Please use a PC Browser to access Register-Tadawul

LyondellBasell Industries (LYB): Evaluating Valuation as Industry Oversupply and Analyst Reassessment Shape Investor Sentiment

LyondellBasell Industries NV LYB | 43.33 | -2.39% |

Recent remarks from Evercore ISI have put LyondellBasell Industries (NYSE:LYB) in the spotlight. The firm highlighted persistent industry oversupply, lowered profit expectations, and operational changes in Europe as key dynamics influencing investor sentiment.

Despite industry headwinds and a recent dip in its share price, LyondellBasell Industries remains a focus for investors reassessing both risks and long-term prospects. Over the past twelve months, the company’s total shareholder return edged down, reflecting ongoing caution as the chemical sector navigates oversupply concerns and evolving market dynamics.

If today’s volatility has you looking to expand your watchlist beyond just one sector, now is a great time to discover fast growing stocks with high insider ownership

With shares appearing nearly 17% undervalued against analyst targets but sector uncertainty lingering, investors are left to ask: Does LyondellBasell present a buying opportunity, or is the market already pricing in future recovery?

Most Popular Narrative: 17% Undervalued

The most widely followed narrative places LyondellBasell Industries’ fair value at $59.61, well above the last closing price of $49.47. This sets the stage for a discussion about what is driving this valuation gap, particularly as investors weigh future earnings potential against ongoing industry pressures.

LyondellBasell's strategic investments in circular and advanced recycling (MoReTec-1 and plans for MoReTec-2, plus expanding renewable feedstock capacity in Europe) position the company to benefit from rising regulatory and consumer demand for recycled and sustainable plastics, improving product mix and supporting higher net margins and long-term revenue growth.

Curious how cutting-edge recycling bets and a renewed business mix could shape the next phase for LyondellBasell? The most important financial assumptions behind this fair value might surprise you. Diving deeper reveals bold projections on profits and margins that challenge today’s consensus. Find out what really sets this narrative apart.

Result: Fair Value of $59.61 (UNDERVALUED)

However, continued global overcapacity and potential delays in key growth investments could undermine margin recovery and present challenges for LyondellBasell's turnaround story.

Another View: High Market Multiple Raises Questions

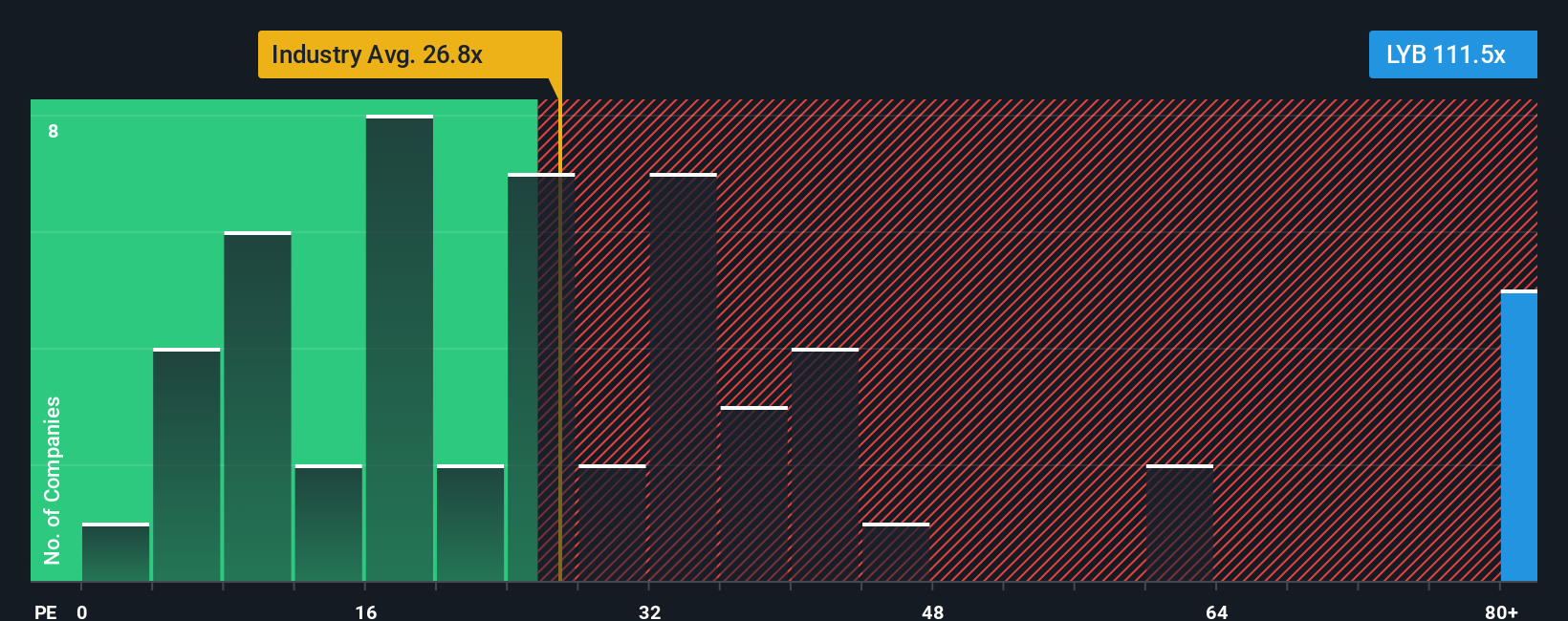

Looking at valuation through the lens of price-to-earnings, LyondellBasell trades at 106.1x, which is much higher than the US Chemicals industry average of 26.3x and the peer average of 19.7x. Even the fair ratio for the stock is estimated at 38.9x. Such a wide gap could signal overvaluation risk if future earnings do not rebound sharply. Does the current share price reflect optimism that may not materialize?

Build Your Own LyondellBasell Industries Narrative

If you have a different take or want to dive into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to one sector when there are breakthrough opportunities ready for you to seize? The Simply Wall Street Screener puts hundreds of standout picks within reach, but you need to take the first step.

- Tap into the potential of next-generation computing and position your portfolio at the edge of innovation by following these 26 quantum computing stocks, which is driving rapid advances in this pioneering technology.

- Maximize income potential by targeting steady, high-yield opportunities through these 19 dividend stocks with yields > 3%, which consistently reward shareholders above the market average.

- Get ahead with a shortlist of undervalued gems chosen for their strong fundamentals and upside possibilities when you put these 896 undervalued stocks based on cash flows on your radar today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.