Please use a PC Browser to access Register-Tadawul

Lacklustre Performance Is Driving Hyatt Hotels Corporation's (NYSE:H) Low P/E

Hyatt Hotels Corporation Class A H | 161.55 | +0.25% |

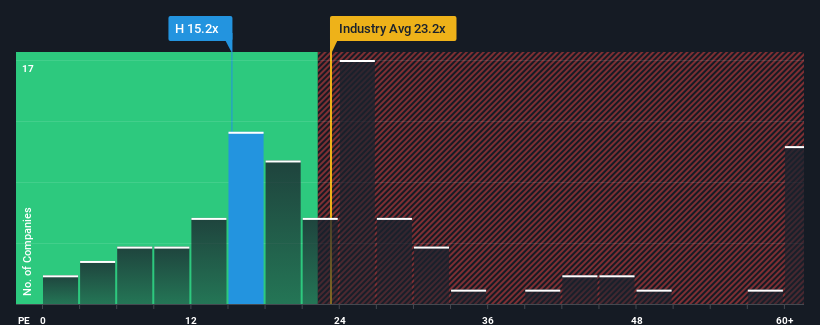

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Hyatt Hotels Corporation (NYSE:H) as an attractive investment with its 15.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Hyatt Hotels has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hyatt Hotels' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 126% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 13% each year over the next three years. Meanwhile, the broader market is forecast to expand by 10% each year, which paints a poor picture.

With this information, we are not surprised that Hyatt Hotels is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hyatt Hotels' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Hyatt Hotels has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.