Please use a PC Browser to access Register-Tadawul

Mercury Systems, Inc.'s (NASDAQ:MRCY) 33% Price Boost Is Out Of Tune With Revenues

Mercury Systems, Inc. MRCY | 103.02 | +0.07% |

Mercury Systems, Inc. (NASDAQ:MRCY) shareholders have had their patience rewarded with a 33% share price jump in the last month. The annual gain comes to 131% following the latest surge, making investors sit up and take notice.

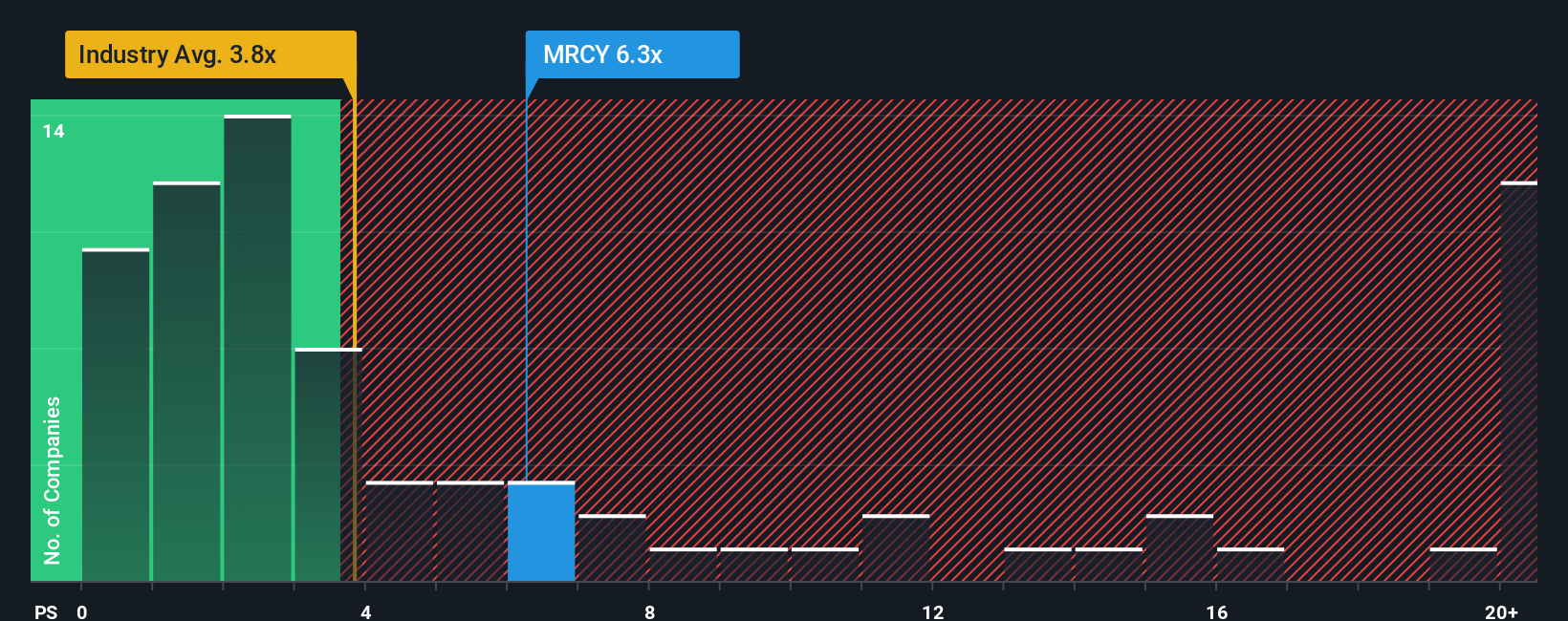

Since its price has surged higher, when almost half of the companies in the United States' Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 3.8x, you may consider Mercury Systems as a stock not worth researching with its 6.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Mercury Systems' P/S Mean For Shareholders?

Recent times haven't been great for Mercury Systems as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Mercury Systems will help you uncover what's on the horizon.How Is Mercury Systems' Revenue Growth Trending?

In order to justify its P/S ratio, Mercury Systems would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.7%. However, this wasn't enough as the latest three year period has seen an unpleasant 5.9% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 4.3% over the next year. Meanwhile, the rest of the industry is forecast to expand by 12%, which is noticeably more attractive.

With this information, we find it concerning that Mercury Systems is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Mercury Systems' P/S?

The strong share price surge has lead to Mercury Systems' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Mercury Systems currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Mercury Systems with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Mercury Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.