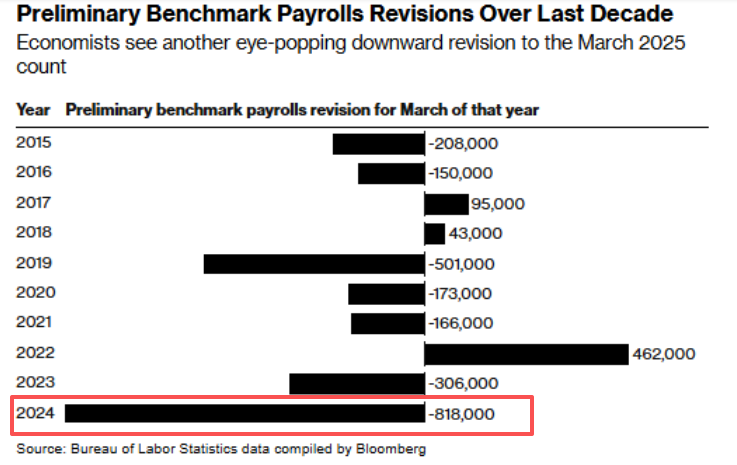

Specifically, the preliminary benchmark revision of non-farm employment data will be released tonight. Economists from institutions like Wells Fargo and Bank of America predict that the revision will show a decrease of nearly 800,000 jobs compared to current estimates as of March, with the maximum downward revision possibly nearing 1 million. This translates to an average monthly shortfall of about 83,000 jobs.

Although this revision pertains to historical data, a significant downward adjustment will confirm that last year's labor market momentum was weaker than expected, further reinforcing the market's expectation of a series of Fed rate cuts.

Additionally, the latest PPI and CPI data will be released over the next two days, representing the last batch of crucial data before the Fed meeting.

Economists surveyed by Dow Jones expect the overall U.S. CPI to rise to 2.9%, with core CPI remaining at 3.1%. If CPI exceeds expectations, it will further solidify the Fed's decision to cut rates by 25 basis points at the September meeting.

Rate Cut Speculation Dominates U.S. Stocks! Analysts Highlight Eight Key Asset Directions to Watch

The Fed's September rate decision could have a significant impact on market volatility. Analysts from major institutions like CICC and JPMorgan have identified eight interest rate-sensitive assets for investors to consider:

| Asset Category | ETF | Core Components | Reasons for Attention |

|---|---|---|---|

| Real Estate | Interest rate cuts lower mortgage rates, stimulating housing demand. | ||

| Finance | Pressure on net interest margins eases, credit demand rebounds. | ||

| Utilities | Dividend yield advantages become prominent, strengthening capital allocation preferences. | ||

| Biotechnology | The industry relies on external financing, and lower discount rates directly increase valuations. | ||

| Consumer Discretionary | Consumer Discret Select Sector SPDR(XLY.US) Vanguard World Fds Vanguard Consumer Discretionary ETF(VCR.US) | Interest rate cuts reduce costs for auto loans and credit card rates, encouraging large consumer purchases. | |

| Technology | Lower financing costs improve corporate earnings expectations; increased investment risk appetite enhances long-term growth potential in tech. | ||

| Small Cap | Reduced financing costs for small companies improve the U.S. economic outlook. | ||

| Emerging Markets | Ishares Msci Emerging Index Fund(EEM.US) | Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) | Emerging market debt pressures ease, with increased dollar capital inflows and enhanced stock market appeal. |

| Avoidance Assets | A weaker dollar and improved liquidity boost commodity prices, with inflation driving demand for safe-haven assets. |

Data Sources: Wind, CICC, JPMorgan Chase.

Among these asset classes, gold has been the first to rally under the Fed's September rate cut expectations, with a cumulative gain of 10% over the past 15 trading days. Gold prices are nearing $3,700 per ounce, with a year-to-date increase of nearly 40%.

Global institutions such as Morgan Stanley and UBS are collectively advising investors to increase gold holdings before the Fed's September rate cut. Goldman Sachs suggests that in extreme scenarios, gold could surge to nearly $5,000.

Index ETFs to Watch:

| Index Name | Related ETF Name | Ticker | Leverage/Direction |

|---|---|---|---|

| S&P 500 | SPDR S&P 500 ETF | ETF-S&P 500(SPY.US) | 1x Long |

| S&P 500 ETF-Vanguard | Vanguard S&P 500 Etf(VOO.US) | 1x Long | |

| Nasdaq | Nasdaq 100 ETF-Invesco QQQ Trust | PowerShares QQQ Trust,Series 1(QQQ.US) | 1x Long |

| 3x Long Nasdaq ETF-ProShares | Ultrapro QQQ Proshares(TQQQ.US) | 3x Long | |

| 3x Short Nasdaq ETF-ProShares | Ultrapro Short QQQ Proshares(SQQQ.US) | 3x Short | |

| Dow Jones | SPDR Dow Jones ETF | ETF-Dow Jones Industrial Average(DIA.US) | 1x Long |

| ProShares 3x Short Dow 30 ETF | Ultrapro Short DOW 30 Proshares(SDOW.US) | 3x Short | |

| Volatility Index | Long Volatility ETF | iPath Series B S&P 500 VIX Short-Term Futures ETN(VXX.US) | 1x Long |

| 1.5x Long Volatility ETF | Proshares Trust Ii Ultra Vix Sht Trm Futr Etf 2017(Post Spt(UVXY.US) | 1.5x Long | |

| 0.5x Short Volatility ETF | Proshares Trust Ii Short Vix Short-Term Futures ETF(SVXY.US) | 0.5x Short |

Risk Warning: Unpredictable Rate Cut Path

Historically, the market's differing expectations for the U.S. economy correspond to different rate cut paths. The Fed's rate cut cycles typically fall into two categories:

- Preventive rate cuts: Implemented when the economy shows signs of slowing to prevent a recession.

- Recessionary rate cuts: Used to provide emergency relief when the economy is in recession or faces a major crisis.

The prevailing view is that the current rate cut is preventive. CICC's research report notes that as a preventive measure, the Fed doesn't need to cut rates more quickly or significantly, as rate cuts can rapidly boost demand.

Tianfeng Securities' latest analysis outlines three scenarios for the Fed's rate cut path:

- Scenario 1 (Baseline): The current consensus expects two rate cuts this year and three more next year. In this scenario, the U.S. economy slows or experiences a brief "shallow recession," achieving a "soft landing."

- Scenario 2 (Recession): If the economy deteriorates unexpectedly and unemployment rises sharply, the Fed will implement significant rate cuts to support the economy. This could lead to lower Treasury yields, declining U.S. and Hong Kong stocks, and rising gold prices.

- Scenario 3 (High Inflation): In the event of historic high inflation or "stagflation," the Fed prioritizes controlling inflation, maintaining high rates for longer. This scenario may see simultaneous declines in U.S. stock and bond prices.

It's important to note that the rate cut path will directly influence market sentiment towards rate cut trades. Investors should closely monitor global macroeconomic developments and the FedWatch tool's rate cut probability forecasts.

Finally, how many basis points do you think the Fed will cut next week? Which rate cut assets will be more favored by investors? Feel free to share your thoughts in the comments.