Please use a PC Browser to access Register-Tadawul

Meta Platforms (NasdaqGS:META) Eyes US$14 Billion Investment In Scale AI For AI Revamp

Meta Platforms META | 661.20 | -1.34% |

Meta Platforms (NasdaqGS:META) recently entered into advanced talks to invest $14 billion into Scale AI, signaling a shift in its AI strategy amid competition in the tech sector. This move, alongside a strong Q1 earnings report, sets a backdrop for the company's 17% share price increase over the last quarter. In the same period, the S&P 500 and Nasdaq also rose, although at a modest pace, reflecting broader market optimism. Meta's AI investment discussions and successful earnings breakthrough likely added positive sentiment in line with overall market advancements, contributing to the stock's significant quarterly growth.

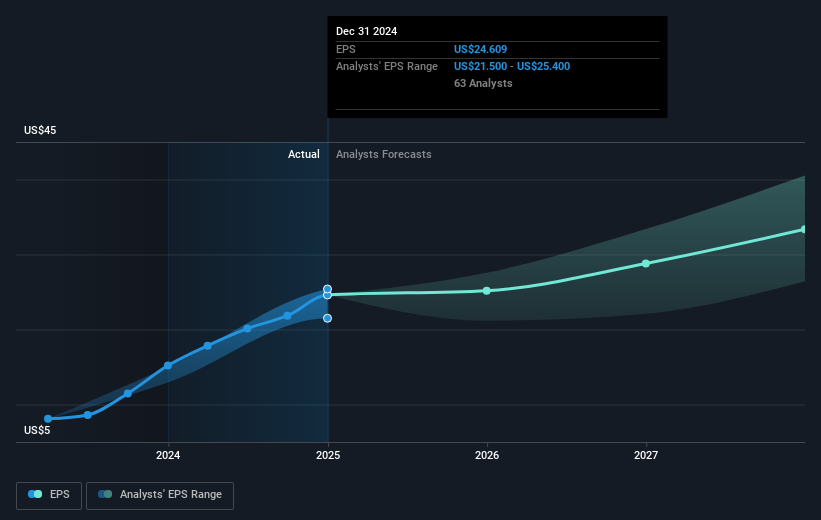

The recent news of Meta Platforms' US$14 billion investment talks with Scale AI highlights a strategic emphasis on their AI capabilities, potentially impacting the company's narrative focused on AI-enhanced digital engagement. The advancement in AI could enhance ad targeting and creativity, which may positively influence revenue as advertising remains a significant global expenditure. This potential revenue boost aligns with analysts' forecasts expecting a 12.7% annual revenue growth over the next three years. Further, investments in AI and operational changes could affect earnings margins, with forecasts indicating a contraction from 39.1% to 35.3% in the same period. These factors could adjust analysts' revenue and earnings expectations, potentially aligning more closely with Meta's consensus price target of US$703.89, which is around 16.6% above the current share price.

Over the past three years, Meta's total return, including share price and dividends, reached a very large 311.82%, underscoring significant long-term growth. In contrast, over the past year, Meta's share performance exceeded the US Interactive Media and Services industry, which had a 12.1% return. This outperformance may provide confidence despite operational risks associated with increased AI investments and regulatory challenges in Europe. Given the current share price and the analysts' target, Meta's price trajectory suggests room for future growth, pending the successful integration of these strategic investments and adherence to foreseen operational efficiencies. Investors are encouraged to evaluate these developments in light of existing market conditions and future expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.