Please use a PC Browser to access Register-Tadawul

Market Buzz | How to Invest in High-Yield Dividend Stocks Amid Rate Cut Expectations

Realty Income Corporation O | 57.44 | -1.10% |

Franklin Resources, Inc. BEN | 23.47 | -0.64% |

AMCOR PLC AMCR | 8.32 | +0.85% |

Kenvue Inc. KVUE | 17.25 | +0.23% |

T. Rowe Price Group TROW | 103.92 | +0.29% |

As the Federal Reserve enters a cycle of interest rate cuts, high-yield dividend stocks may become a focal point for investors.

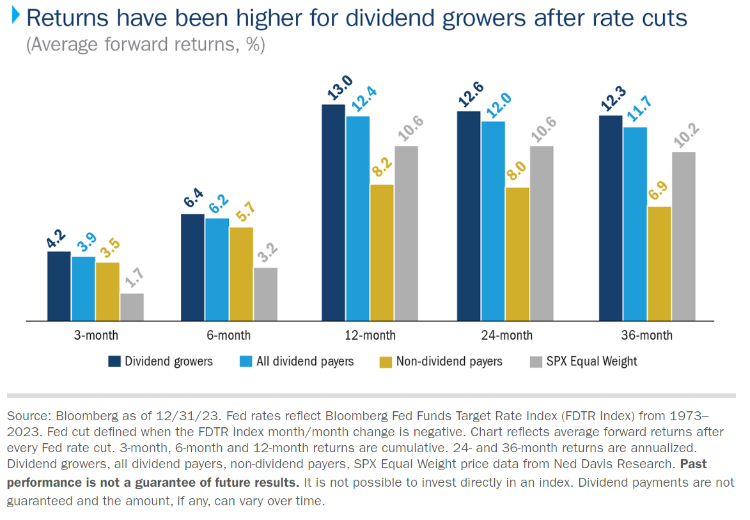

According to a report from Morningstar, dividend-paying stocks tend to perform better than non-dividend-paying stocks during periods of rate reductions. There are two potential reasons for this trend:

- Lower interest rates may increase the attractiveness of dividend-paying stocks. For some investors, dividends are a primary source of income from their equity investments.

- Another reason is that stocks generally perform relatively well before an economic recession, often coinciding with rate cuts.

Data Source: Morningstar

How to Select High-Yield Dividend Stocks?

With many high-yield dividend stocks available, how can investors make an informed choice?

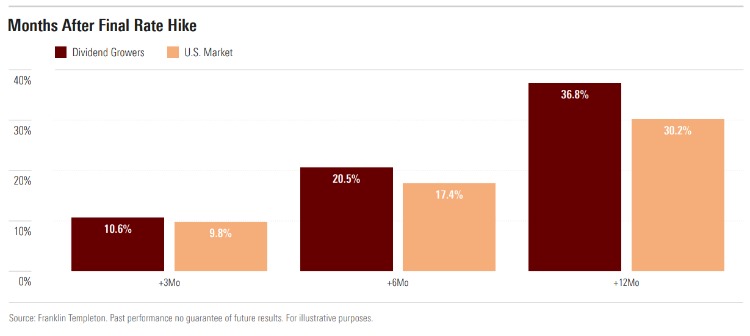

A research report from Columbia Threadneedle Investments suggests that, historically, companies that increase their dividends outperform other stocks when the Federal Reserve initiates rate cuts.

This indicates that when selecting high-yield stocks, the reliability of dividend payments and the potential for dividend growth are key metrics to consider.

In the U.S. stock market, two specific indices track companies that consistently increase their dividends: the Dividend Aristocrats and the Dividend Kings.

The Dividend Aristocrats index tracks companies that have raised their dividends for at least 25 consecutive years, while the Dividend Kings index focuses on companies that have done so for 50 straight years.

Generally, companies that can sustain and increase dividends over a long period are rare. Such companies need to have highly stable operations, and their products or services typically remain unaffected by economic downturns, enabling them to continue increasing dividend payouts.

Therefore, the Dividend Aristocrats and Dividend Kings are often blue-chip stocks from various industries. Their business models are well-established, capable of generating stable profits and cash flow, and they generally prefer to return profits to shareholders in the form of dividends.

2024 Dividend Aristocrat List (Ranked by Dividend Yield)

Becoming a Dividend Aristocrat is no easy feat, given the stringent selection criteria:

- Must be a component of the S&P 500

- Must have increased dividends for at least 25 consecutive years

- Must have a market capitalization of over $3 billion

- Must have an average daily trading volume of at least $5 million over the past three months

According to data from Tipranks and Simply Safe Dividends, there are 66 companies featured as Dividend Aristocrats in 2024. Familiar names such as Coca-Cola ( Coca-Cola Company(KO.US) ), McDonald's ( McDonald's Corporation(MCD.US) ), and Walmart ( Wal-Mart Stores, Inc.(WMT.US) ) are prime exemplars of this distinguished group.

Investors can utilize various metrics to identify noteworthy Dividend Aristocrats, with one common metric being the dividend yield.

Given that stock prices fluctuate while dividend payments remain relatively stable, the dividend yield of Dividend Aristocrat stocks can vary over time. (Data as of July 4, 2024)

As of July 4, 2024, based on the latest dividend yield rankings, investors can find the top 10 Dividend Aristocrats. The top three are Realty Income (O), Franklin Resources (BEN), and Amcor (AMCR), with dividend yields of 5.78%, 5.57%, and 5.24%, respectively.

| Ticker | Dividend Yield % | Dividend Growth Streak (Years) |

| Realty Income Corporation(O.US) | 5.78% | 29 |

| Franklin Resources, Inc.(BEN.US) | 5.57% | 43 |

| AMCOR PLC(AMCR.US) | 5.24% | 40 |

| Kenvue Inc.(KVUE.US) | 4.37% | 61 |

| Federal Realty Investment Trust(FRT.US) | 4.33% | 56 |

| T. Rowe Price Group(TROW.US) | 4.29% | 37 |

| Stanley Black & Decker, Inc.(SWK.US) | 4.07% | 56 |

| Chevron Corporation(CVX.US) | 4.07% | 36 |

| J. M. Smucker Company(SJM.US) | 3.86% | 21 |

| International Business Machines Corporation(IBM.US) | 3.78% | 28 |

2024 Dividend Kings List (Ranked by Dividend Yield)

Unlike the Dividend Aristocrats, the Dividend Kings are not required to be S&P 500 index components. However, they must meet an even stricter criterion: increasing their dividends for at least 50 consecutive years.

As a result, the Dividend Kings list may overlap with the Dividend Aristocrats but also includes high-quality dividend-paying stocks outside of the S&P 500.

According to Simply Safe Dividends data, 49 companies have been designated as Dividend Kings in 2024. The three companies with the longest streaks of consecutive dividend increases are American States Water ( American States Water Company(AWR.US) ), Northwest Natural Gas ( Northwest Natural Gas Company(NWN.US) ), and Dover Corporation ( Dover Corporation(DOV.US) ), each having increased their dividends for at least 68 years.

Investors can also screen the Dividend Kings list using the dividend yield metric. As of July 4, 2024, the top 10 Dividend Kings ranked by dividend yield are as follows:

| Ticker | Dividend Yield | Dividend Growth Streak (Years) |

| Altria Group, Inc.(MO.US) | 8.52 | 54 |

| Universal Corporation(UVV.US) | 6.95 | 54 |

| Northwest Natural Gas Company(NWN.US) | 5.53 | 69 |

| Black Hills Corporation(BKH.US) | 4.87 | 53 |

| United Bankshares, Inc.(UBSI.US) | 4.66 | 50 |

| Fortis Inc.(FTS.US) | 4.47 | 50 |

| Federal Realty Investment Trust(FRT.US) | 4.33 | 56 |

| Stanley Black & Decker, Inc.(SWK.US) | 3.99 | 56 |

| National Fuel Gas Company(NFG.US) | 3.78 | 53 |

| Hormel Foods Corporation(HRL.US) | 3.75 | 58 |

How to Invest in High-Yield Stocks

For investors seeking a steady cash flow, Dividend Aristocrats and Dividend Kings offer some excellent options.

Investors can select dividend-paying stocks using metrics such as dividend yield from these lists. However, investing in individual stocks can carry high risks.

To mitigate risk, investors might consider ETFs that track these dividend-paying stocks instead of investing in one or two individual stocks.

Currently, there are specific ETFs that track Dividend Aristocrats, but no dedicated ETF tracks Dividend Kings yet. According to the S&P Dow Jones Index official website, two ETFs are tracking Dividend Aristocrats in the U.S. market:

- ProShares S&P 500 Dividend Aristocrats ETF ( Proshares Trust S&P 500 Divid Aristocrats ETF(NOBL.US) )

- FT Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF ( Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF(KNG.US) )

Pros and Cons of Investing in High-Yield Stocks

Pros:

1. Stable Cash Flow: Dividend Aristocrats and Dividend Kings can provide a steady stream of dividend income even during market downturns or economic recessions.

2. Financial Stability: Holding Dividend Aristocrats and Dividend Kings for at least 25 years and receiving consistently increasing dividends indicates these companies can maintain financial stability even in adverse macroeconomic conditions. This is a strong sign of their resilience against market volatility.

Cons:

1. Lower Growth: These stocks are usually mature companies with limited growth potential. They may not offer high-growth opportunities like emerging companies.

2. Dividend Cuts: Being on the Dividend Aristocrats or Dividend Kings list doesn't guarantee future dividend increases. Companies facing deteriorating business conditions or declining profits might cut dividends, potentially dropping out of the list.

3. Dividend Taxes: Even if you plan to hold stocks long-term to avoid capital gains tax, annual dividend payments are still subject to taxation. This could affect your overall investment returns, so it's essential to consider tax implications in your investment decisions.

Conclusion

Holding high-yield stocks offers a reliable source of dividend income for investors, but it also comes with some limitations. Investors need to weigh these pros and cons to ensure alignment with their individual investment goals and risk tolerance.