Please use a PC Browser to access Register-Tadawul

Little Excitement Around TPG Inc.'s (NASDAQ:TPG) Revenues As Shares Take 26% Pounding

TPG Inc Class A TPG | 44.51 | -0.16% |

TPG Inc. (NASDAQ:TPG) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 17% in that time.

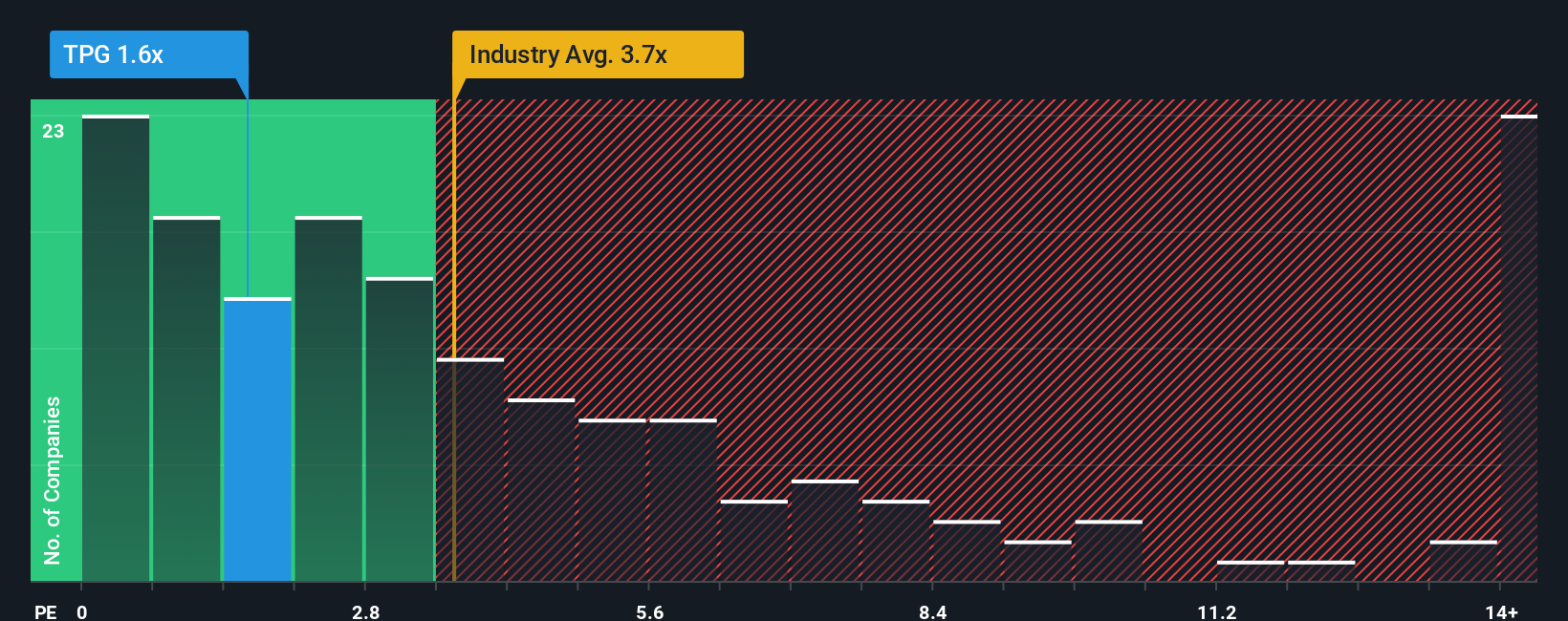

Even after such a large drop in price, TPG may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does TPG's Recent Performance Look Like?

TPG certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think TPG's future stacks up against the industry? In that case, our free report is a great place to start.How Is TPG's Revenue Growth Trending?

In order to justify its P/S ratio, TPG would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Pleasingly, revenue has also lifted 133% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 46% as estimated by the five analysts watching the company. That's not great when the rest of the industry is expected to grow by 5.6%.

With this information, we are not surprised that TPG is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On TPG's P/S

TPG's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that TPG's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.