Please use a PC Browser to access Register-Tadawul

Marex Group (NasdaqGS:MRX) Valuation in Focus After Fraud Allegations and Intensified Legal Scrutiny

Marex Group plc MRX | 38.38 | +0.80% |

If you hold or are eyeing Marex Group (NasdaqGS:MRX), the latest news is impossible to ignore. Allegations of a years-long accounting scheme, including off-balance-sheet entities, fictitious transactions, and misleading disclosures, have rocked the company. Investigations now span multiple law firms, turning up the pressure on Marex’s leadership and placing transparency questions front and center for every shareholder.

The fallout has been immediate. Marex’s stock price took a sharp dive after the initial NINGI Research report surfaced, shaking confidence and fueling waves of legal inquiry. Yet, despite this turmoil, the stock still boasts a 45% gain over the past year, as well as a modest climb since the start of the year. This reflects both the long-term momentum and the seesaw of investor sentiment. Recent participation at industry conferences highlights management’s attempt to steady the narrative, but the market’s reaction suggests elevated risk is here to stay for now.

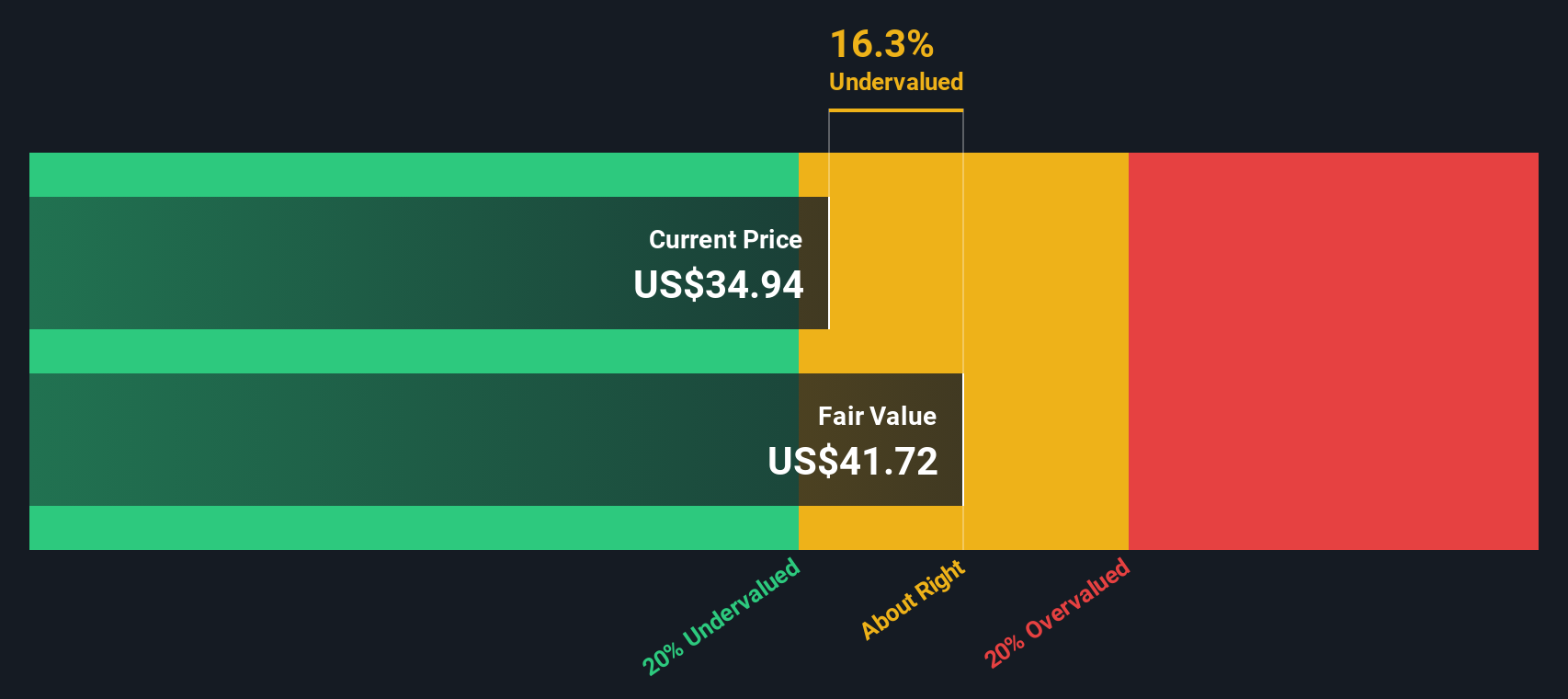

So after all this drama and the stock’s strong yearly return, is Marex Group now trading at a discount, or is the ongoing uncertainty already baked in?

Most Popular Narrative: 30.8% Undervalued

According to the most widely followed narrative, Marex Group may be significantly undervalued, with analysts projecting strong growth in future earnings and margin improvements that are not fully reflected in today's stock price.

Ongoing M&A activity, particularly the transformative Winterflood acquisition and a robust pipeline of smaller deals, is expected to drive both revenue and margin synergies through product and geographic diversification, cross-selling, and operational scale. These factors could positively impact topline and earnings stability.

What is fueling this bold upside call? This narrative is based on a combination of rapid margin expansion, broader market reach, and some aggressive bottom-line forecasts. Whether Marex can live up to these assumptions and meet the target remains an open question. The details behind this valuation could surprise even seasoned investors.

Result: Fair Value of $50.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent governance concerns or tougher competition in market making could quickly overshadow growth drivers and challenge Marex Group's current discount narrative.

Find out about the key risks to this Marex Group narrative.Another View: The SWS DCF Model Perspective

Taking a different approach, our DCF model also finds Marex Group undervalued. This highlights the impact of projected future cash flows and discount rates. Does this alternative view reinforce the upside, or are risks still underestimated?

Build Your Own Marex Group Narrative

If you have a different perspective or want to investigate Marex Group on your own terms, you have the option to craft your own research-backed view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Marex Group.

Looking for More Investment Ideas?

Don’t let your next standout opportunity slip by. There are plenty of compelling stocks out there, and these smart shortcuts make finding them easier than ever:

- Target unbeatable value by scanning for undervalued stocks based on cash flows. This is perfect for investors aiming to capitalize on mispriced companies poised for growth.

- Tap into next-generation healthcare breakthroughs by finding healthcare AI stocks, where artificial intelligence is transforming patient care and diagnostics.

- Accelerate your search for robust yields with dividend stocks with yields > 3% to zero in on companies rewarding shareholders with above-average returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.