Please use a PC Browser to access Register-Tadawul

Mach Natural Resources (MNR) Valuation Check After KeyBanc Downgrade And Integration Concerns

Mach Natural Resources LP MNR | 11.69 | -0.04% |

KeyBanc’s downgrade of Mach Natural Resources (MNR) to Sector Weight, tied to integration hurdles around new Central Basin Platform and San Juan Basin assets and reduced capital spending, has pushed investors to reassess the partnership’s near term outlook.

At a share price of $11.01, Mach Natural Resources has seen pressure build over the past quarter, with a 90 day share price return of 7.25% and a 1 year total shareholder return decline of 28.21%, which suggests momentum has been fading as investors factor in integration risks and recent board changes.

If asset integration risk is front of mind, it can help to widen your lens and see what else is out there, including aerospace and defense stocks as a different corner of the market to assess.

With Mach Natural Resources trading at $11.01 and screens suggesting a meaningful discount to some valuation estimates, you have to ask: is this weakness setting up a mispriced entry point, or is the market already bracing for tougher integration and slower growth?

Most Popular Narrative: 42.6% Undervalued

With Mach Natural Resources last closing at US$11.01 and the most followed narrative pointing to fair value around US$19.17, the gap between trading price and modelled worth is hard to ignore, especially given the focus on future cash generation and distributions.

The slow transition away from hydrocarbons and persistent reliance on oil and gas in the global energy mix provide Mach with a longer runway to generate sustained free cash flow from its diversified, low-decline production base. This supports stable or rising distributions and net margins, especially as macro energy security concerns favor U.S. supply.

Curious what has to happen for that valuation to make sense? The narrative leans heavily on compounding revenue, rising earnings and a future earnings multiple that undercuts the wider sector. Want to see how those moving parts connect?

Result: Fair Value of $19.17 (UNDERVALUED)

However, you still have to weigh the heavy tilt toward natural gas and the reliance on acquisition driven growth, both of which could strain margins and future distributions if conditions turn less supportive.

Another View On Valuation

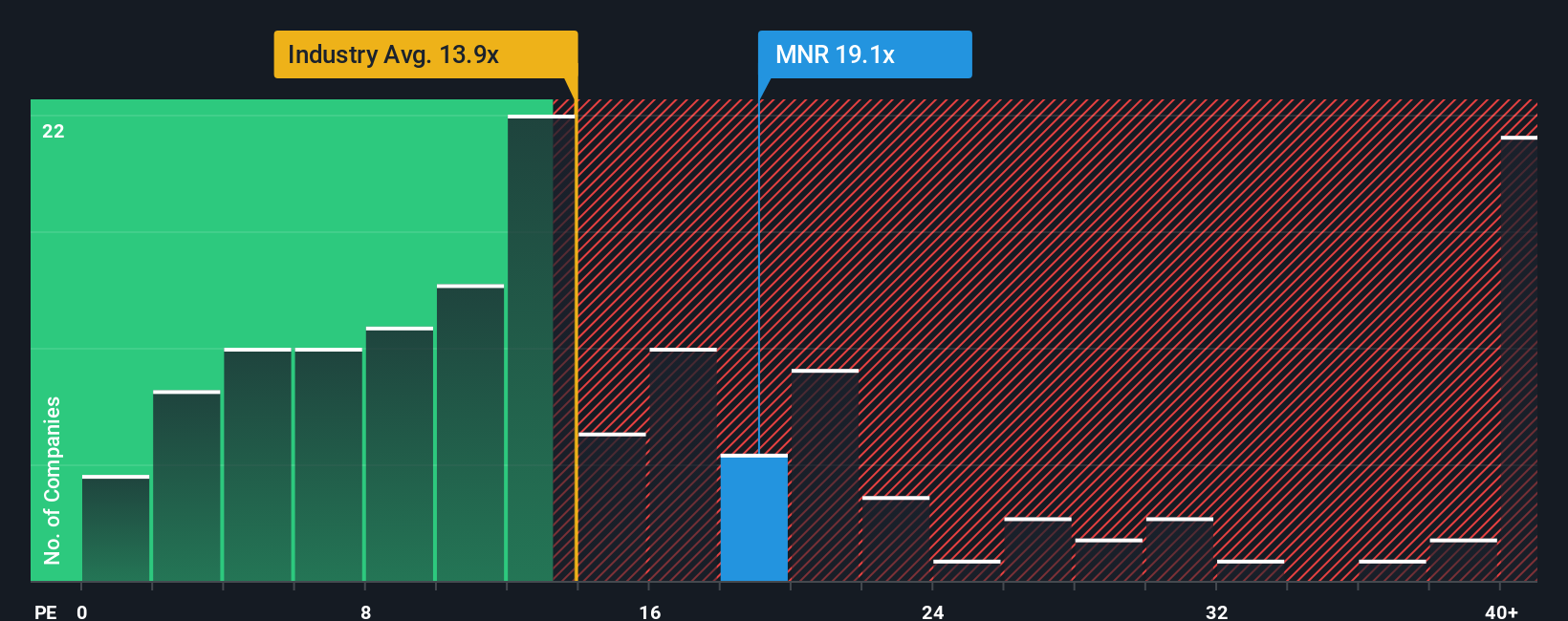

Those fair value models point to a wide gap, but the P/E story is more restrained. Mach trades on 17.4x earnings, above the US Oil and Gas average of 13.7x, below a 33.3x peer average, and close to a fair ratio of 18.2x. Is this really a deep discount, or just a modest margin of safety?

Build Your Own Mach Natural Resources Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to do your own analysis, you can build a fresh view in minutes with Do it your way.

A great starting point for your Mach Natural Resources research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with a single stock, you risk missing better fits for your goals. Put the Simply Wall St Screener to work and compare more options side by side.

- Kick start your search for higher-risk, high-reward opportunities with these 3539 penny stocks with strong financials that already clear basic financial quality checks.

- Tap into long term tech themes by scanning these 24 AI penny stocks that sit at the intersection of artificial intelligence and early stage growth.

- Zero in on potential mispricings by filtering for these 868 undervalued stocks based on cash flows where cash flow based metrics suggest a gap between price and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.