Please use a PC Browser to access Register-Tadawul

Monte Rosa Therapeutics, Inc. (NASDAQ:GLUE) Shares Fly 29% But Investors Aren't Buying For Growth

Monte Rosa Therapeutics GLUE | 18.66 19.39 | +13.43% +3.91% Pre |

Monte Rosa Therapeutics, Inc. (NASDAQ:GLUE) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

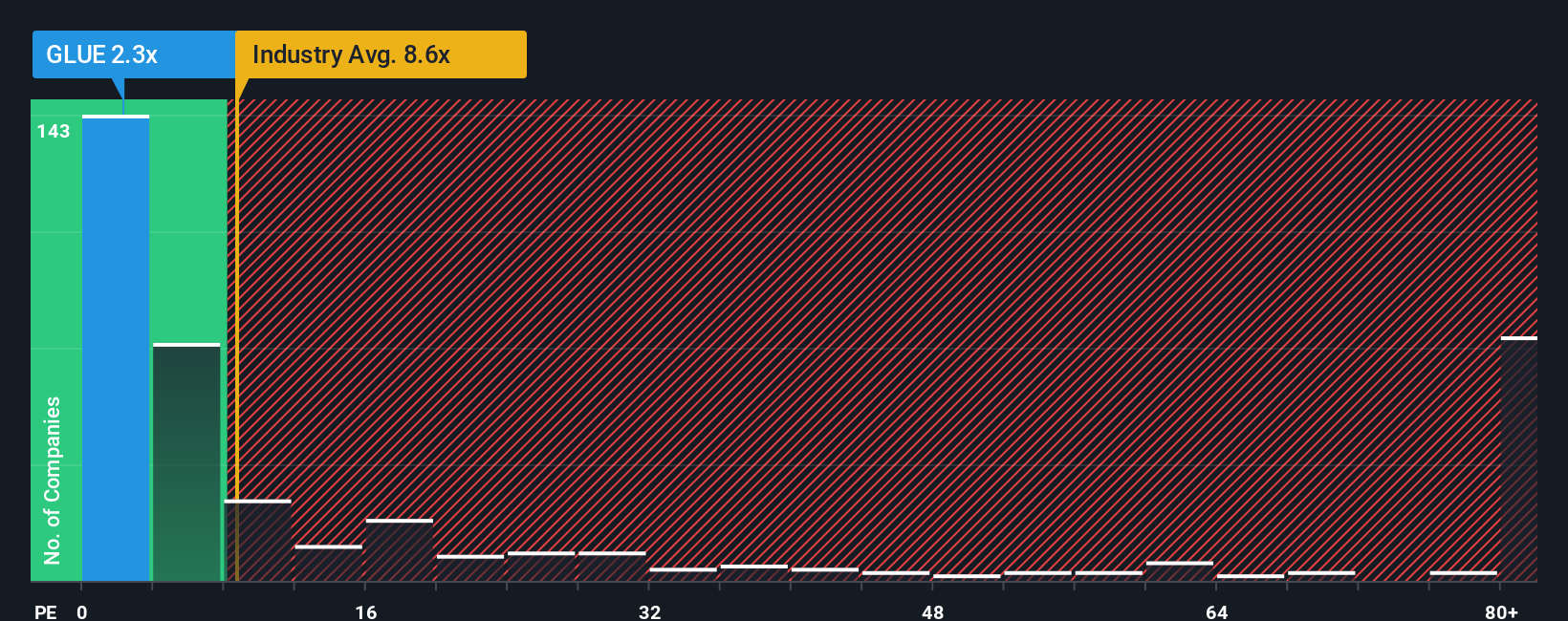

In spite of the firm bounce in price, Monte Rosa Therapeutics' price-to-sales (or "P/S") ratio of 2.3x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 8.6x and even P/S above 61x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Monte Rosa Therapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Monte Rosa Therapeutics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Monte Rosa Therapeutics.Is There Any Revenue Growth Forecasted For Monte Rosa Therapeutics?

Monte Rosa Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 31% per annum as estimated by the eight analysts watching the company. With the industry predicted to deliver 103% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Monte Rosa Therapeutics' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Shares in Monte Rosa Therapeutics have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Monte Rosa Therapeutics' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.