Please use a PC Browser to access Register-Tadawul

Mobileye (MBLY) Q4 Loss And Premium P/S Multiple Test Bullish Profitability Narratives

Mobileye Global, Inc. Class A MBLY | 8.98 | -3.13% |

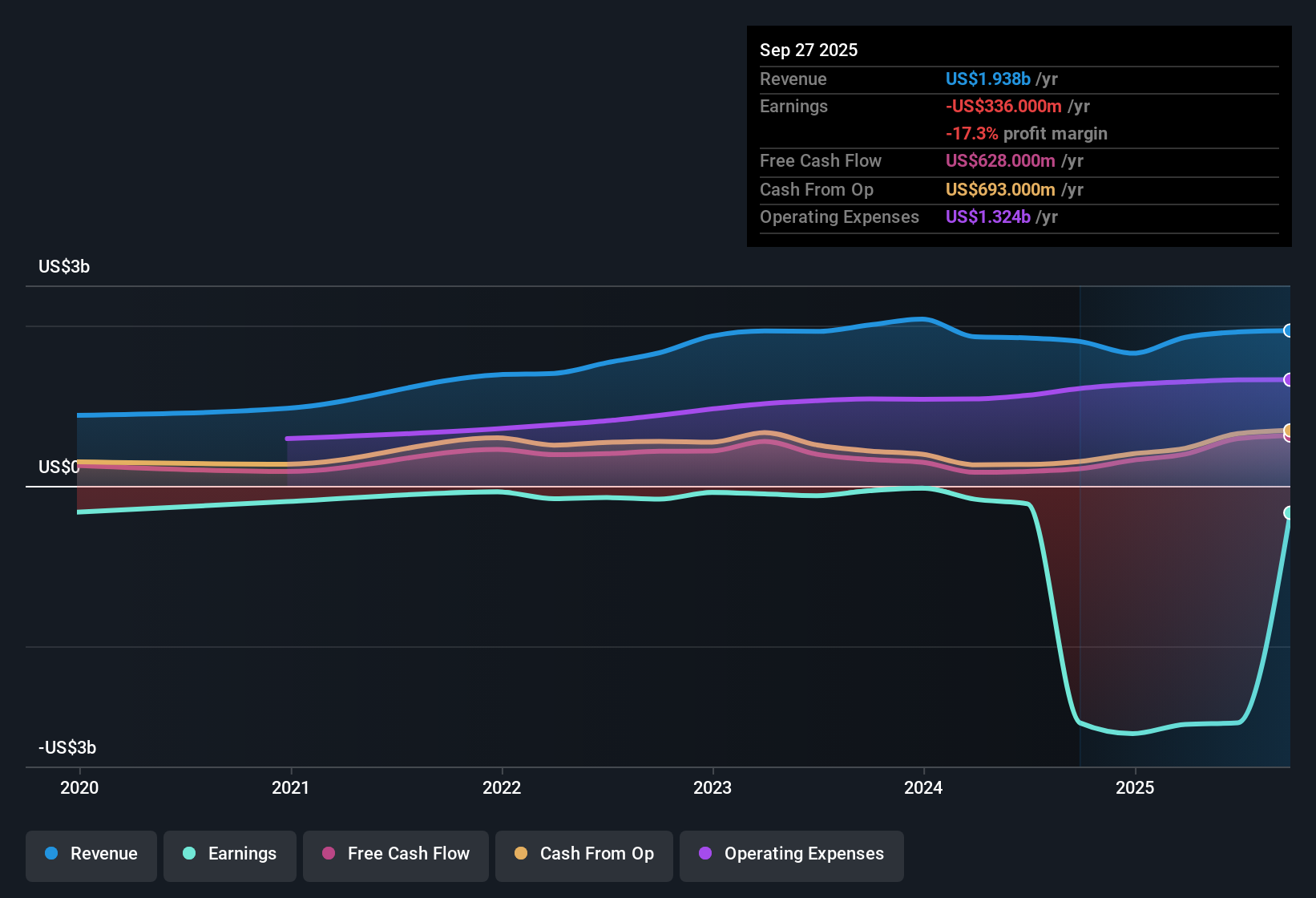

Mobileye Global (MBLY) closed out FY 2025 with Q4 revenue of US$446 million and a basic EPS loss of US$0.16, as the company continued to run at a net loss. The company has seen quarterly revenue range from US$438 million to US$506 million over FY 2025, while basic EPS losses have moved between US$0.08 and US$0.16. This sets up a story where top line scale and the path toward better margins are front and center for investors. Overall, the latest numbers keep attention firmly on how quickly Mobileye can convert growing sales into improving profitability and more resilient margins.

See our full analysis for Mobileye Global.With the headline figures on the table, the next step is to weigh these results against the dominant narratives around Mobileye’s growth potential, the timing of profitability, and what that mix means for long term returns.

US$392 million loss over the last year

- On a trailing 12 month basis to Q4 2025, Mobileye recorded net income of a US$392 million loss on US$1.9b of revenue, compared with a Q4 2025 quarterly loss of US$127 million on US$446 million of revenue.

- What stands out for a bullish view that focuses on improving earnings is that the trailing loss of US$392 million is far smaller than the US$3.1b loss shown a year earlier in the trailing data, yet the company is still unprofitable, so the optimism about future earnings has to be balanced against the fact that every quarter in FY 2025, from US$67 million to US$127 million in net losses, still added to that deficit.

- Supporters of the bullish case can point to trailing revenue rising from US$1.7b at Q4 2024 to US$1.9b at Q4 2025. This aligns with forecasts that expect strong earnings improvement from this larger revenue base.

- At the same time, critics of that optimistic view can highlight that Basic EPS over the last twelve months sits at a loss of US$0.48 per share. This underlines that the company has not yet converted this higher revenue into positive earnings.

Bulls argue that the move from multibillion dollar losses in the trailing data to hundreds of millions, while revenue holds near US$1.9b, could be the early stage of an earnings recovery story that long term investors are watching closely. 📊 Read the full Mobileye Global Consensus Narrative.

P/S of 4.5x versus 0.8x industry

- Mobileye trades on a P/S of 4.5x, compared with 0.8x for the wider US Auto Components industry and 1.0x for peers, even though the company remains loss making over the last twelve months.

- Bears focus on this valuation gap as a key concern, arguing that paying over 4 times sales for a business with a trailing loss of US$392 million leaves little room for disappointment, especially when industry peers trade much closer to 1x sales.

- The tension here is clear, as a higher multiple usually sits more comfortably on companies that are already profitable. By contrast, Mobileye’s Basic EPS over the last twelve months is still a loss of US$0.48 per share.

- Skeptics also point out that every quarter of FY 2025 was loss making, with net losses between US$67 million and US$127 million. As a result, the premium P/S multiple depends heavily on the forecast shift to profitability playing out as expected.

DCF fair value above US$10.52 price

- The current share price of US$10.52 sits about 27.7% below a DCF fair value estimate of roughly US$14.55, while analysts’ metrics in the data reference expected revenue growth of 21.4% a year and earnings growth of 54.45% a year.

- Supportive investors lean on this combination of an implied DCF upside and strong growth forecasts, arguing that the gap between the US$10.52 price and the US$14.55 DCF fair value could be justified if the company moves from a trailing loss of US$392 million toward the profitability that forecasts anticipate within three years.

- That optimistic angle is anchored in the fact that trailing revenue has reached about US$1.9b, providing a larger base for those projected earnings improvements.

- On the other hand, the same data set reminds you that historical profitability metrics are weak. The bullish view therefore depends on a meaningful shift from the current loss making position rather than a continuation of the last twelve months.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mobileye Global's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Mobileye’s premium 4.5x P/S multiple, continuing quarterly losses, and trailing US$392 million net loss highlight the risk of paying up for a business that is not yet profitable.

If you want alternatives with valuations that work harder for you today, check out our these 879 undervalued stocks based on cash flows to find companies whose prices already reflect stronger fundamentals and cash flow support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.