Please use a PC Browser to access Register-Tadawul

Market Might Still Lack Some Conviction On ATA Creativity Global (NASDAQ:AACG) Even After 40% Share Price Boost

ATA CREATIVITY GLOBAL SPON ADS EACH REP 2 ORD SHS AACG | 0.91 0.91 | +6.43% 0.00% Pre |

ATA Creativity Global (NASDAQ:AACG) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

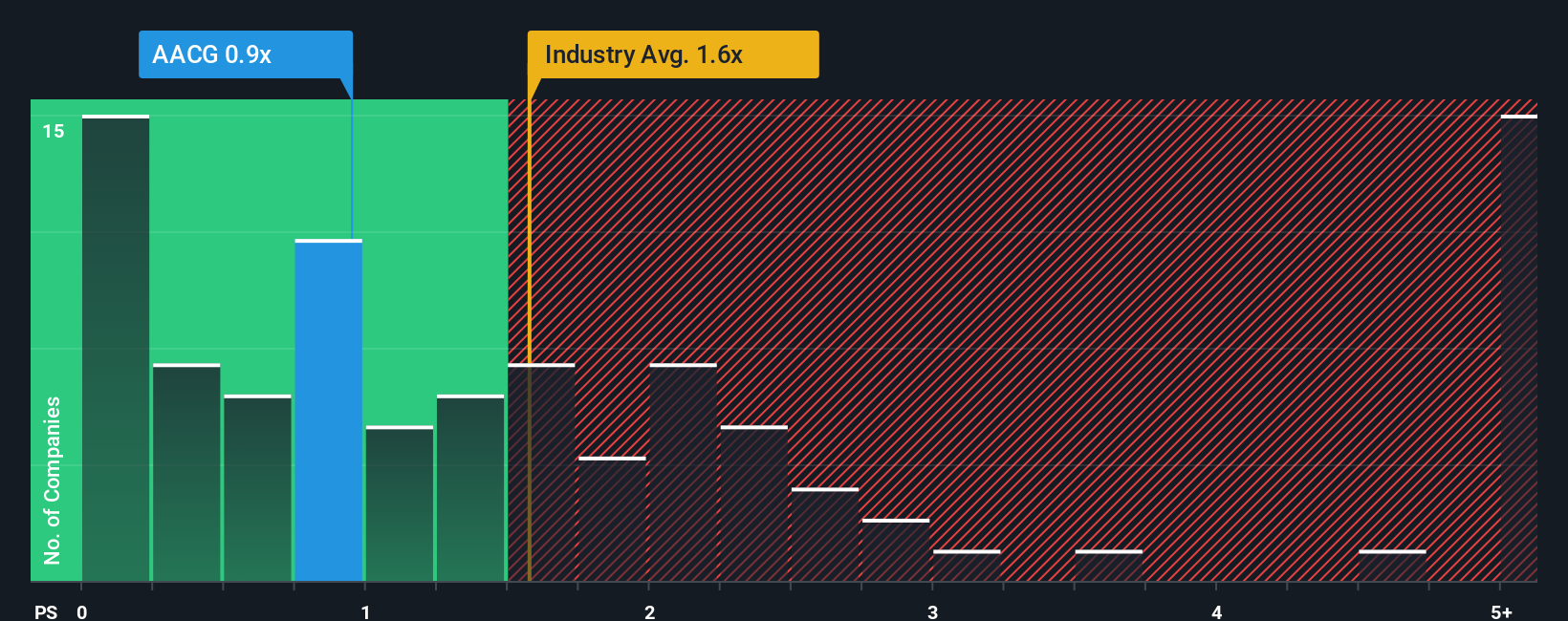

Although its price has surged higher, given about half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider ATA Creativity Global as an attractive investment with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has ATA Creativity Global Performed Recently?

Revenue has risen firmly for ATA Creativity Global recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for ATA Creativity Global, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as ATA Creativity Global's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that ATA Creativity Global's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

ATA Creativity Global's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that ATA Creativity Global currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.