Please use a PC Browser to access Register-Tadawul

Mesa Laboratories (NASDAQ:MLAB) Has Affirmed Its Dividend Of $0.16

Mesa Laboratories, Inc. MLAB | 77.77 | -1.06% |

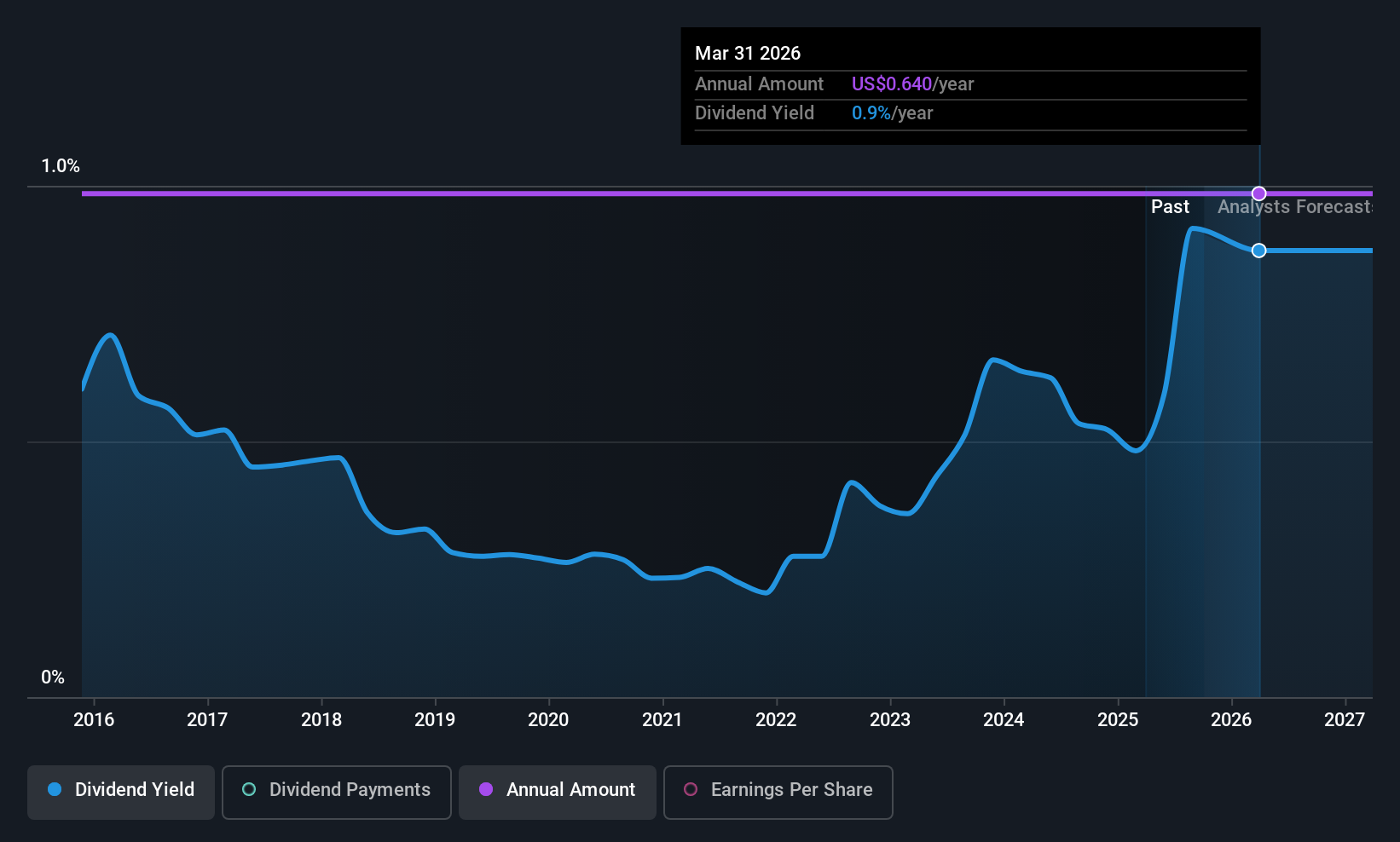

Mesa Laboratories, Inc. (NASDAQ:MLAB) has announced that it will pay a dividend of $0.16 per share on the 15th of December. This means the annual payment is 0.9% of the current stock price, which is above the average for the industry.

Mesa Laboratories Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. While Mesa Laboratories is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS is forecast to rise by 53.8%. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The healthy cash flows are definitely a good sign though, so we wouldn't panic just yet, especially with the earnings growing.

Mesa Laboratories Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. There hasn't been much of a change in the dividend over the last 10 years. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Mesa Laboratories' EPS has fallen by approximately 68% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.