Please use a PC Browser to access Register-Tadawul

MultiPlan Corporation (NYSE:MPLN) Looks Inexpensive After Falling 29% But Perhaps Not Attractive Enough

MultiPlan Corporation Class A Common Stock MPLN | 23.15 | 0.00% |

Unfortunately for some shareholders, the MultiPlan Corporation (NYSE:MPLN) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

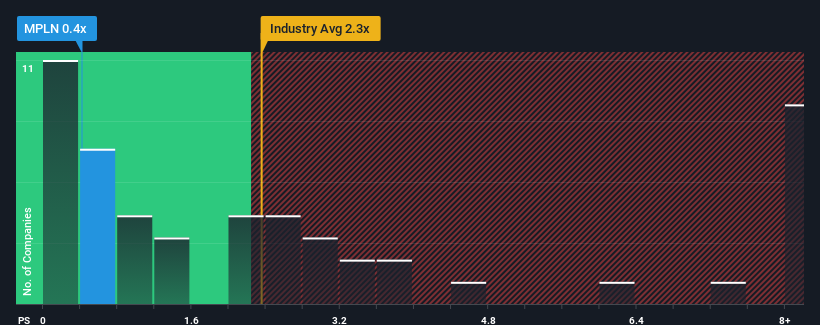

Since its price has dipped substantially, considering around half the companies operating in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") above 2.3x, you may consider MultiPlan as an solid investment opportunity with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for MultiPlan

What Does MultiPlan's Recent Performance Look Like?

While the industry has experienced revenue growth lately, MultiPlan's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on MultiPlan will help you uncover what's on the horizon.How Is MultiPlan's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like MultiPlan's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.8%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 8.3% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 13% growth forecast for the broader industry.

With this information, we can see why MultiPlan is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The southerly movements of MultiPlan's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of MultiPlan's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware MultiPlan is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.