Please use a PC Browser to access Register-Tadawul

Is Zimmer Biomet Trading Below Its True Value After Recent Digital Surgery Progress?

Zimmer Biomet Holdings, Inc. ZBH | 91.59 | -0.93% |

Thinking about what to do with Zimmer Biomet Holdings stock? You are not alone. With so many options in a volatile market, investors like you are closely watching signs of real value and searching for any edge that helps decision-making. The past few weeks have been a quiet but intriguing period for Zimmer Biomet. After drifting modestly higher, the stock has posted a 1.1% gain over the last 7 days and is up 4.1% in the last month. However, stepping back and looking from a longer-term perspective reveals a more complicated picture, with year-to-date performance down 1.4% and the 1-year return just 1.6%. Over three and five years, the stock is still catching up, showing losses of 6.9% and 16.3%, respectively.

Some of this movement seems linked to ongoing optimism in the broader healthcare sector. Investors have also responded to recent updates on regulatory approvals and progress in Zimmer Biomet's digital surgery initiatives. These developments have shed new light on the company’s growth potential and could be shifting how the market evaluates its risk and reward profile, though they have yet to cause dramatic spikes in the share price.

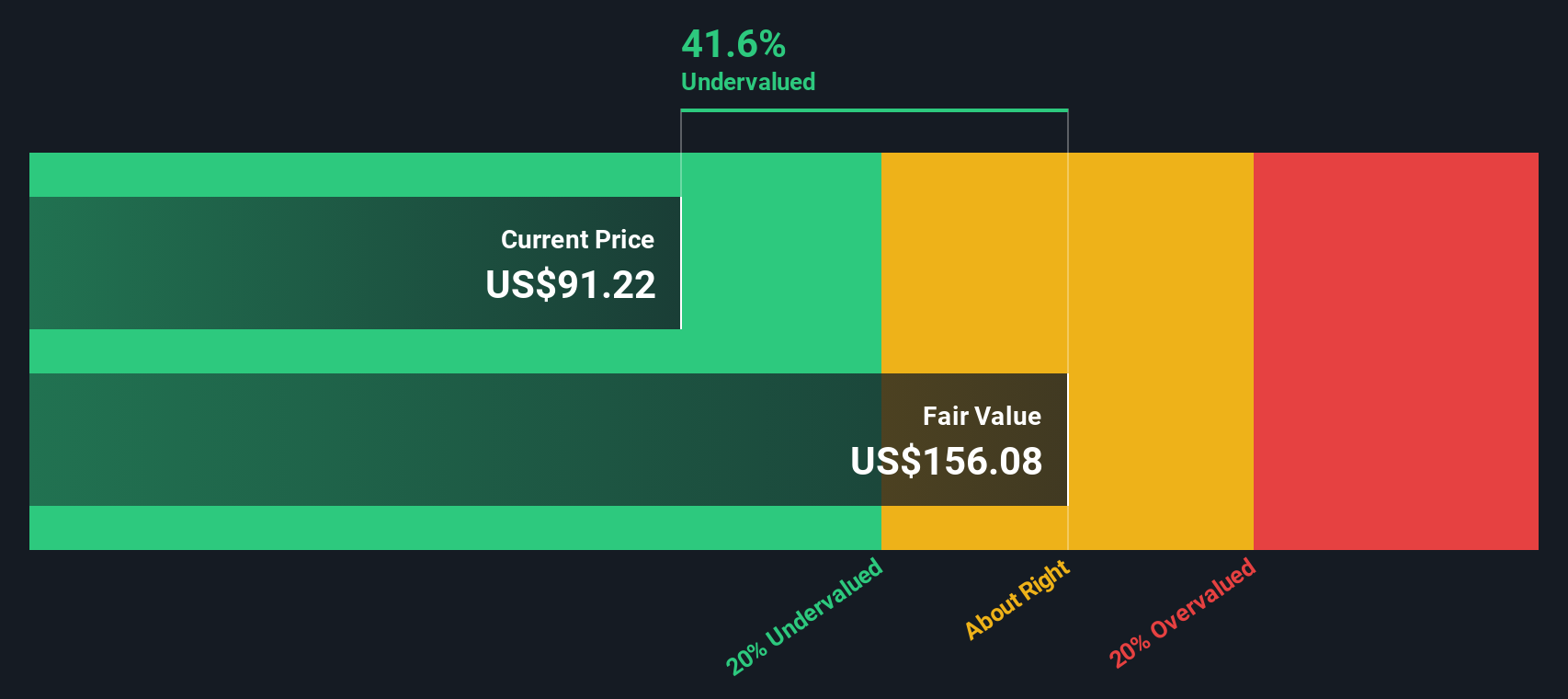

With a value score of 5 out of 6 possible checks for undervaluation, Zimmer Biomet stands out as a stock that could be trading below its underlying worth. Let’s take a closer look at those valuation methods next. Stay tuned, because I will introduce an even more insightful way to gauge the stock’s true value further on.

Approach 1: Zimmer Biomet Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today’s value. This approach helps investors determine a stock’s intrinsic worth based on expectations for the company’s ongoing ability to generate cash.

Zimmer Biomet Holdings currently produces about $1.03 billion in free cash flow (FCF) per year. Analyst estimates provide projections for the next five years, followed by extrapolated longer-term estimates. Projections suggest FCF will continue to grow, potentially reaching approximately $2.29 billion by 2035, with incremental growth each year. These cash flows are all calculated in US dollars ($).

Using the two-stage Free Cash Flow to Equity approach, the model estimates Zimmer Biomet’s fair value at $167.48 per share. Compared to where the stock trades today, this intrinsic value implies a substantial 38.5% discount, suggesting that shares may be trading well below their estimated worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zimmer Biomet Holdings is undervalued by 38.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

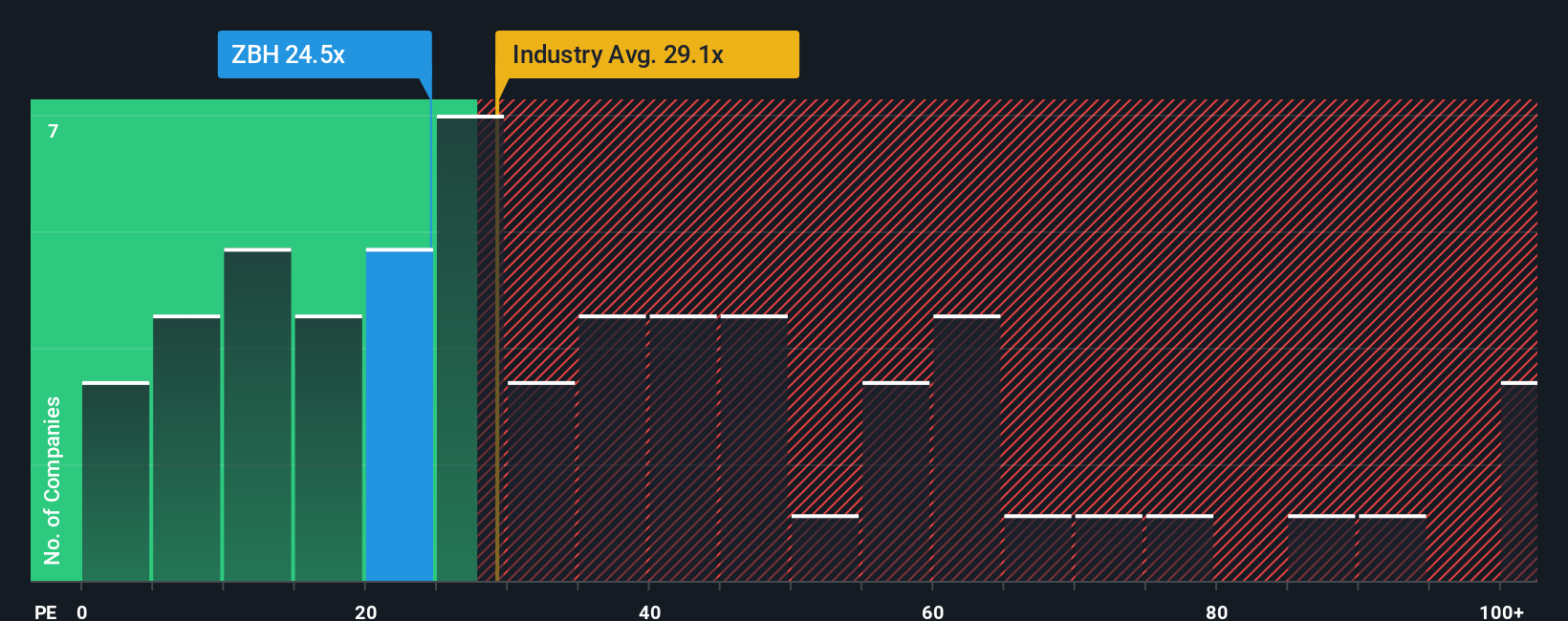

Approach 2: Zimmer Biomet Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely-used metric for valuing profitable companies because it reflects how much investors are willing to pay for each dollar of earnings. For firms with consistent profits like Zimmer Biomet Holdings, this measure offers a straightforward way to gauge whether the stock trades at a premium or discount relative to industry norms and growth prospects.

It is important to remember that a company’s growth outlook and business risks directly impact what counts as a “normal” PE ratio. Higher growth companies typically deserve higher PE multiples, while increased risk can justify a lower multiple. Therefore, benchmarking against peers and industry averages provides useful context, but does not always reveal the whole picture.

Zimmer Biomet’s current PE ratio is 24.8x. This sits below the Medical Equipment industry average of 29.7x, as well as below its selected peer group’s average of 32.6x. However, Simply Wall St’s unique “Fair Ratio” model, which considers the company’s expected earnings growth, profit margins, business risks, and size, calculates a fair PE of 26.5x for Zimmer Biomet. This proprietary metric offers a more tailored assessment than broad industry or peer comparisons by recognizing factors specific to Zimmer Biomet’s position and outlook.

Since the actual PE ratio (24.8x) is just slightly below the calculated Fair Ratio (26.5x), the current pricing appears to be about right.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zimmer Biomet Holdings Narrative

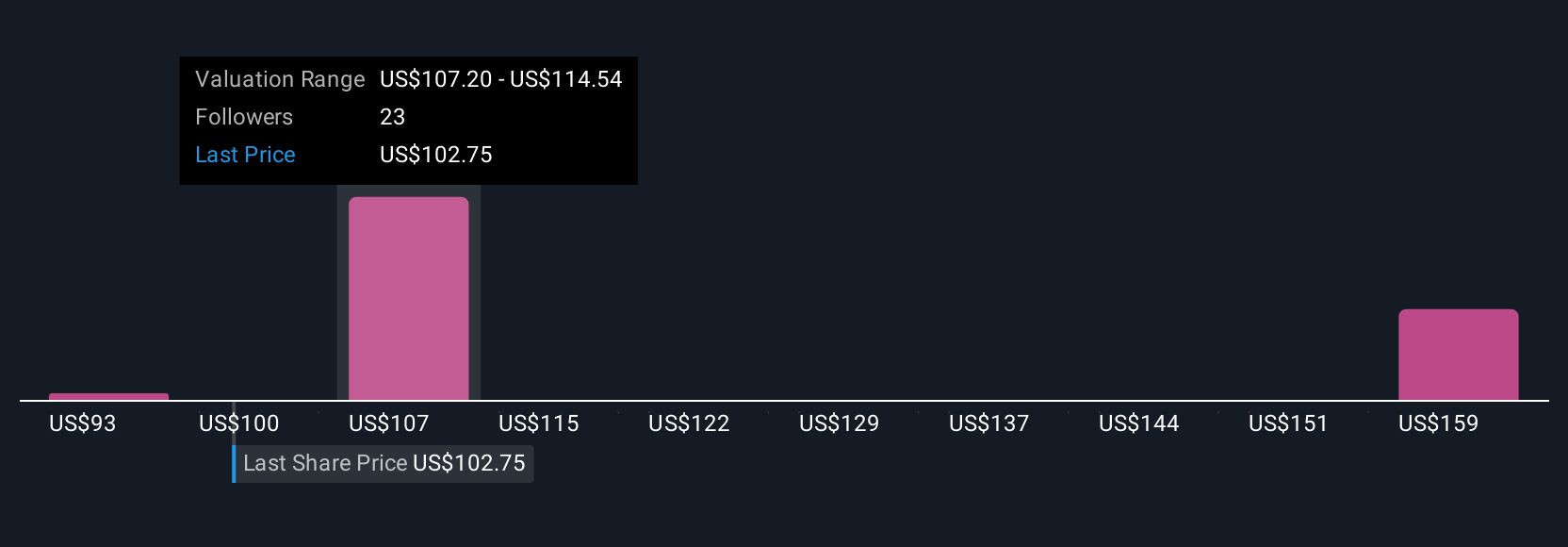

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives: a Narrative is your personal story behind Zimmer Biomet Holdings. It represents the "why" that connects your view of the business, your assumptions about its future (such as revenue, margins, and fair value), and a clear, trackable forecast.

Narratives make investing more intuitive by allowing you to express your outlook, link it directly to financial forecasts, and instantly see what the stock should be worth if your perspective plays out. On Simply Wall St's Community page, millions of investors use Narratives to create, update, and share their perspectives. This helps each other weigh up when a stock is undervalued, overvalued, or fairly priced by comparing Fair Value to the current Price.

Unlike static analyst price targets, Narratives are dynamic. They update automatically when new information is available, such as breaking news or earnings reports, so your strategy adapts in real time. For Zimmer Biomet Holdings, for example, some investors (the most bullish) see huge long-term potential driven by robotics and an aging population, estimating future earnings as high as $1.8 billion and fair values up to $138 per share. Others (the most cautious) focus on risks like competition and regulatory delays, estimating earnings at just $924.9 million with fair values as low as $96 per share.

Do you think there's more to the story for Zimmer Biomet Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.