Please use a PC Browser to access Register-Tadawul

Lacklustre Performance Is Driving Cirrus Logic, Inc.'s (NASDAQ:CRUS) 29% Price Drop

Cirrus Logic, Inc. CRUS | 122.52 | -2.78% |

The Cirrus Logic, Inc. (NASDAQ:CRUS) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 17% share price drop.

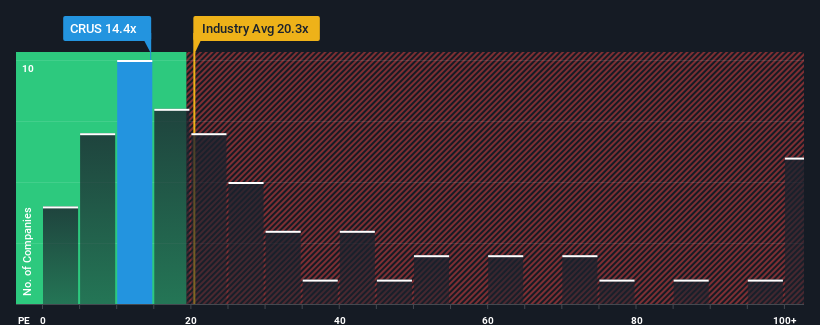

After such a large drop in price, Cirrus Logic's price-to-earnings (or "P/E") ratio of 13.5x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 16x and even P/E's above 29x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Cirrus Logic as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Cirrus Logic's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 78%. The latest three year period has also seen a 29% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 2.5% during the coming year according to the six analysts following the company. With the market predicted to deliver 14% growth , that's a disappointing outcome.

In light of this, it's understandable that Cirrus Logic's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The softening of Cirrus Logic's shares means its P/E is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Cirrus Logic's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Cirrus Logic with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Cirrus Logic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.