Please use a PC Browser to access Register-Tadawul

Is There Hidden Value in TSMC After 52% Surge Amid AI Chip Demand News?

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 348.85 | +5.48% |

- Wondering if Taiwan Semiconductor Manufacturing is trading at a fair price, or if there's an opportunity hiding in plain sight? You're not the only one looking for value in one of the chip industry's giants.

- The stock has outperformed for much of the last year, rising 52.1% over twelve months and up 39.9% just since January, though it has pulled back 4.4% in the last month.

- Some of these moves coincide with a wave of news around AI chip demand, U.S.-China trade dynamics, and partnerships with major tech companies. Taiwan Semiconductor has been making headlines for its essential role in global supply chains and its aggressive investments in new manufacturing capacity.

- But what does the data say, specifically, how does it score on valuation checks? Right now, Taiwan Semiconductor Manufacturing clocks in at a 3 out of 6 on our value score, which sets the stage for a closer look at different valuation methods, and a revealing, under-the-radar way to look at this stock we'll highlight at the end.

Approach 1: Taiwan Semiconductor Manufacturing Discounted Cash Flow (DCF) Analysis

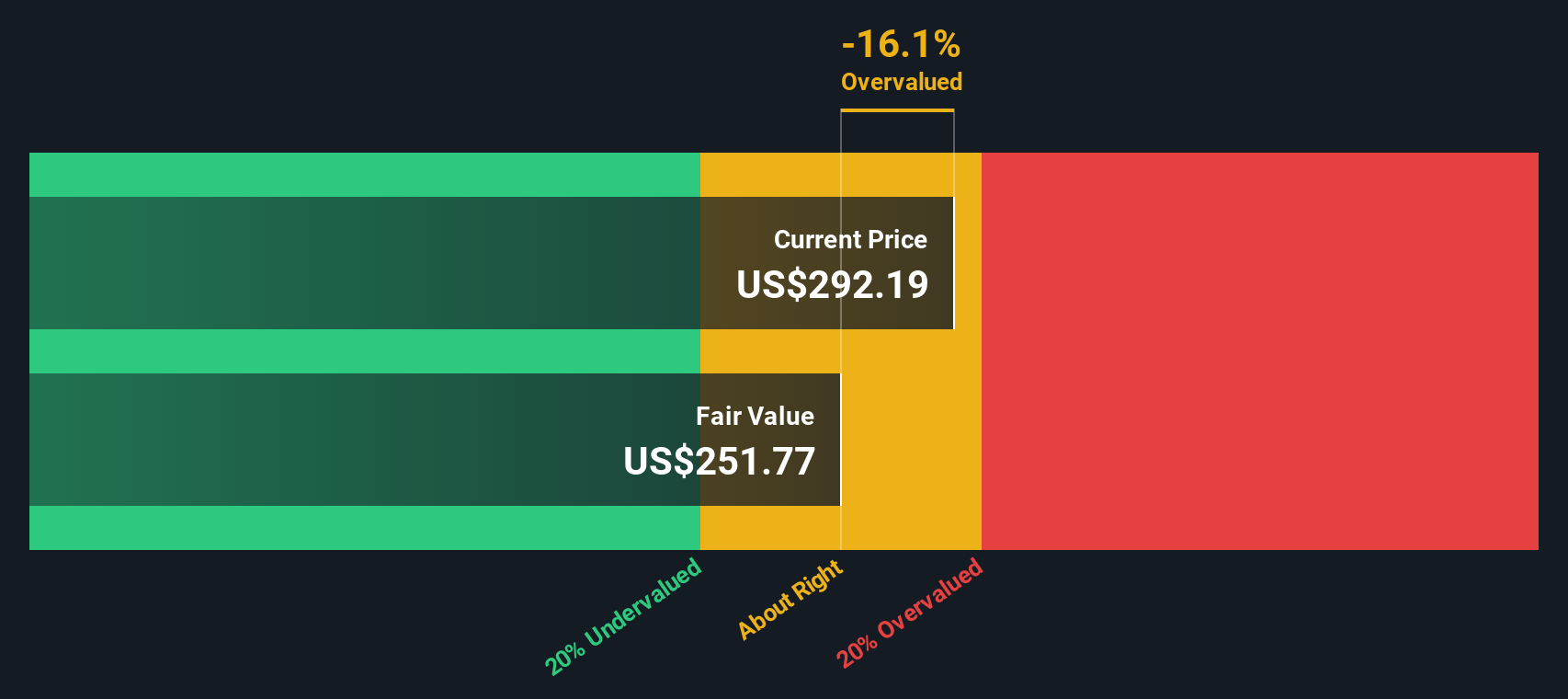

A Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future cash flows and discounting them back to today’s value. For Taiwan Semiconductor Manufacturing, this method relies on projecting free cash flows (FCF) years into the future and applying a suitable discount rate to reflect present value in New Taiwan Dollars (NT$).

Currently, Taiwan Semiconductor generated NT$802.4 billion in free cash flow over the last twelve months. Analysts provide FCF estimates up to 2029, with projections indicating significant growth ahead. By 2029, free cash flow is expected to reach NT$2.77 trillion. The model continues to extrapolate future figures through to 2035, anticipating a steady rise in FCF backed by global chip demand and industry investment cycles.

Despite these robust projections, the analysis yields an estimated intrinsic value per share of $245.28. That places Taiwan Semiconductor roughly 15% above this fair value estimate. This means the stock is currently trading at a premium to the calculated fundamentals when using this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taiwan Semiconductor Manufacturing may be overvalued by 15.0%. Discover 899 undervalued stocks or create your own screener to find better value opportunities.

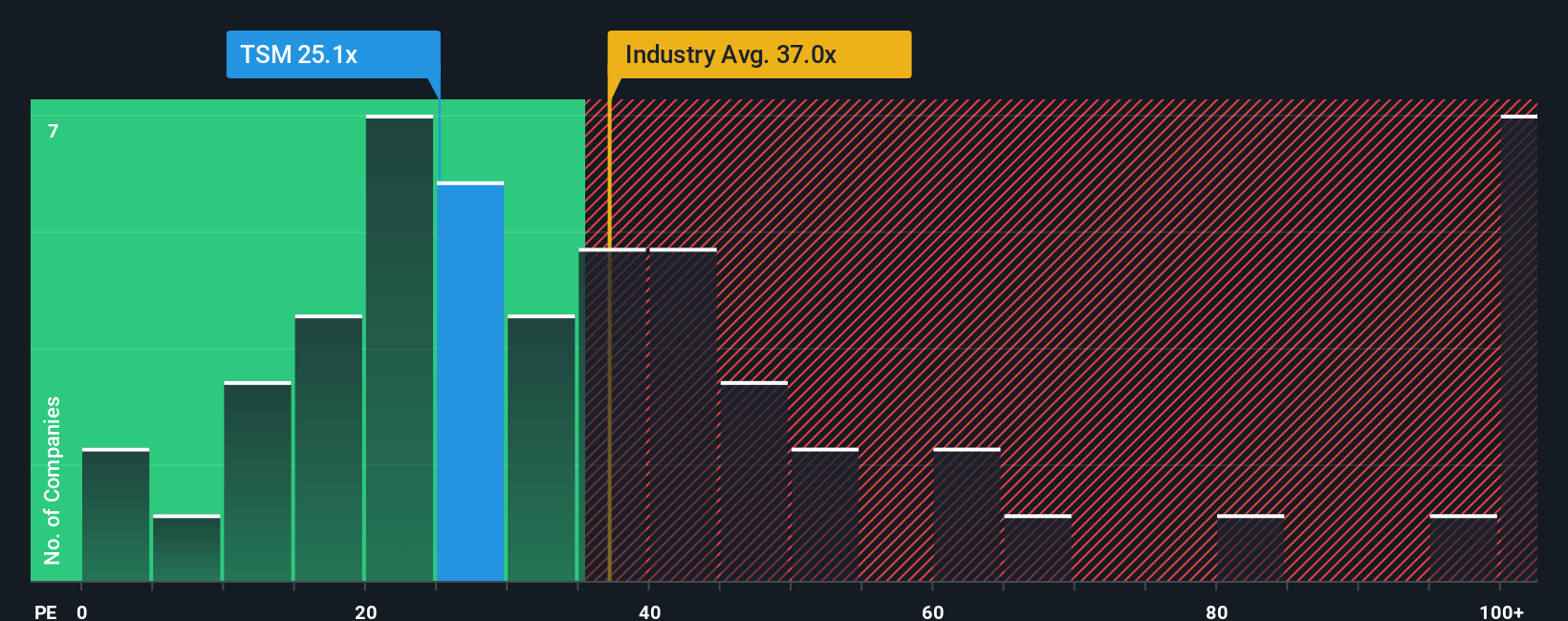

Approach 2: Taiwan Semiconductor Manufacturing Price vs Earnings

For profitable companies like Taiwan Semiconductor Manufacturing, the price-to-earnings (PE) ratio is a widely accepted metric to gauge valuation. It helps investors understand how much the market is willing to pay today for a dollar of the company’s earnings. Typically, higher growth prospects or lower business risks warrant a higher PE ratio, while less growth or greater risk would justify a lower one.

Currently, Taiwan Semiconductor trades at a PE of 23.8x. For perspective, the broader semiconductor industry averages 34.7x, while the company’s peer set averages an even higher 68.8x. On the surface, TSM appears to be trading at a meaningful discount relative to both peers and the wider industry.

However, instead of just comparing PE ratios in isolation, Simply Wall St’s “Fair Ratio” takes things a step further. This proprietary metric considers not only the company’s growth outlook, profit margins, and risk, but also factors like its industry, size, and position in the market. This approach provides a more tailored view of what would actually be a fair valuation multiple for TSM, rather than assuming it should simply match peers or sector averages.

Applying this Fair Ratio, TSM’s fair PE is estimated at 46.5x. With the actual PE at 23.8x, the shares look undervalued even after considering all those additional business and market dynamics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1418 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taiwan Semiconductor Manufacturing Narrative

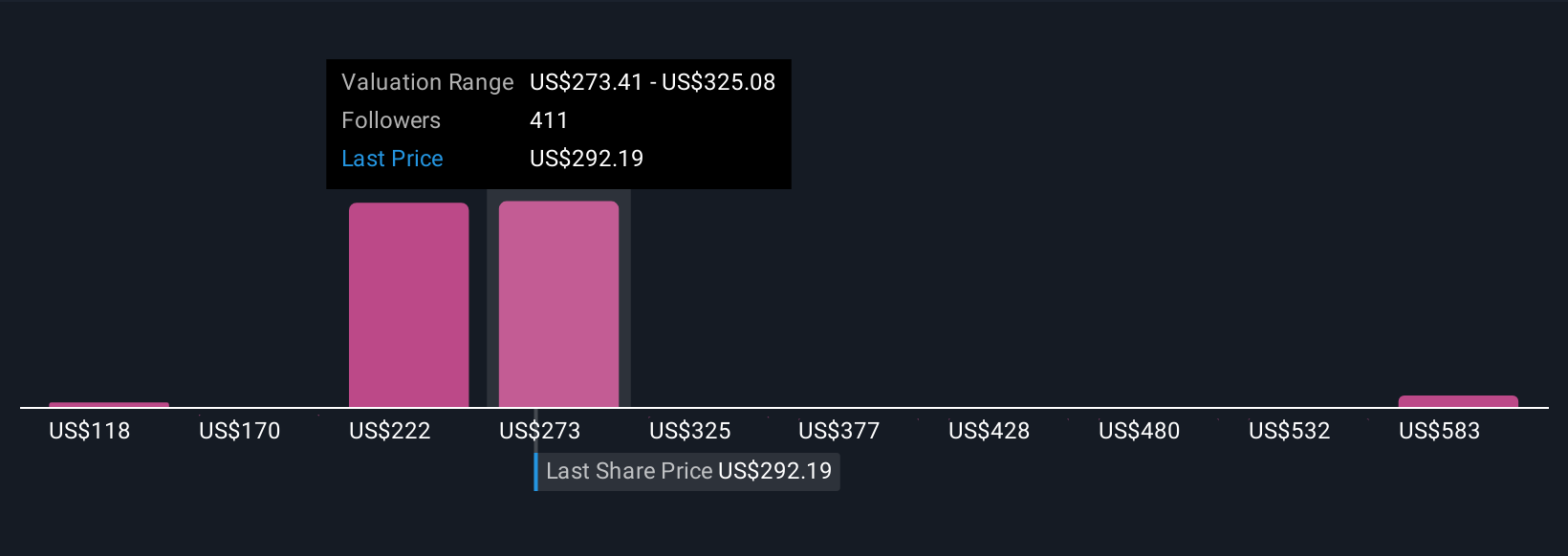

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is your personal investment story. It connects what you believe about a company (like Taiwan Semiconductor Manufacturing’s future growth, risks, and margins) to financial projections and then to a Fair Value estimate. Narratives take you beyond formulas by letting you combine your own insights, forecasts, and context with the numbers, telling your version of how the company’s story could unfold.

On Simply Wall St’s Community page, users create and share these dynamic Narratives. This makes it an intuitive, widely-used tool accessible to millions of investors. Narratives help you decide when to buy or sell by clearly showing if today’s price is above or below the Fair Value that matches your perspective. Even better, each Narrative’s value is updated automatically as new company news or earnings are released, ensuring your view stays relevant.

For example, one investor’s Narrative might highlight record profits, unrivaled chip technology, and huge expansion plans to support a Fair Value of $310 per share. Another, more cautious view could focus on geopolitical risks and margin pressure to arrive at a Fair Value of $118.40. Narratives empower you to see a range of thoughtfully-built opinions and choose which story and valuation make the most sense for your investments.

For Taiwan Semiconductor Manufacturing, we’ll make it really easy for you with previews of two leading Taiwan Semiconductor Manufacturing Narratives:

Fair Value: $310.00

Current valuation: 9% undervalued compared to narrative fair value

Revenue Growth Rate: 0%

- The "Foundry King" of the semiconductor industry, TSMC manufactures chips for top clients like Apple and Nvidia, holding approximately 50% global market share and leading in advanced chip technology (3nm, 5nm, moving to 2nm in 2025).

- Financial results are robust, driven by AI and high-performance computing chip demand with Q2 2025 revenue of US$30B (up 38.6% year over year), high margins (gross margin approximately 58.6%), and strong dividend history backed by disciplined management.

- Major expansion is underway with over $38B in annual capital expenditures and new fabs globally. Risks such as geopolitical friction, margin pressure from currency and overseas costs, and customer concentration exist, but the narrative views TSMC as a stable, strategic, and low-risk way to capture long-term AI infrastructure growth.

Fair Value: $118.40

Current valuation: 138% overvalued compared to narrative fair value

Revenue Growth Rate: -23.21%

- TSMC’s global leadership remains robust with a healthy balance sheet, diversified production expansion, and large repeat customers, but future growth is expected to slow and margins may face pressure.

- The narrative assumes geopolitical status quo but highlights the possibility of significant disruption if China-Taiwan relations deteriorate, as well as risks around dependence on critical suppliers like ASML for advanced chipmaking equipment.

- While organic growth and efficiency improvements are supporting results, the current stock price is substantially above the calculated fair value, presenting a narrower margin of safety and greater downside risk if challenges materialize.

Do you think there's more to the story for Taiwan Semiconductor Manufacturing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.