Please use a PC Browser to access Register-Tadawul

Liva Insurance Company's (TADAWUL:8280) Business And Shares Still Trailing The Market

LIVA 8280.SA | 11.47 | -1.46% |

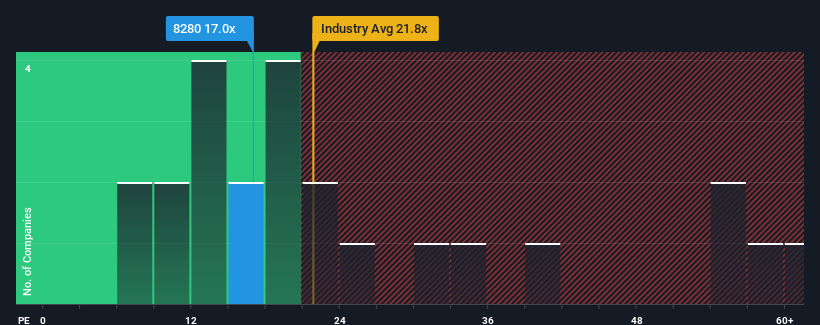

Liva Insurance Company's (TADAWUL:8280) price-to-earnings (or "P/E") ratio of 17x might make it look like a buy right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios above 23x and even P/E's above 40x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Liva Insurance certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For Liva Insurance?

In order to justify its P/E ratio, Liva Insurance would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 193% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Liva Insurance is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Liva Insurance revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Liva Insurance with six simple checks.

Of course, you might also be able to find a better stock than Liva Insurance. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.