Please use a PC Browser to access Register-Tadawul

Market Expects Over 90% Probability of Rate Cut in September: These Targets Could Be Potential Winners

Real Estate Select Sector SP XLRE | 40.63 | -0.68% |

Ishares U.S. Real Estate ETF IYR | 93.56 | -0.70% |

Ultra Real Estate Proshares URE | 59.90 | 0.00% |

Simon Property Group, Inc. SPG | 183.03 | -0.62% |

Lennar Corporation Class A LEN | 117.61 | -1.77% |

On Monday, investors resumed buying U.S. stocks as market sentiment shifted from last Friday's weak July non-farm payroll report and significant downward revisions to May and June data, towards expectations of a possible Federal Reserve rate cut.

Federal Reserve Officials Lean Towards Rate Cuts, Trump Celebrates U.S. Stock Surge

The Federal Reserve's July meeting revealed rare divisions, with Fed Governors Bowman and Waller opposing a pause and advocating for an immediate 25 basis point rate cut. Bowman's shift from a hawkish stance highlights growing concerns over economic slowdown.

San Francisco Fed President Daly stated on Monday that with a weakening job market and inflation not rising significantly due to tariffs, the timing for a rate cut is ripe. Although she supported a July pause, she emphasized that "waiting indefinitely" is not an option, and policy adjustments could occur at any upcoming meeting. She considers a path of two rate cuts this year, each by 25 basis points, generally appropriate, but the pace will depend on data. The decision for September hinges on employment and inflation figures.

Daly noted that July's non-farm payrolls did not show "dramatic deterioration," but various indicators suggest the labor market is weakening. If this softness persists without an inflation rebound, more than two rate cuts might be necessary. She also warned that there is currently no evidence that tariffs are causing sustained inflation, but excessive waiting could lead to policy lag.

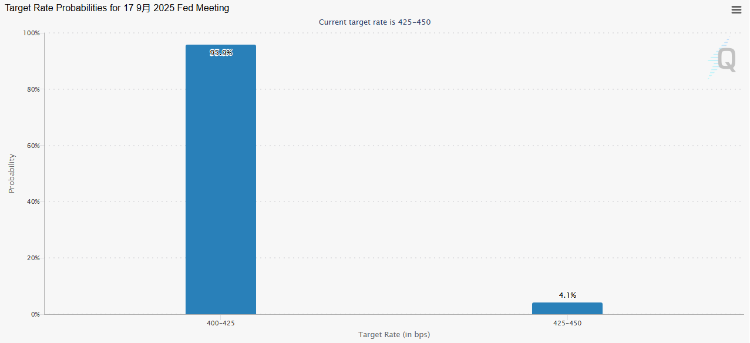

According to CME Group data, the probability of a rate cut in September has now reached 95.9%, compared to less than 40% before the non-farm data release. Goldman Sachs indicated that if the next employment report shows a further rise in unemployment, the Fed might cut rates by an additional 50 basis points. The market is broadly betting on at least two rate cuts before year-end, with increasing expectations for consecutive 25 basis point cuts in September and October, followed by another in December, totaling three cuts and 75 basis points.

On Monday, Trump once again took to social media to celebrate the significant rise in U.S. stocks, predicting more days like this in the future. It's noteworthy that this isn't the first time Trump has publicly commented on the stock market. Back in April, shortly before announcing a pause on "reciprocal tariffs," he used social media to encourage investors to seize the moment. The pause on tariffs sparked a strong market reaction, leading to a 9.5% surge in the S&P 500 at the close, nearly recovering 70% of the losses from the previous four trading days.

Federal Reserve Governors' Unexpected Departure Sparks Early Succession Battle

Federal Reserve Governor Kugler, whose term was set to end in January 2026, will unexpectedly leave on August 8. This move forces the White House to immediately start searching for his replacement, effectively accelerating the process for selecting the next Fed Chair. Trump announced on Sunday that a new Fed Governor would be chosen "in the coming days." Leading candidates include White House National Economic Council Director Kevin Hassett, Stanford University's Hoover Institution's Kevin Warsh, and Treasury Secretary Scott Besant.

Trump has long been dissatisfied with Powell's resistance to rate cuts, believing his high-interest rate policy hinders economic growth and expressing concern that his tariff measures could lead to inflation. Trump has frequently criticized Powell as "foolish" and "politicized," even privately discussing the possibility of demotion or dismissal. Kugler's departure creates an opportunity for Trump to install someone at the Fed more aligned with his preference for rate cuts.

UBS noted that the previous plan was to fill the governor's seat after Kugler's term ended, then elevate the successor to chair after Powell's term ends in May 2026. Now, the timeline is compressed. Fed rules require the chair to be a governor, so the White House must appoint the future chair to Kugler's seat early to avoid nomination issues, as the chair must be a current member. However, having the "heir apparent" work alongside the current chair on the FOMC could cause policy communication conflicts and intensify internal tensions.

Fed Rate Cut Beneficiaries

The Fed's September rate decision could significantly impact market volatility. Sahm has outlined tools for both bullish and bearish strategies and trading opportunities under rate cut expectations, including index long/short positions and interest rate-sensitive assets, for investors' reference

- Sectors to Watch:

- Relevant Index ETFs to Watch.

| Index | Code | Leverage/Direction |

|---|---|---|

| S&P 500 | ETF-S&P 500(SPY.US) | 1x Long |

| Vanguard S&P 500 Etf(VOO.US) | 1x Long | |

| NASDAQ | PowerShares QQQ Trust,Series 1(QQQ.US) | 1x Long |

| Ultrapro QQQ Proshares(TQQQ.US) | 3x Long | |

| Ultrapro Short QQQ Proshares(SQQQ.US) | 3x Short | |

| Dow Jones | ETF-Dow Jones Industrial Average(DIA.US) | 1x Long |

| Ultrapro Short DOW 30 Proshares(SDOW.US) | 3x Short | |

| Small Cap Index | Russell 2000 ETF(IWM.US) | 1x Long |

| Direxion Shares Etf Trust Direxion Daily Small Cap Bull 3X Shs(TNA.US) | 3x Long | |

| China Index | Kraneshares Csi China Internet(KWEB.US) | 1x Long |

| Golden Dragon China Powershares(PGJ.US) | 1x Long | |

| China Bull 3X Direxion(YINN.US) | 3x Long | |

| Daily China Bear 3x Shares(YANG.US) | 3x Short |

- Commodity:

- Bonds:

| Code | Description |

|---|---|

| 20+ Year Trsy Bond Ishares(TLT.US) | Tracks the index of U.S. Treasury bonds with maturities over 20 years, offering long-term investment opportunities. |

| Direxion Shares ETF Trust Daily 20+ Yr Treas Bull 3X(TMF.US) | |

| Ishares 7-10 Year Treasury Bond ETF(IEF.US) | Tracks the index of 7-10 year U.S. Treasury bonds, providing medium-term investment opportunities. |

| Interm-Term Govt Bd Idx ETF Vanguard(VGIT.US) | |

| SPDR Bloomberg Barclays 1-3 Month T-Bill ETF(BIL.US) | Suitable for investors seeking ultra-short-term investments. |