Please use a PC Browser to access Register-Tadawul

Market Cool On ChargePoint Holdings, Inc.'s (NYSE:CHPT) Revenues Pushing Shares 33% Lower

ChargePoint Holdings Inc Ordinary Shares - Class A CHPT | 7.61 7.66 | -3.79% +0.66% Pre |

ChargePoint Holdings, Inc. (NYSE:CHPT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

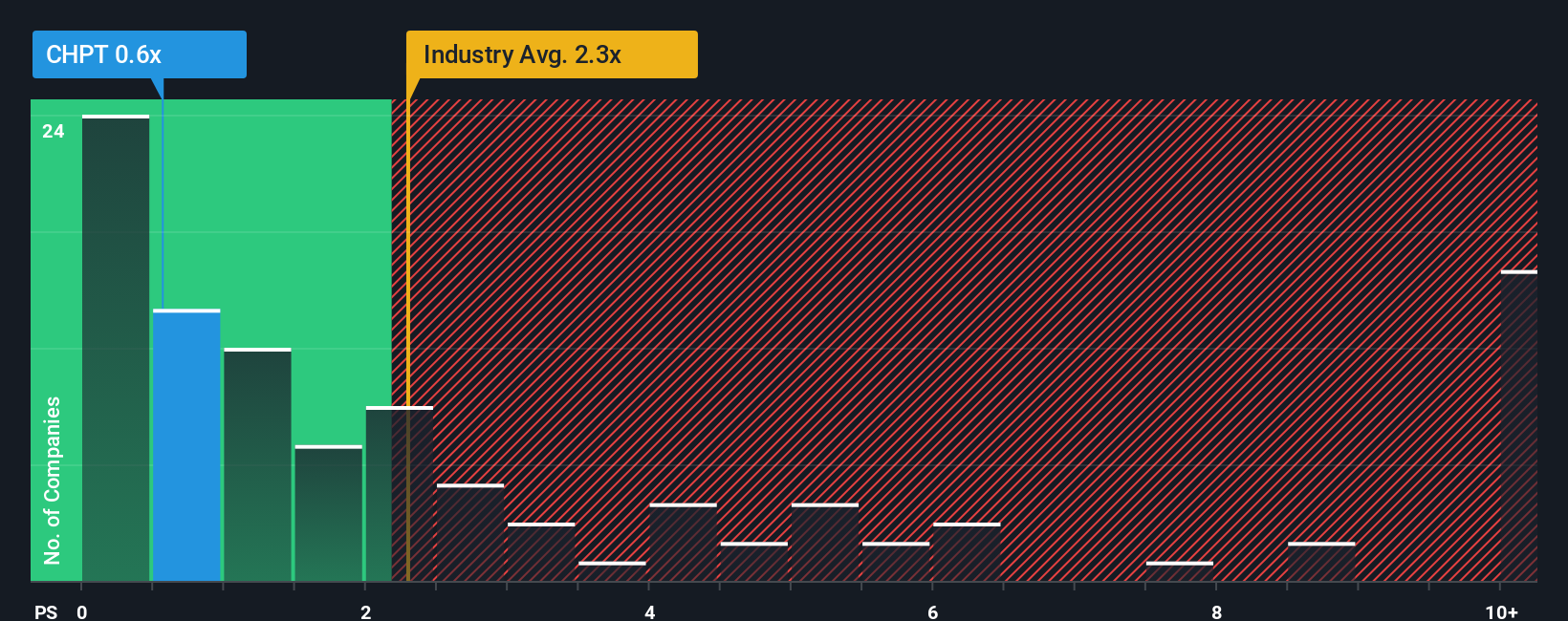

After such a large drop in price, ChargePoint Holdings' price-to-sales (or "P/S") ratio of 0.6x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 2.3x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does ChargePoint Holdings' P/S Mean For Shareholders?

ChargePoint Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think ChargePoint Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For ChargePoint Holdings?

In order to justify its P/S ratio, ChargePoint Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Even so, admirably revenue has lifted 45% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 24% per year over the next three years. With the industry only predicted to deliver 16% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that ChargePoint Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

ChargePoint Holdings' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems ChargePoint Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware ChargePoint Holdings is showing 3 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.