Please use a PC Browser to access Register-Tadawul

MediaAlpha, Inc. (NYSE:MAX) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

MediaAlpha, Inc. MAX | 12.95 | +1.41% |

MediaAlpha, Inc. (NYSE:MAX) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 30% in the last year.

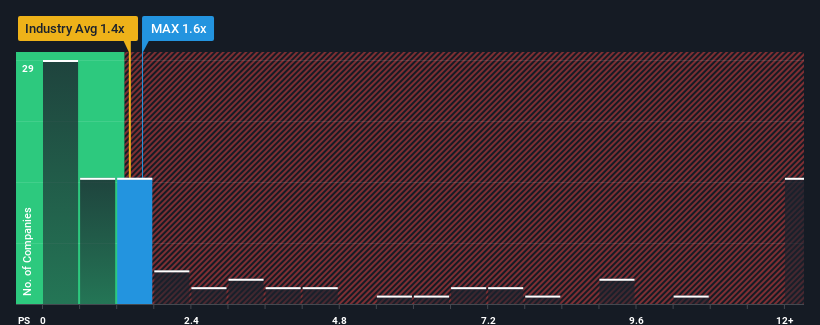

Although its price has dipped substantially, there still wouldn't be many who think MediaAlpha's price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S in the United States' Interactive Media and Services industry is similar at about 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How MediaAlpha Has Been Performing

MediaAlpha could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MediaAlpha.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MediaAlpha's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 37% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 27% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 12% per annum, which is noticeably less attractive.

In light of this, it's curious that MediaAlpha's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does MediaAlpha's P/S Mean For Investors?

MediaAlpha's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that MediaAlpha currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.