Please use a PC Browser to access Register-Tadawul

Little Excitement Around Krispy Kreme, Inc.'s (NASDAQ:DNUT) Revenues As Shares Take 31% Pounding

Krispy Kreme, Inc. DNUT | 3.03 | +1.68% |

Krispy Kreme, Inc. (NASDAQ:DNUT) shares have had a horrible month, losing 31% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

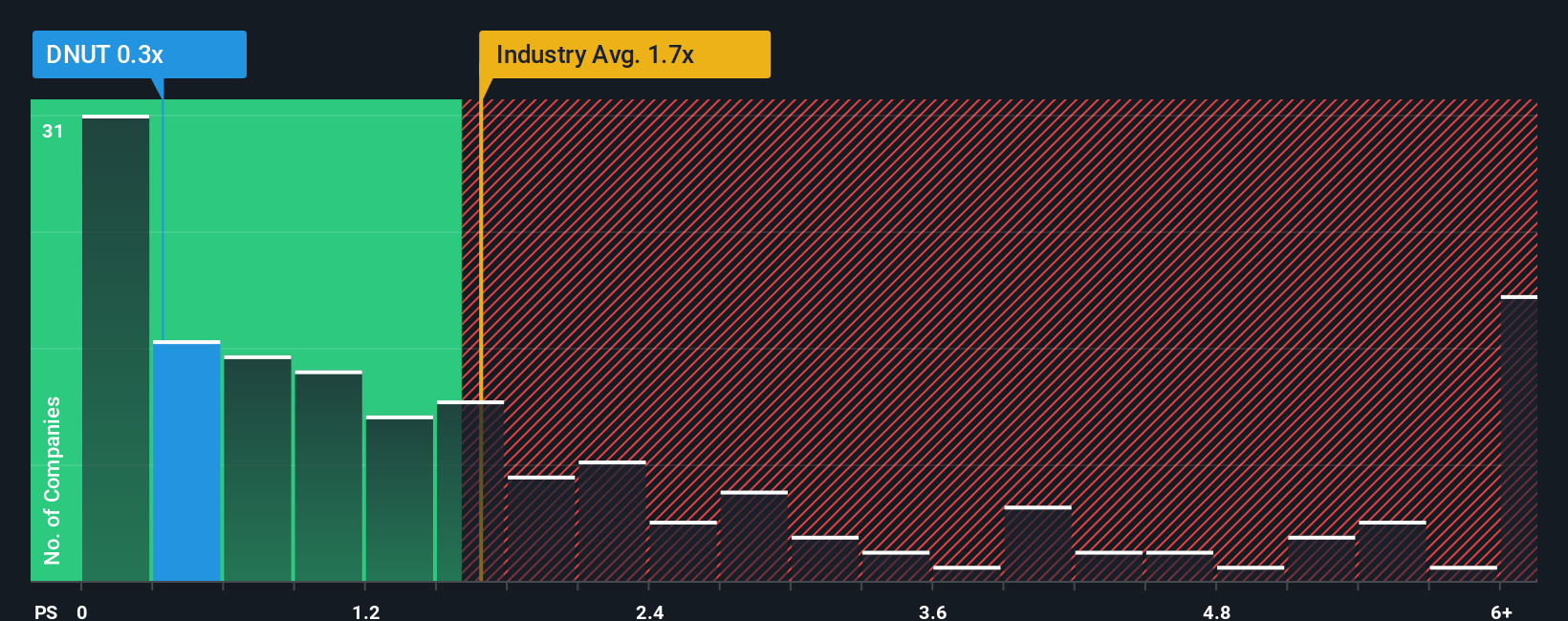

Following the heavy fall in price, Krispy Kreme's price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Hospitality industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Krispy Kreme Has Been Performing

Krispy Kreme could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Krispy Kreme's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Krispy Kreme's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 5.4% per annum during the coming three years according to the six analysts following the company. With the industry predicted to deliver 13% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Krispy Kreme's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Krispy Kreme's P/S?

Krispy Kreme's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Krispy Kreme's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.