Please use a PC Browser to access Register-Tadawul

Market Cool On Bit Digital, Inc.'s (NASDAQ:BTBT) Revenues Pushing Shares 27% Lower

Bit Digital, Inc. BTBT | 2.10 | +1.45% |

Unfortunately for some shareholders, the Bit Digital, Inc. (NASDAQ:BTBT) share price has dived 27% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 8.4% in the last year.

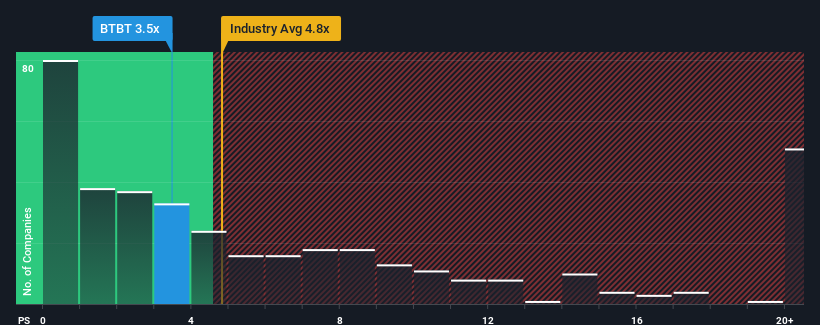

Following the heavy fall in price, Bit Digital's price-to-sales (or "P/S") ratio of 3.5x might make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 4.7x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Bit Digital's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Bit Digital has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bit Digital.Is There Any Revenue Growth Forecasted For Bit Digital?

In order to justify its P/S ratio, Bit Digital would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 167% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 53% over the next year. That's shaping up to be materially higher than the 17% growth forecast for the broader industry.

With this information, we find it odd that Bit Digital is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Bit Digital's P/S?

The southerly movements of Bit Digital's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Bit Digital's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.