Please use a PC Browser to access Register-Tadawul

LyondellBasell Industries (LYB): Evaluating Valuation After Strategic Pivot Toward Sustainability and Portfolio Reshaping

LyondellBasell Industries NV LYB | 42.98 | -0.83% |

Deciding what to do with shares in LyondellBasell Industries (NYSE:LYB) has suddenly become more interesting after the company’s latest moves. With management doubling down on its Circular and Low Carbon Solutions business, sharpening its portfolio through exits such as refining, and pushing for tighter cost control, investors are paying attention. The strategic shift is not just about new buzzwords; it is supported by concrete steps to reshape the business for a more sustainable and efficient future.

Yet, the market’s recent reaction has not been all positive. LyondellBasell Industries’ stock has dropped over the past month and three months, and it is down roughly 41% over the past year. Even over a longer view, the five-year total return is close to flat, signaling that momentum has faded despite years of solid dividends and industry standing. The current strategy and recognition as a high dividend stock have kept it on radars, but the price performance presents a more cautious picture.

After a year like this, is LYB offering an undervalued opportunity based on its future plans, or is the market already factoring in all the growth and transformation on the horizon?

Most Popular Narrative: 16.6% Undervalued

The most widely followed narrative currently values LyondellBasell Industries at a notable discount and projects a fair value significantly above its current share price. Analysts believe the company’s strategic investments and earnings growth potential may not yet be reflected in the market’s cautious stance.

LyondellBasell's strategic investments in circular and advanced recycling (MoReTec-1 and plans for MoReTec-2, plus expanding renewable feedstock capacity in Europe) position the company to benefit from rising regulatory and consumer demand for recycled and sustainable plastics, improving product mix and supporting higher net margins and long-term revenue growth.

Is the market missing something big? Find out what long-term forecasts and bold margin assumptions are hidden behind this narrative's compelling fair value. The most closely watched projections hint at a future profit surge and a valuation typically reserved for industry disruptors. Curious why the projected turnaround is gaining momentum? Discover the quantitative secrets behind this undervaluation.

Result: Fair Value of $61.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent industry overcapacity or delayed investment in recycling projects could quickly undermine LyondellBasell’s bullish turnaround story and projected margin improvement.

Find out about the key risks to this LyondellBasell Industries narrative.Another View: What Do Valuation Ratios Say?

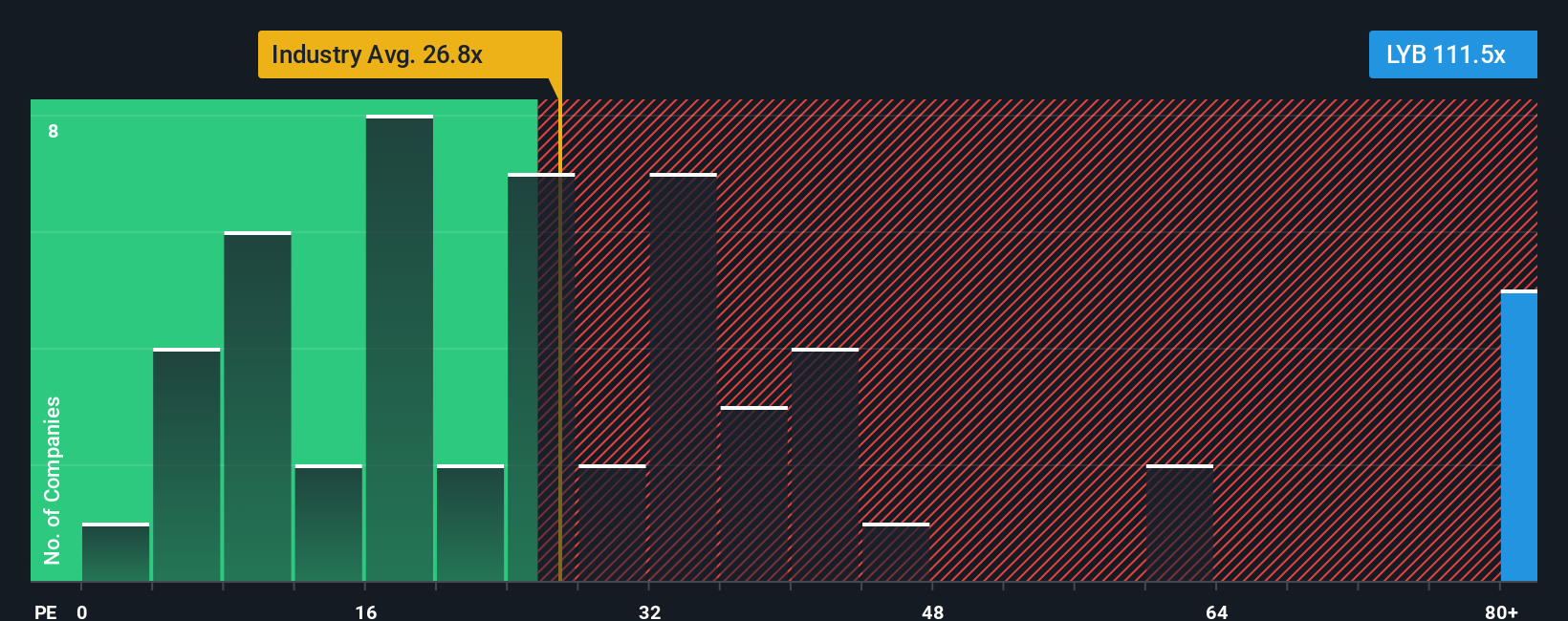

While analysts see upside based on future earnings, valuation ratios tell a different story. By this method, LyondellBasell shares look expensive compared to the industry, which casts doubt on the undervalued narrative. Could the truth be somewhere in between?

Build Your Own LyondellBasell Industries Narrative

If the prevailing views do not align with your own thinking, or you want to take a hands-on approach, you can build your version of the story in just minutes. Do it your way.

A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your portfolio to just one story. Smart investors keep an eye on a variety of themes to capture opportunities the crowd misses. Here are three exciting areas you can act on right now:

- Uncover stocks with built-in value by analyzing those undervalued stocks based on cash flows and see which companies the market may be mispricing today.

- Tap into the rise of health technology by searching for healthcare AI stocks that are transforming patient care with advanced artificial intelligence and data-driven breakthroughs.

- Spot income opportunities with dividend stocks with yields > 3% offering robust yields for an added layer of portfolio resilience and long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.