Please use a PC Browser to access Register-Tadawul

LeMaitre Vascular (LMAT) Valuation Check After Mixed Share Performance And Growth Trends

LeMaitre Vascular, Inc. LMAT | 92.94 | +1.18% |

With no single headline event driving LeMaitre Vascular (LMAT) today, the story for investors centers on how its recent share performance and underlying financial profile line up with expectations.

At a share price of $85.80, LeMaitre Vascular has paired a 7.02% year to date share price return with an 88.03% three year total shareholder return, while the 1 year total shareholder return of a 13.10% decline suggests some of that earlier momentum has cooled.

If this kind of mixed momentum has you thinking about portfolio balance, it could be a good moment to scan other healthcare stocks that might fit your style and risk tolerance.

With annual revenue and net income growth both around 8% and the share price sitting below the average analyst target, the key question is whether LeMaitre Vascular is quietly undervalued or whether the market is already pricing in future growth.

Price to Earnings of 36.5x: Is it justified?

On a P/E of 36.5x at the last close of $85.80, LeMaitre Vascular sits between two signals, cheaper than some peers yet expensive against several benchmarks.

The P/E ratio compares the current share price to earnings per share, so for a medical equipment company like LeMaitre Vascular it reflects what investors are currently paying for each dollar of earnings.

According to the data, LMAT is described as good value against its peer average P/E of 56.7x, which suggests the market is not assigning it the same earnings multiple as some comparable names. However, it is also described as expensive versus the broader US Medical Equipment industry average P/E of 31.2x, and expensive relative to an estimated fair P/E of 19.3x that the market could move towards if sentiment or expectations cooled.

That combination, trading below a 56.7x peer average but above a 31.2x industry average and well above a 19.3x fair P/E estimate, points to a valuation that prices in solid earnings quality and past growth, but at a level that could be sensitive if growth expectations or profitability assumptions soften.

Result: Price-to-Earnings of 36.5x (OVERVALUED)

However, a 13.10% 1 year total return decline, alongside an 8% annual revenue and net income growth rate, could limit upside if investor expectations remain elevated.

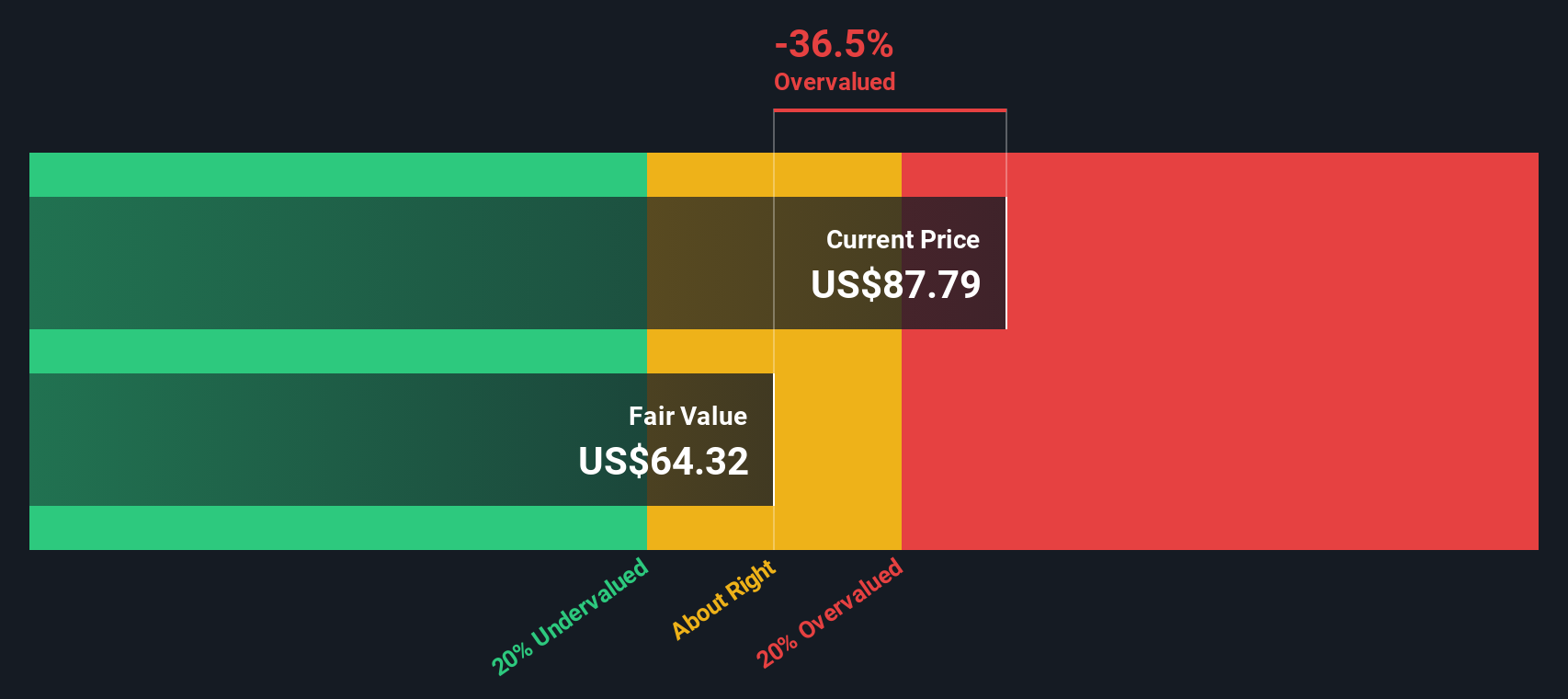

Another View: SWS DCF Model Points Lower

Our DCF model paints a different picture. On this approach, LeMaitre Vascular is described as expensive, with the current price of $85.80 sitting above an estimated fair value of $66.62. For you, the question is whether the earnings quality justifies paying above that fair value line.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out LeMaitre Vascular for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own LeMaitre Vascular Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own view against the data, you can build a custom thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LeMaitre Vascular.

Ready to hunt for your next opportunity?

If LeMaitre Vascular has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to line up fresh ideas that truly match your goals.

- Target income potential by zeroing in on companies with consistent payouts using these 13 dividend stocks with yields > 3% backed by data you can quickly scan and compare.

- Spot underappreciated opportunities by filtering for businesses trading below estimated cash flow value with these 872 undervalued stocks based on cash flows before others catch on.

- Consider major tech shifts by focusing on AI driven names through these 24 AI penny stocks so you are not watching the trend from the sidelines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.