Please use a PC Browser to access Register-Tadawul

It's Down 32% But Futu Holdings Limited (NASDAQ:FUTU) Could Be Riskier Than It Looks

Futu Holdings Limited FUTU | 171.45 | -0.76% |

Futu Holdings Limited (NASDAQ:FUTU) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 25%.

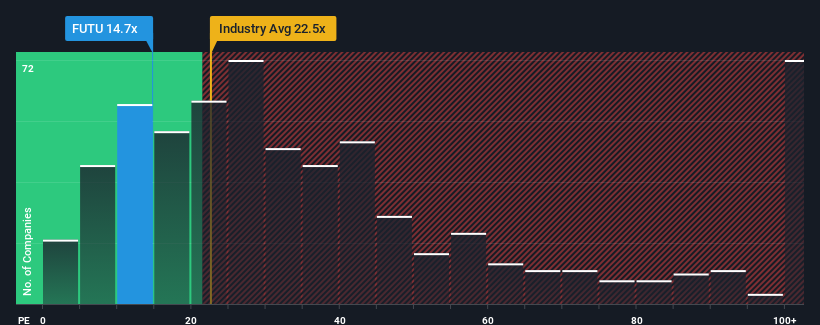

In spite of the heavy fall in price, it's still not a stretch to say that Futu Holdings' price-to-earnings (or "P/E") ratio of 14.7x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Futu Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Is There Some Growth For Futu Holdings?

The only time you'd be comfortable seeing a P/E like Futu Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 27% last year. Pleasingly, EPS has also lifted 111% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 25% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's curious that Futu Holdings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Futu Holdings' P/E?

Following Futu Holdings' share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Futu Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about this 1 warning sign we've spotted with Futu Holdings .

If these risks are making you reconsider your opinion on Futu Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.