Please use a PC Browser to access Register-Tadawul

Middle East Hidden Gems Including Saudi Cement And Two Promising Small Caps

SAUDI CEMENT 3030.SA | 34.40 | -0.23% |

As Middle Eastern markets navigate a landscape shaped by geopolitical tensions and uncertainty surrounding U.S. Federal Reserve rate cuts, investors are increasingly cautious, with most Gulf bourses experiencing slight declines. Despite these challenges, the region continues to offer intriguing opportunities for those seeking potential growth in less-explored sectors; identifying strong fundamentals and resilience can be key to uncovering hidden gems like Saudi Cement and promising small-cap companies in this dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 13.06% | 3.14% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Payton Industries | NA | 7.02% | 14.80% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| Aura Investments | 196.85% | 9.21% | 41.84% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Saudi Cement (SASE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Cement Company engages in the manufacturing and sale of cement and related products both domestically in Saudi Arabia and internationally, with a market capitalization of SAR5.97 billion.

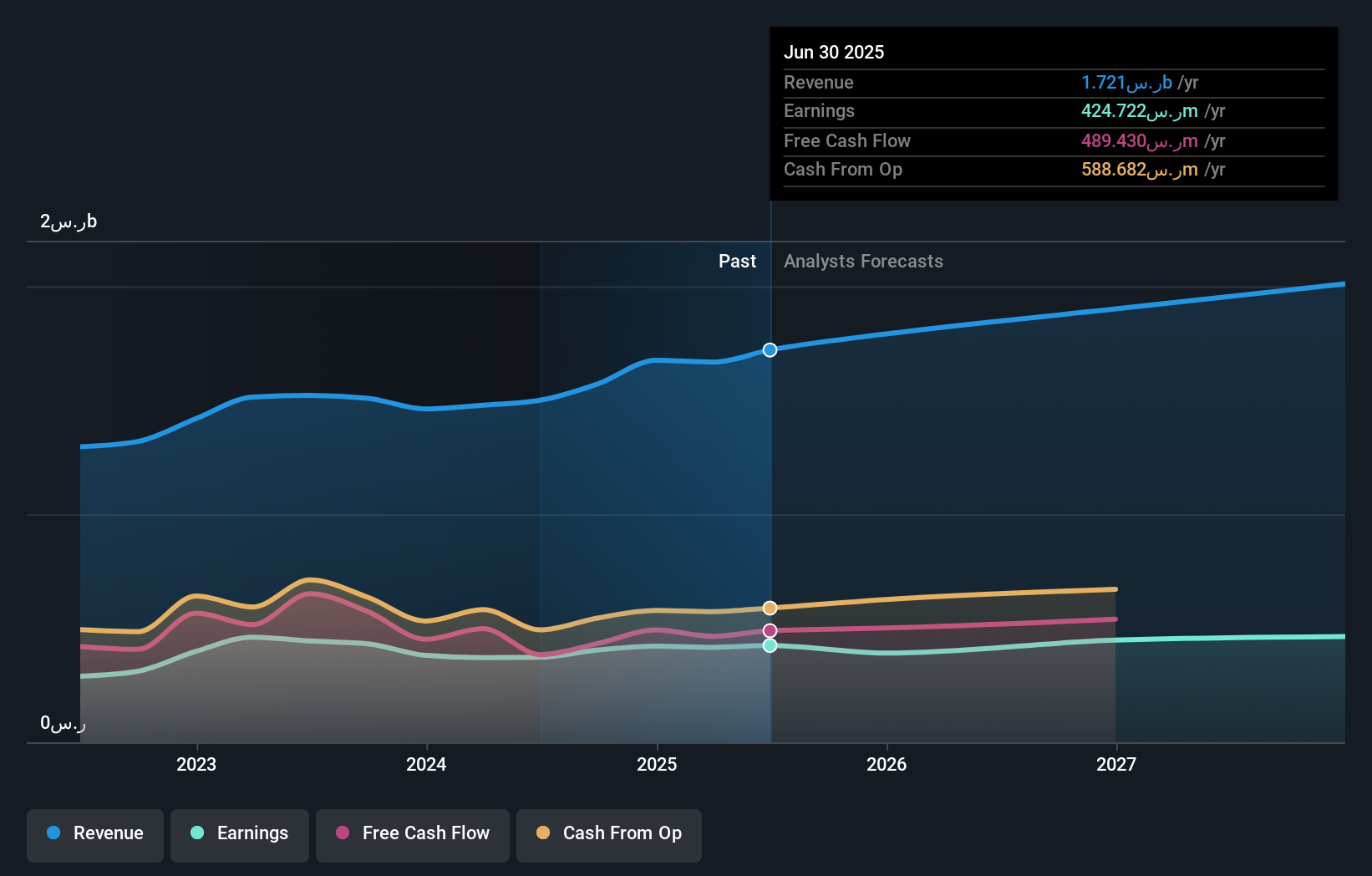

Operations: The company's primary revenue stream is from its Cement Sector, generating SAR1.72 billion.

Saudi Cement, a relatively smaller player in the Middle East cement industry, has shown a steady performance with recent quarterly sales of SAR 431.53 million and net income of SAR 95.46 million. The company trades at 9.5% below its estimated fair value and is considered to have satisfactory debt levels with a net debt to equity ratio of 8.7%. Earnings per share improved slightly to SAR 0.62 from SAR 0.57 last year, indicating solid operational efficiency despite not outpacing industry growth rates significantly over the past year (13.8% vs industry’s 54.3%). Future revenue is expected to grow by about 6% annually, suggesting potential for moderate expansion within its sector context.

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Max Stock Ltd. operates a chain of discount stores across Israel with a market capitalization of ₪2.63 billion.

Operations: Max Stock Ltd. generates revenue primarily from its retail trade segment, amounting to ₪1.36 billion. The company's focus on discount retailing contributes to its financial performance, with a particular emphasis on optimizing cost structures to enhance profitability.

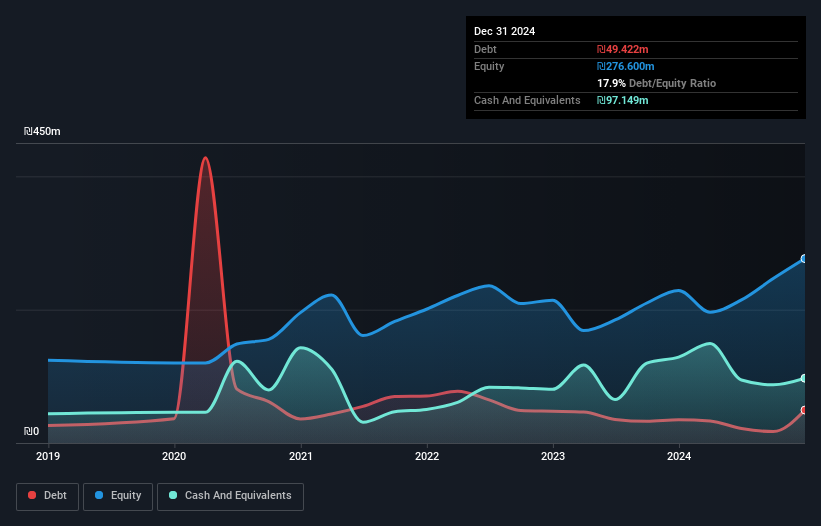

Max Stock stands out with its impressive earnings growth of 30.3% over the past year, surpassing the Multiline Retail industry average of -4%. The company has effectively reduced its debt to equity ratio from a high 356.4% to a manageable 19.5% in five years, indicating strong financial management. Its price-to-earnings ratio of 23.5x is attractive compared to the industry average of 27.3x, suggesting potential undervaluation. Recent events include a cash dividend approval totaling ILS 40 million and an M&A transaction where Apax Partners LLP sold a 5.50% stake for ILS 120 million, highlighting active investor interest and engagement in Max Stock's future prospects.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Y.D. More Investments Ltd is a privately owned investment manager with a market cap of ₪2.94 billion, focusing on various financial services including mutual fund management and the management of provident and pension funds.

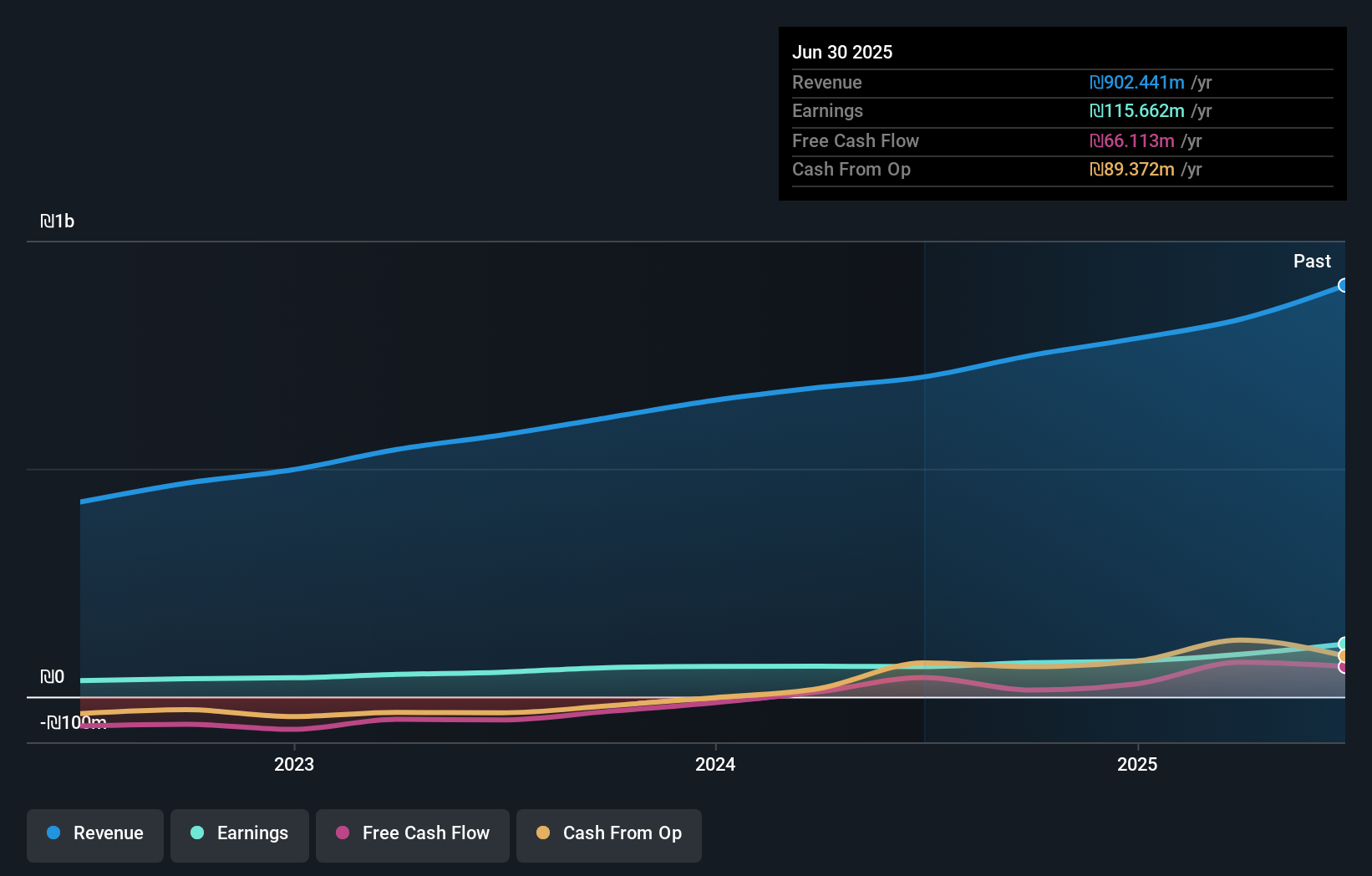

Operations: Revenue streams for Y.D. More Investments primarily include mutual fund management generating ₪231.26 million and the management of provident and pension funds contributing ₪540.82 million. Investment portfolio management adds another ₪34.40 million to the revenue mix.

Y.D. More Investments, a nimble player in the Middle East market, has showcased impressive growth with earnings surging by 38.9% over the past year, outpacing its industry peers' 29.4% rise. The company reported first-quarter revenue of ILS 230 million, up from ILS 188 million last year, while net income jumped to ILS 31.62 million from ILS 17.11 million previously. With basic earnings per share climbing to ILS 0.44 from ILS 0.24 and diluted EPS at ILS 0.43, Y.D.'s financial health looks robust as it prepares to release Q2 results on August 19th amid continued positive cash flow trends and strong debt coverage ratios (60x EBIT).

Next Steps

- Click through to start exploring the rest of the 216 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.