Kraft Heinz (NASDAQ:KHC) Has Announced A Dividend Of $0.40

Kraft Heinz Company KHC | 0.00 |

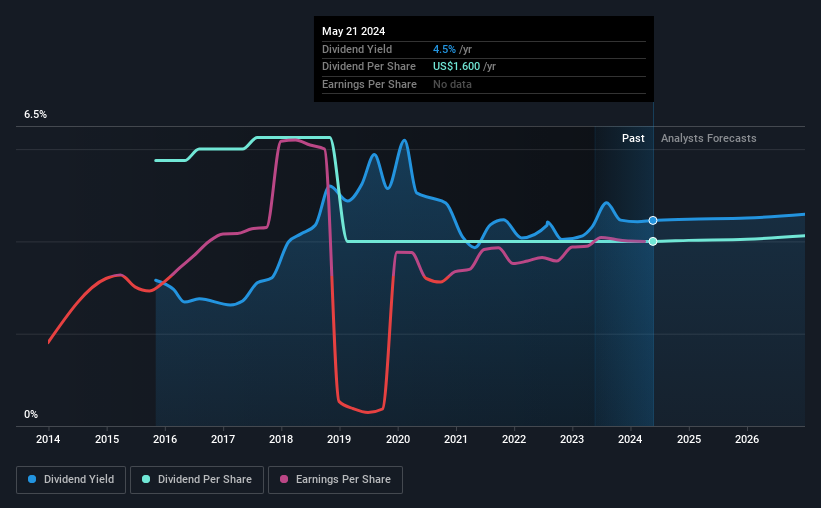

The Kraft Heinz Company (NASDAQ:KHC) will pay a dividend of $0.40 on the 28th of June. This means the annual payment is 4.5% of the current stock price, which is above the average for the industry.

See our latest analysis for Kraft Heinz

Kraft Heinz's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last dividend was quite easily covered by Kraft Heinz's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to expand by 47.4%. If the dividend continues on this path, the payout ratio could be 45% by next year, which we think can be pretty sustainable going forward.

Kraft Heinz's Dividend Has Lacked Consistency

Kraft Heinz has been paying dividends for a while, but the track record isn't stellar. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2015, the dividend has gone from $2.30 total annually to $1.60. Doing the maths, this is a decline of about 4.0% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Kraft Heinz has seen EPS rising for the last five years, at 69% per annum. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Kraft Heinz could prove to be a strong dividend payer.

Kraft Heinz Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Kraft Heinz that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 07/11 21:00

Lazydays Announces Plan To Delist Common Shares From Nasdaq, Effective Nov. 28

Benzinga News 07/11 21:08BillionToOne Announces Closing of Upsized Initial Public Offering and Full Exercise of Underwriters’ Option to Purchase Additional Shares

Reuters 07/11 21:05NI Holdings Q3 EPS $(0.08) Up From $(0.13) YoY, Sales $71.905M Down From $83.270M YoY

Benzinga News 07/11 21:16Canaccord Genuity Maintains Buy on Lifetime Brands, Lowers Price Target to $4

Benzinga News 07/11 21:46Will VNET Group’s (VNET) Green REIT Launch Reshape Its Approach to Capital Efficiency and Growth?

Simply Wall St 07/11 22:36Assessing News Corp (NWSA) Valuation: What Recent Price Trends Reveal for Investors

Simply Wall St 08/11 00:39A Look at Kraft Heinz’s (KHC) Valuation Following Spin-Off Plans and Reduced 2025 Outlook

Simply Wall St 09/11 09:35