Please use a PC Browser to access Register-Tadawul

Nabors Industries Ltd. (NYSE:NBR) Soars 26% But It's A Story Of Risk Vs Reward

Nabors Industries Ltd. NBR | 49.72 | -7.13% |

The Nabors Industries Ltd. (NYSE:NBR) share price has done very well over the last month, posting an excellent gain of 26%. But the last month did very little to improve the 63% share price decline over the last year.

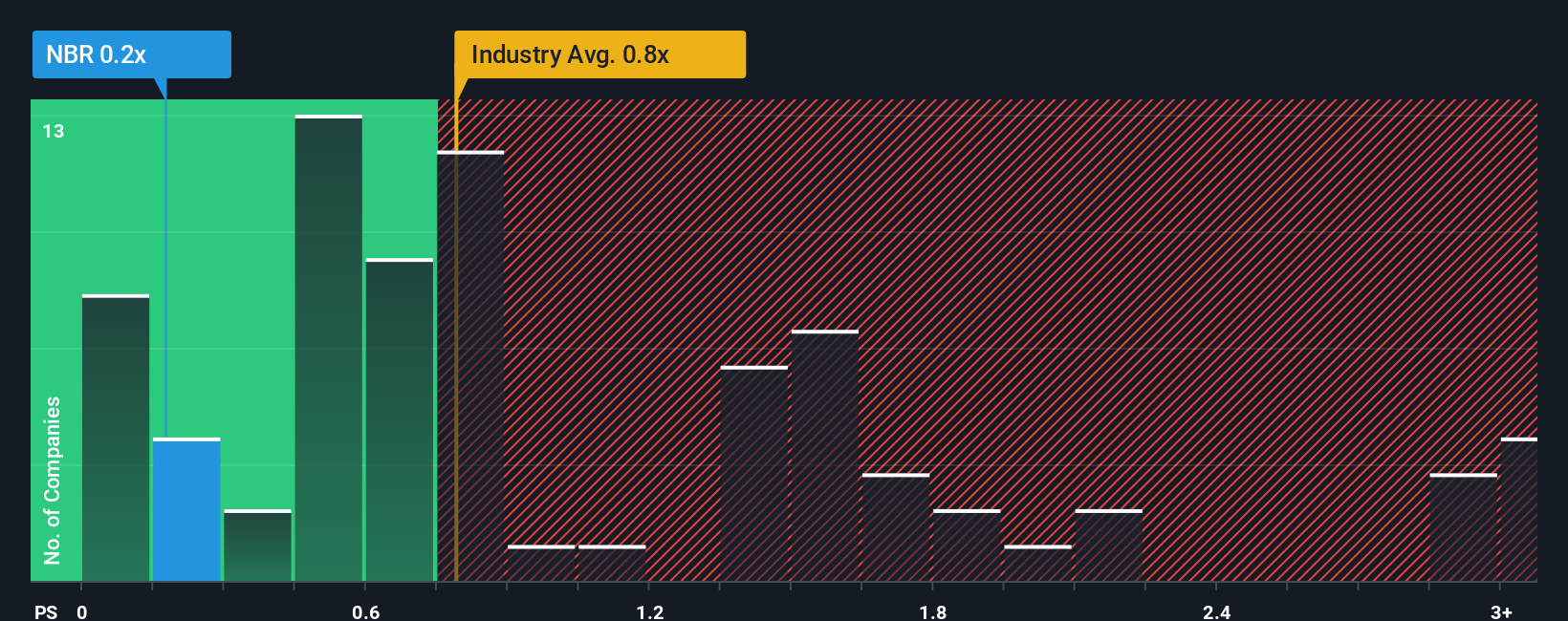

In spite of the firm bounce in price, given about half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Nabors Industries as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Nabors Industries' P/S Mean For Shareholders?

Nabors Industries could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nabors Industries.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Nabors Industries' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 38% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Turning to the outlook, the next three years should generate growth of 6.7% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.9% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Nabors Industries' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Nabors Industries' P/S

The latest share price surge wasn't enough to lift Nabors Industries' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Nabors Industries' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.