Please use a PC Browser to access Register-Tadawul

News Headline | Deutsche Bank Maps Fed's 2025 'Hawk-Dove Chart,' Clearly Illustrating Internal Divisions

ETF-S&P 500 SPY | 694.07 | +0.66% |

PowerShares QQQ Trust,Series 1 QQQ | 626.65 | +1.00% |

ETF-Dow Jones Industrial Average DIA | 495.02 | +0.51% |

Tesla Motors, Inc. TSLA | 445.01 | +2.11% |

NVIDIA Corporation NVDA | 184.86 | -0.10% |

Fed's 2025 Rate Decisions May Face Greater Internal Discord, Deutsche Bank Reports

Following robust U.S. employment data, Deutsche Bank has released a comprehensive analysis of the Federal Reserve's potential monetary policy direction for 2025, highlighting increased divergence among voting members' policy stances.

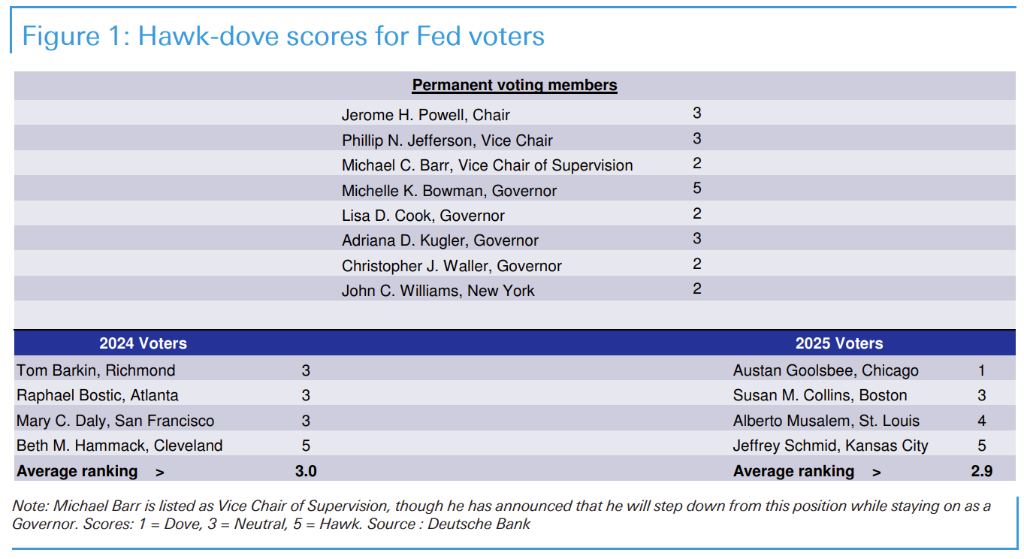

According to a recent report by Deutsche Bank's Chief U.S. Economist Matthew Luzzetti and his team, their updated assessment of Fed voting members' policy inclinations reveals significant shifts in the internal dynamics. While the average policy stance remains relatively neutral, similar to 2024, there is notably wider dispersion in individual members' positions.

The analysis assigns scores from 1 (most dovish) to 5 (most hawkish), with 3 representing a neutral stance. For regional Federal Reserve presidents, 2025's composition shows more pronounced divergences compared to 2024's relatively unified neutral positions. Two notably hawkish regional presidents have emerged: Alberto Musalem of Kansas City (scored 4) and Jeffrey Schmid of St. Louis (scored 5). In contrast, Chicago's Austan Goolsbee represents a decidedly dovish perspective (scored 1).

Among permanent committee members, the policy divide persists. Michelle K. Bowman maintains a notably hawkish position (scored 5), having previously dissented from September's 50-basis-point rate cut proposal. Conversely, Christopher J. Waller has consistently demonstrated a more dovish approach (scored 2).

Deutsche Bank's team suggests these widening policy divergences could lead to more pronounced internal disagreements in 2025, particularly if potential changes in trade and immigration policies under a Trump administration create additional supply chain complications for the U.S. economy.

Looking ahead, Deutsche Bank estimates the nominal neutral interest rate at approximately 3.75%. The bank anticipates the Fed will likely maintain relatively stable rates throughout 2025, balancing restrictive monetary policy while carefully utilizing limited room for rate reductions.