Please use a PC Browser to access Register-Tadawul

Las Vegas Sands (NYSE:LVS) Faces 13% Weekly Price Drop As CEO Transition Looms

Las Vegas Sands Corp. LVS | 67.32 67.32 | +0.49% 0.00% Pre |

Las Vegas Sands (NYSE:LVS) saw its share price decline 13% over the past week amid significant leadership transitions, including the appointment of Muktesh Micky Pant to the board and impending changes in the CEO role. While these corporate dynamics unfolded, broader market turmoil from escalating global trade tensions exacerbated the decline. The Dow, S&P, and Nasdaq all experienced steep losses, with drops of 8%, 9%, and 10% respectively, as tariffs unsettled investor sentiment. The concurrent market and company-specific events likely influenced the sharp decline in LVS's share price during this turbulent period.

Over the past three years, Las Vegas Sands has experienced a total return decline of 4.27%, indicating challenges despite industry potential. Notably, this return underperformed the US market and the hospitality industry over the past year. Several factors may have influenced this performance. First, the completion of The Londoner in 2025 is anticipated to improve competitive standing in Macao. However, operational challenges prior to full capacity utilization may have weighed on margins. Additionally, the consistent reliance on the Chinese economy introduces some risk, especially given fluctuating market conditions and the potential impact on revenue growth.

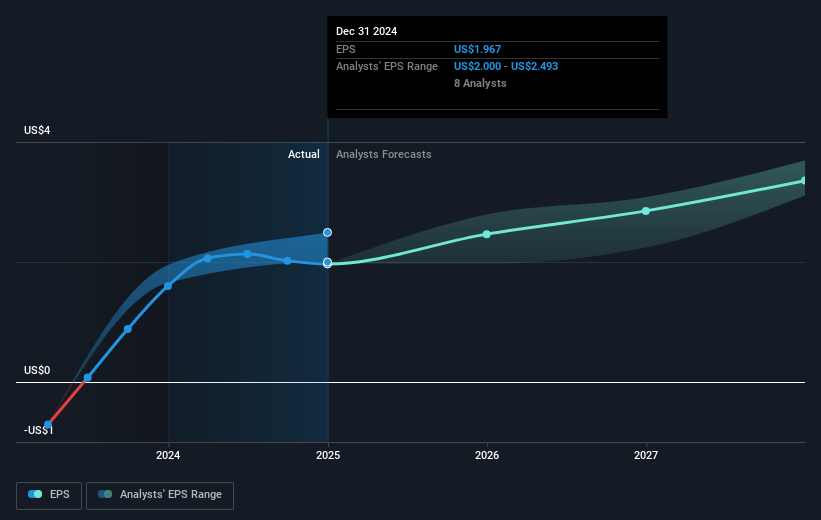

The company continued its capital returns focus, with active buyback initiatives and dividend announcements. A US$449.96 million repurchase of shares between October and December 2024 highlights this commitment. Despite robust earnings growth, as seen in the fourth quarter of 2024, these measures did not offset market concerns fully. Moreover, executive changes, including appointments like Muktesh Micky Pant and internal shifts with Robert G. Goldstein, might have impacted investor confidence, contributing to the share price performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.