Please use a PC Browser to access Register-Tadawul

Kodiak Sciences (KOD) Valuation Check As Phase 3 Readouts And Capital Raise Focus Investor Attention

Kodiak Sciences Inc. KOD | 25.28 | -5.19% |

Event driven setup for Kodiak Sciences

Kodiak Sciences (KOD) has just finished enrolling patients in its Phase 3 diabetic retinopathy trial, with topline data expected in Q1 2026 and additional wet AMD results targeted for Q2 2026.

Those timelines, together with a recent capital raise to support operations through these readouts, are now central to how investors are evaluating Kodiak’s risk profile and potential reward.

After a sharp run over the past quarter, with a 90 day share price return of 47.59% and a 1 year total shareholder return of 255.20%, Kodiak’s recent 1 week share price pullback of 5.93% suggests some investors are locking in gains ahead of the 2026 trial readouts and its J.P. Morgan Healthcare Conference appearance.

If you are watching Kodiak around these trial milestones, it can also be useful to see how other drug developers are trading by scanning healthcare stocks as a next step.

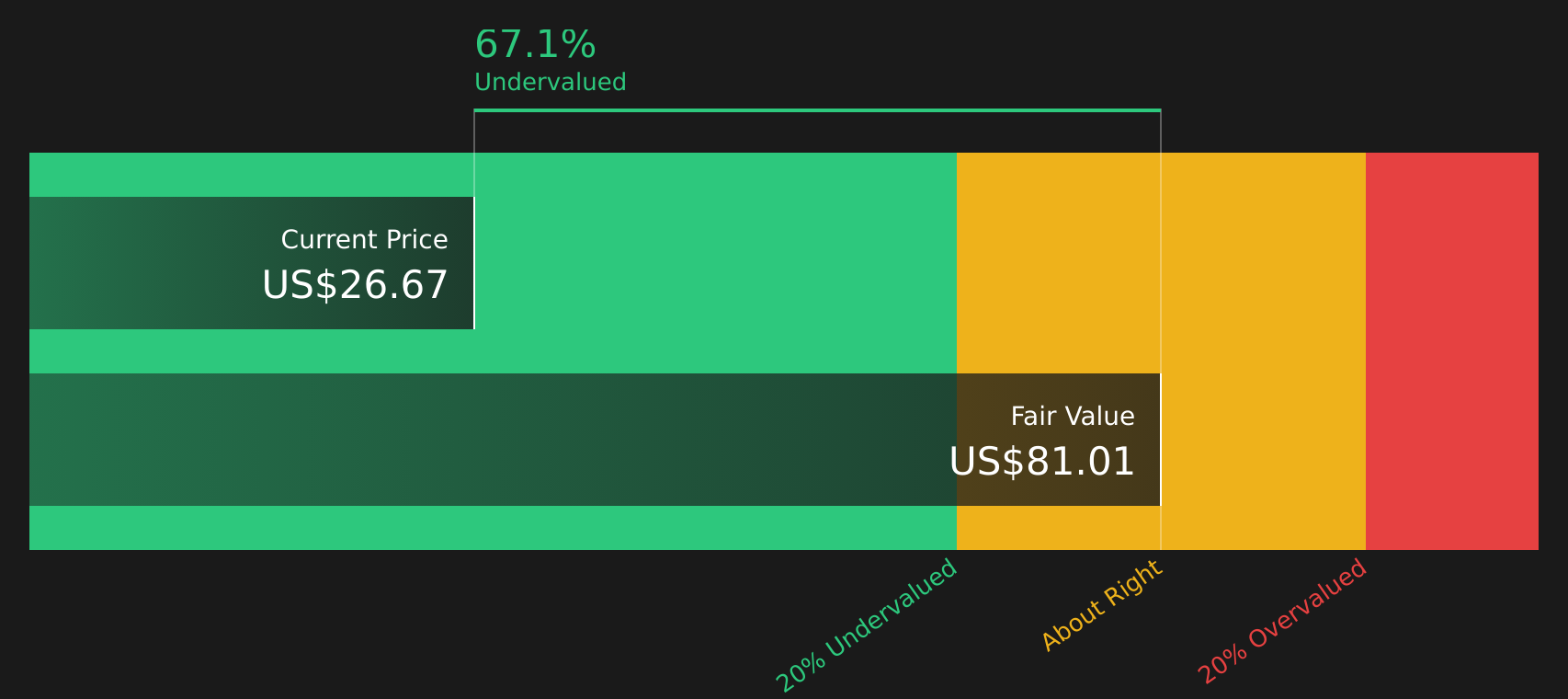

With Kodiak trading close to its US$27.50 analyst price target yet still showing an estimated intrinsic discount of about 17%, you have to ask: is there genuine upside left here, or is the market already pricing in future growth?

Price to Book of 69.7x: Is it justified?

With Kodiak Sciences last closing at US$26.64 and our DCF estimate of fair value at US$32.27, the shares are trading at a P/B ratio of 69.7x compared to a peer average of 6.2x and a US Biotechs industry average of 2.6x.

P/B compares the market value of the company to its net assets on the balance sheet, and for pre revenue biopharma names like Kodiak it often reflects expectations about future drug approvals rather than current earnings power.

Here, the P/B figure is very high relative to both peers and the broader Biotechs group. This suggests the market is assigning a sizeable premium to Kodiak’s pipeline and future cash flow potential even though it currently reports no meaningful revenue and remains loss making.

Against the industry average P/B of 2.6x, Kodiak’s 69.7x multiple is extremely rich. It also stands well above the 6.2x peer average, signaling that investors are paying a much higher price per dollar of book value than is typical across the sector.

Result: Price to book of 69.7x (OVERVALUED)

However, you still have to weigh trial risk and the size of Kodiak’s current loss of US$217.336 million, as either factor could quickly reset sentiment.

Another angle on value

The P/B of 69.7x screens as expensive, yet our DCF model points the other way, with a fair value estimate of US$32.27 versus the current US$26.64. That implies Kodiak trades at roughly a 17% discount. Which perspective do you prioritize: the balance sheet view or the cash flow view?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kodiak Sciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kodiak Sciences Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a custom Kodiak view in minutes with Do it your way.

A great starting point for your Kodiak Sciences research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Kodiak is on your radar, it is worth broadening your watchlist so you do not miss other opportunities that might fit your style and risk tolerance.

- Scan for potential value by checking out these 872 undervalued stocks based on cash flows that currently trade below their estimated cash flow based worth.

- Spot early tech themes by reviewing these 24 AI penny stocks that are tied to artificial intelligence trends across different parts of the market.

- Add a different growth angle by researching these 3530 penny stocks with strong financials where smaller share prices can come with very different risk and reward profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.