Please use a PC Browser to access Register-Tadawul

Is the U.S. Stock Market "Party" Unsustainable? Renowned Investment Bank Warns: S&P 500 Could Plunge 14% in H2!

Stifel Financial Corp. SF | 127.58 | -0.51% |

S&P 500 index SPX | 6800.26 | -0.24% |

① Barry Bannister, Chief Equity Strategist at prominent U.S. investment bank Stifel (Stifel Financial Corp.(SF.US)), warns investors that despite the U.S. stock market's recovery since its April plunge, the second half of 2025 could bring turbulence;

② Bannister sets a year-end target of 5,500 for the S&P 500 (S&P 500 index(SPX.US)), citing high valuations and the potential for economic growth to slow.

As U.S. stocks repeatedly hit record highs recently, market optimism seems to be "rising with the tide." However, Barry Bannister, Chief Equity Strategist at prominent U.S. investment bank Stifel, warns investors not to become too complacent with the current rally.

Bannister believes that although U.S. stocks have recovered since their April plunge, the second half of 2025 could bring turbulence. He sets a year-end target of 5,500 for the S&P 500 (the lowest on Wall Street), implying a roughly 14% decline for the benchmark index from current levels.

Bannister points to two main reasons supporting his view: high valuations and the potential for economic growth to slow.

"Look at the core of the economy. How are consumers and capital expenditures? In our view, the economy will slow in the second half," he said, referring to core GDP, defined as real final consumer sales plus fixed business investment.

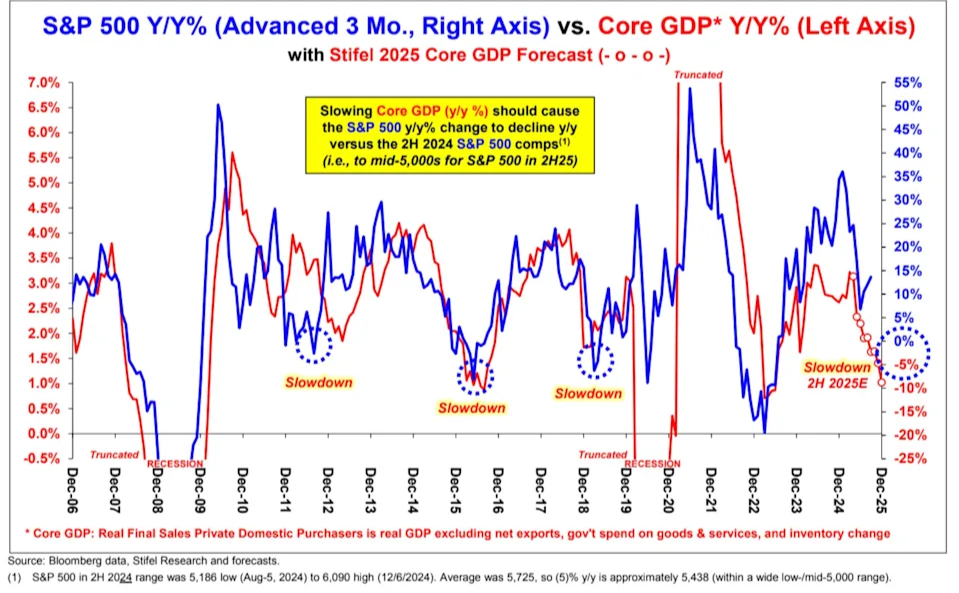

In a report to clients this month, Bannister shared the chart below, illustrating the relationship between core GDP and S&P 500 returns. The current trend suggests negative annualized returns for the S&P 500 in the coming months.

On valuation, Bannister states that U.S. stocks are "expensive" and at "very high levels." Another chart shared in his report measures the overall "expensiveness" of the market. It considers the S&P 500's price-to-earnings ratio, where the earnings component is real operating profits normalized over the past 10 years – similar to the Shiller Cyclically Adjusted P/E Ratio (CAPE).

As the chart shows, this metric is currently at levels indicating "extreme valuation exuberance," comparable to peaks seen in 2021, 2000, and 1929, sitting 1.5 standard deviations above its 10-year trend. This suggests investors may be overly optimistic about AI by historical standards.

Bannister suggests that a macroeconomic downturn could ultimately shatter this optimism. However, according to him, this doesn't necessarily guarantee a stock market decline. He said stocks could rise if inflation remains persistently low and the Fed cuts rates multiple times in the near future.

Nevertheless, most analysts on Wall Street expect returns to be roughly flat for the remainder of the year, with many setting targets around 6,000. But some share Bannister's greater skepticism about the health of the rally. For instance, Evercore ISI analyst Julian Emanuel warned stocks could fall 15% in the coming months.

Bannister added that in the near term, he is most bullish on defensive value stocks. He said that from a 10-year perspective, he favors value stocks, small caps, and international equities.