Please use a PC Browser to access Register-Tadawul

Is There Now an Opportunity in Clorox After Recent 8% Share Price Drop?

Clorox Company CLX | 119.59 119.59 | +0.19% 0.00% Post |

- Ever feel like Clorox’s stock price doesn’t quite tell the whole story? If you’re wondering whether there’s real value to be found after all the ups and downs, you’re not alone.

- Recently, Clorox’s shares have seen some volatility. The stock dropped 2.9% over the last week and fell 8.3% in the past month to a recent close of $112.46.

- This slide comes amid notable sector chatter about shifting consumer demand and supply chain updates, both of which have influenced investor sentiment across household product companies. News around operational innovation and cost management strategies has also caught the market’s attention. This has fueled a debate on whether the recent dip spells opportunity or signals ongoing challenges.

- Our deep dive into Clorox’s valuation puts its score at 5 out of 6, suggesting it’s undervalued by several key checks. Next, let’s break down what actually goes into that rating and, more importantly, why there might be an even more insightful way to judge the company’s long-term worth.

Approach 1: Clorox Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to today's dollars. This approach focuses on how much money Clorox is expected to generate in years ahead. It is a cornerstone method for long-term value investors.

For Clorox, the current Free Cash Flow stands at $763.8 Million. Analyst consensus projects that this figure will steadily rise, with cash flow estimates reaching $1.12 Billion by 2030. Analysts have issued direct estimates for the next five years, while projections further out are modeled based on trend estimates.

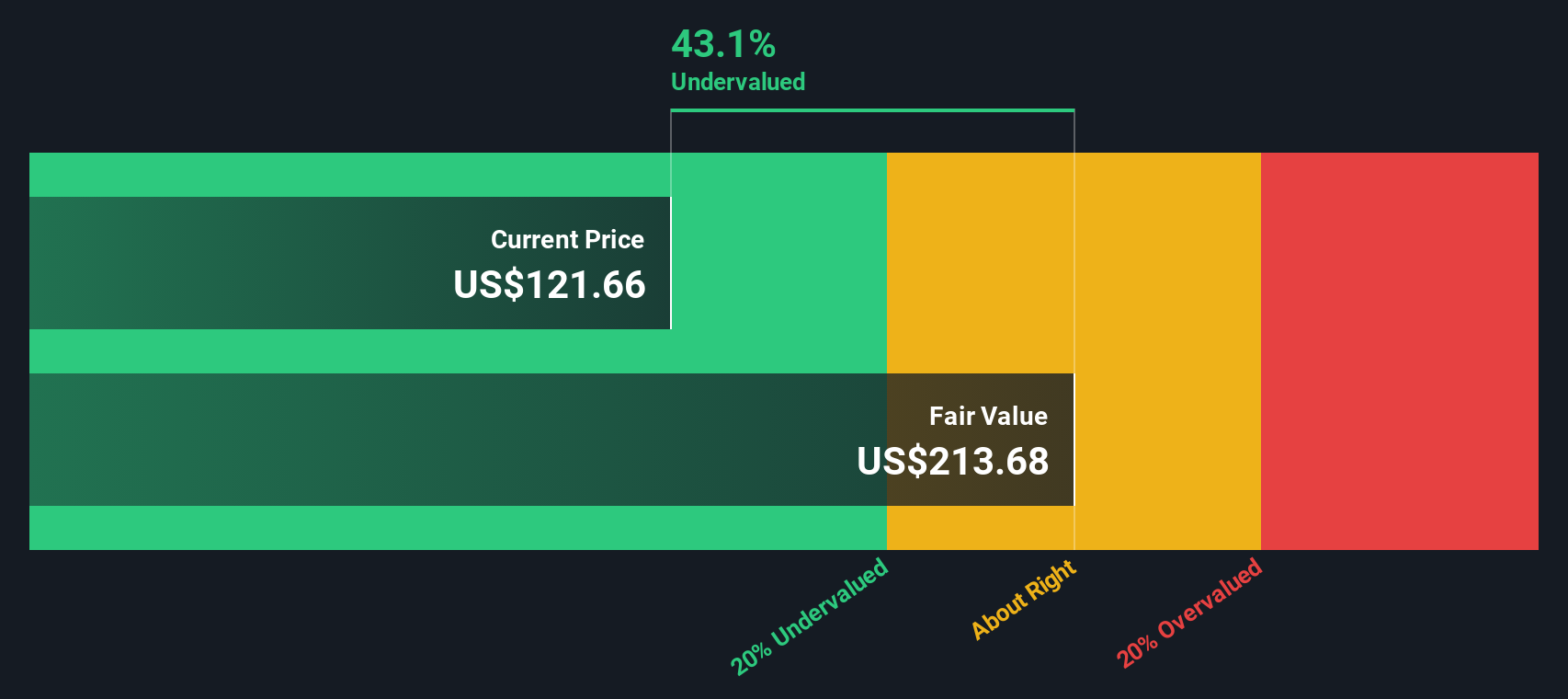

The DCF calculation uses these projected numbers and applies a discount to reflect the risk and time value of money. This results in a fair value estimate of $213.68 per share. Compared to the recent price of $112.46, this signals a 47.4% margin of undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Clorox is undervalued by 47.4%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Clorox Price vs Earnings

For profitable companies such as Clorox, the Price-to-Earnings (PE) ratio is one of the most widely used metrics for assessing whether a stock is fairly valued. The PE ratio compares the current share price to its per-share earnings, making it especially insightful for firms with strong, stable profits.

What constitutes a "normal" or "fair" PE ratio depends on several factors, most notably the company’s future earnings growth and perceived risk. Typically, higher growth prospects or lower risk levels warrant higher PE ratios, while companies facing slow growth or increased risks generally trade at lower multiples.

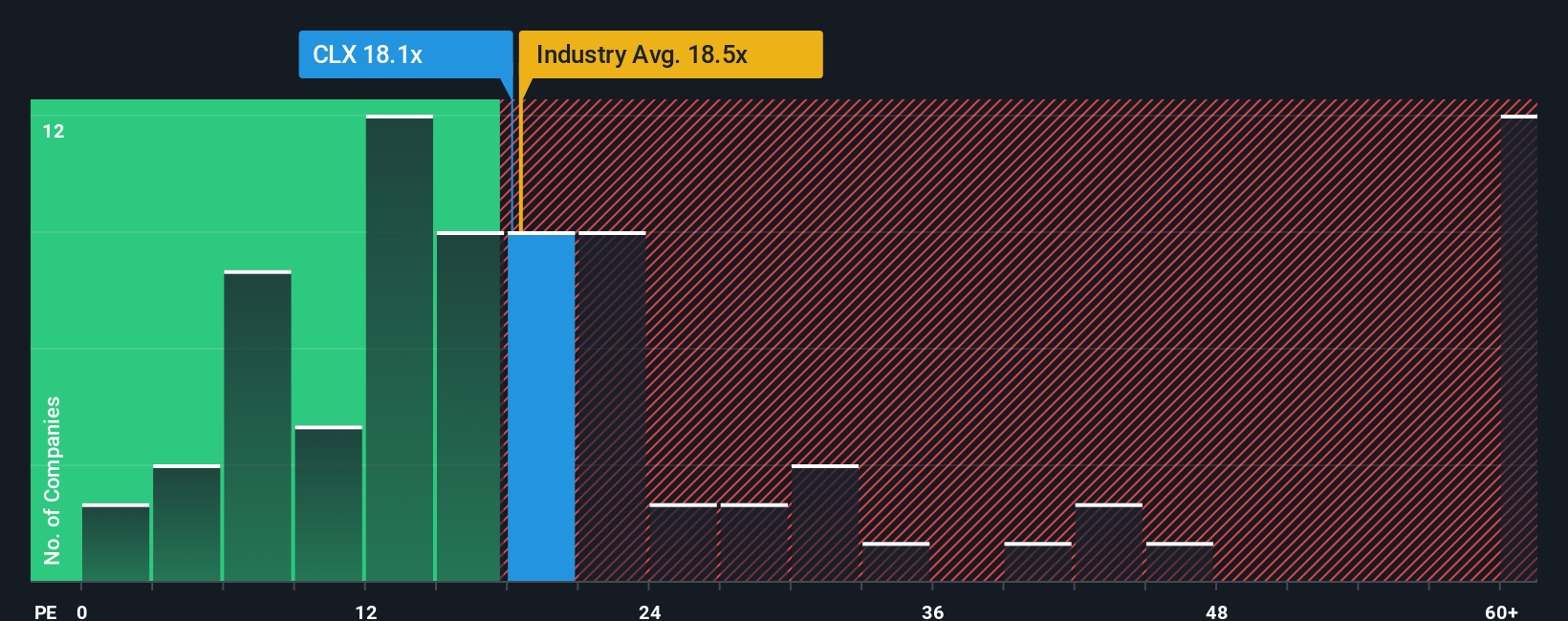

Clorox currently trades at a PE ratio of 17.0x. That stacks up right near the industry average of 17.6x and sits well below the peer group’s average of 24.8x. However, a straight comparison only says so much.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Clorox is 19.8x. This metric considers not just industry trends but also the company's earnings growth outlook, risks, profit margins, and market capitalization. Unlike a plain industry or peer average, the Fair Ratio gives a more holistic picture by balancing all these traits and providing deeper context to the valuation.

With Clorox’s current PE of 17.0x compared to its Fair Ratio of 19.8x, the stock appears undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Clorox Narrative

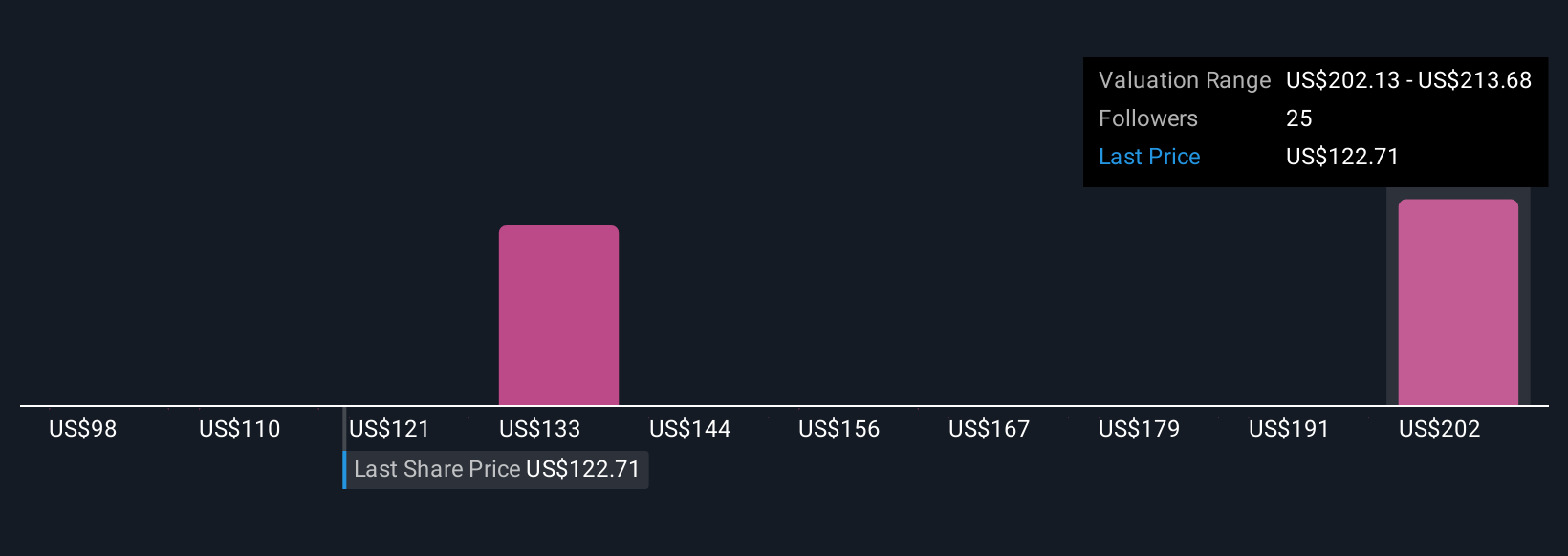

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personal story about a company, bringing together your assumptions on its future revenue, profits, and margins with what you believe is a fair value for the stock.

Unlike traditional valuation models that focus purely on numbers, Narratives link the company’s unique story directly to a financial forecast and a resulting fair value. This approach makes your investment thesis explicit and testable.

Narratives are available for anyone to create and explore within the Simply Wall St Community page, where millions of investors share and update their perspectives as new information comes in.

This tool empowers you to decide when to buy or sell by comparing your calculated Fair Value to the current market Price. Since Narratives are dynamically updated with fresh news or earnings, you always have the latest insights tailored to your viewpoint.

For example, some investors currently expect Clorox’s fair value to be as high as $166.00, convinced that supply chain innovation and premium product launches will accelerate growth. Others are more cautious, seeing a conservative fair value of $115.00 based on muted sales and ongoing cost pressures.

Do you think there's more to the story for Clorox? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.