Please use a PC Browser to access Register-Tadawul

Matson, Inc. (NYSE:MATX) Shares Fly 26% But Investors Aren't Buying For Growth

Matson, Inc. MATX | 167.75 | +1.88% |

Despite an already strong run, Matson, Inc. (NYSE:MATX) shares have been powering on, with a gain of 26% in the last thirty days. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

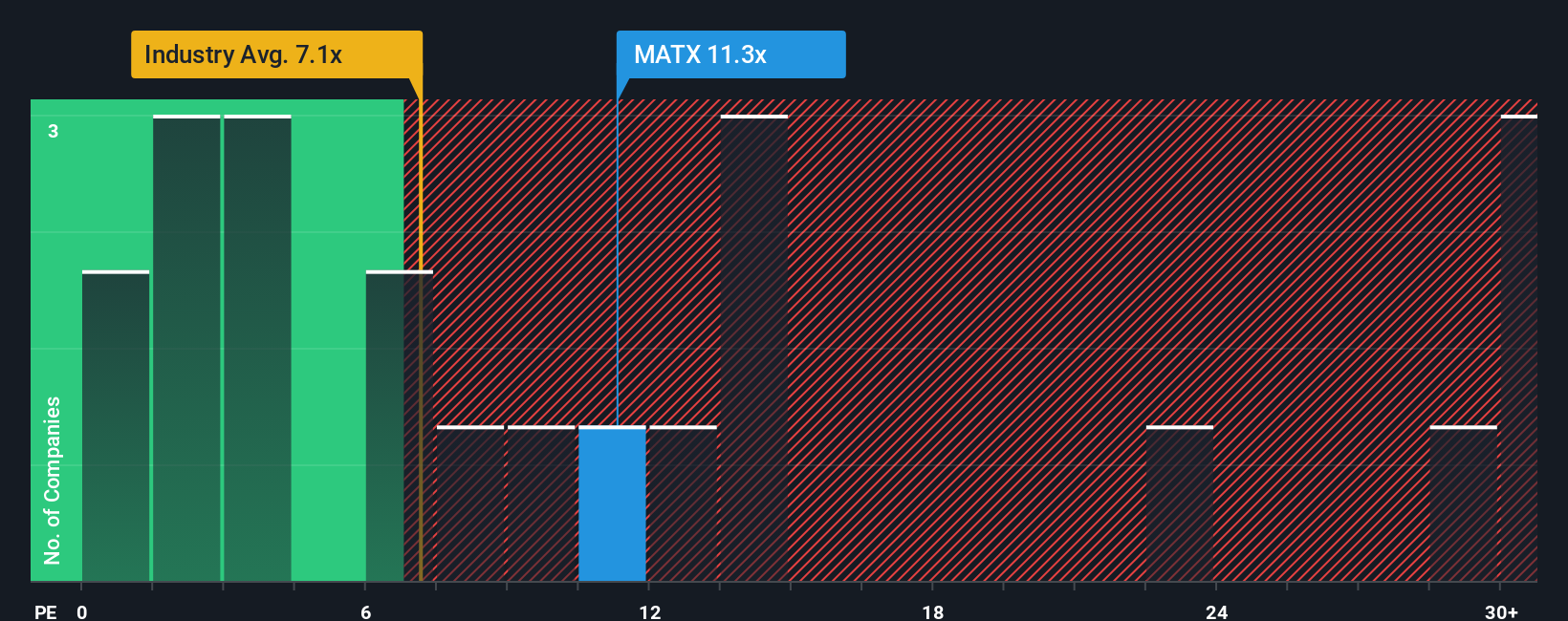

In spite of the firm bounce in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Matson as an attractive investment with its 11.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent earnings growth for Matson has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

How Is Matson's Growth Trending?

Matson's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 60% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 7.7% during the coming year according to the sole analyst following the company. Meanwhile, the broader market is forecast to expand by 16%, which paints a poor picture.

In light of this, it's understandable that Matson's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Matson's P/E?

Matson's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Matson's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Matson.

If you're unsure about the strength of Matson's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.