Please use a PC Browser to access Register-Tadawul

Market Might Still Lack Some Conviction On Fluence Energy, Inc. (NASDAQ:FLNC) Even After 36% Share Price Boost

Fluence Energy, Inc. Class A FLNC | 16.55 | -0.06% |

Despite an already strong run, Fluence Energy, Inc. (NASDAQ:FLNC) shares have been powering on, with a gain of 36% in the last thirty days. The last 30 days bring the annual gain to a very sharp 88%.

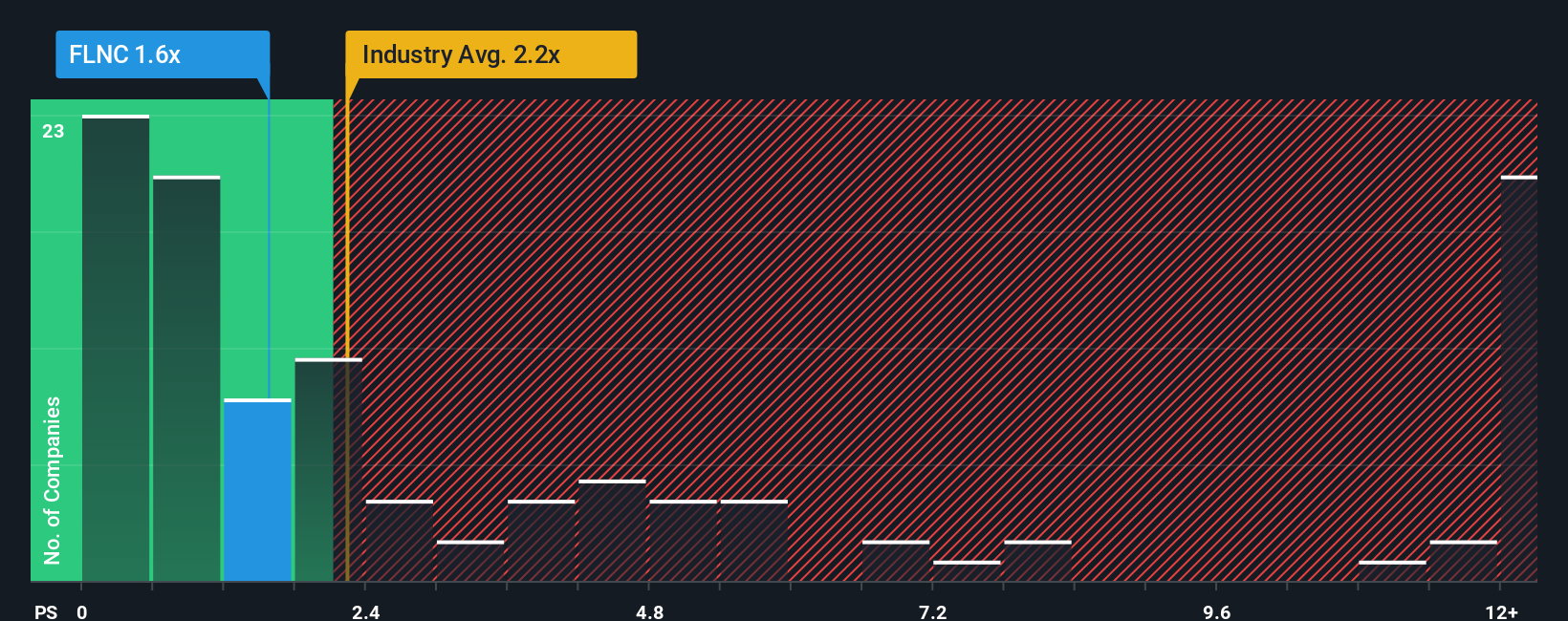

Although its price has surged higher, Fluence Energy's price-to-sales (or "P/S") ratio of 1.6x might still make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 2.2x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Fluence Energy's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Fluence Energy's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fluence Energy.How Is Fluence Energy's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fluence Energy's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 89% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 27% per annum during the coming three years according to the analysts following the company. With the industry only predicted to deliver 17% per annum, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Fluence Energy's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Fluence Energy's P/S Mean For Investors?

Despite Fluence Energy's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Fluence Energy's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.