Please use a PC Browser to access Register-Tadawul

Nordic American Tankers Limited (NYSE:NAT) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Nordic American Tankers Limited NAT | 4.93 | +2.07% |

Nordic American Tankers Limited (NYSE:NAT) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 50%.

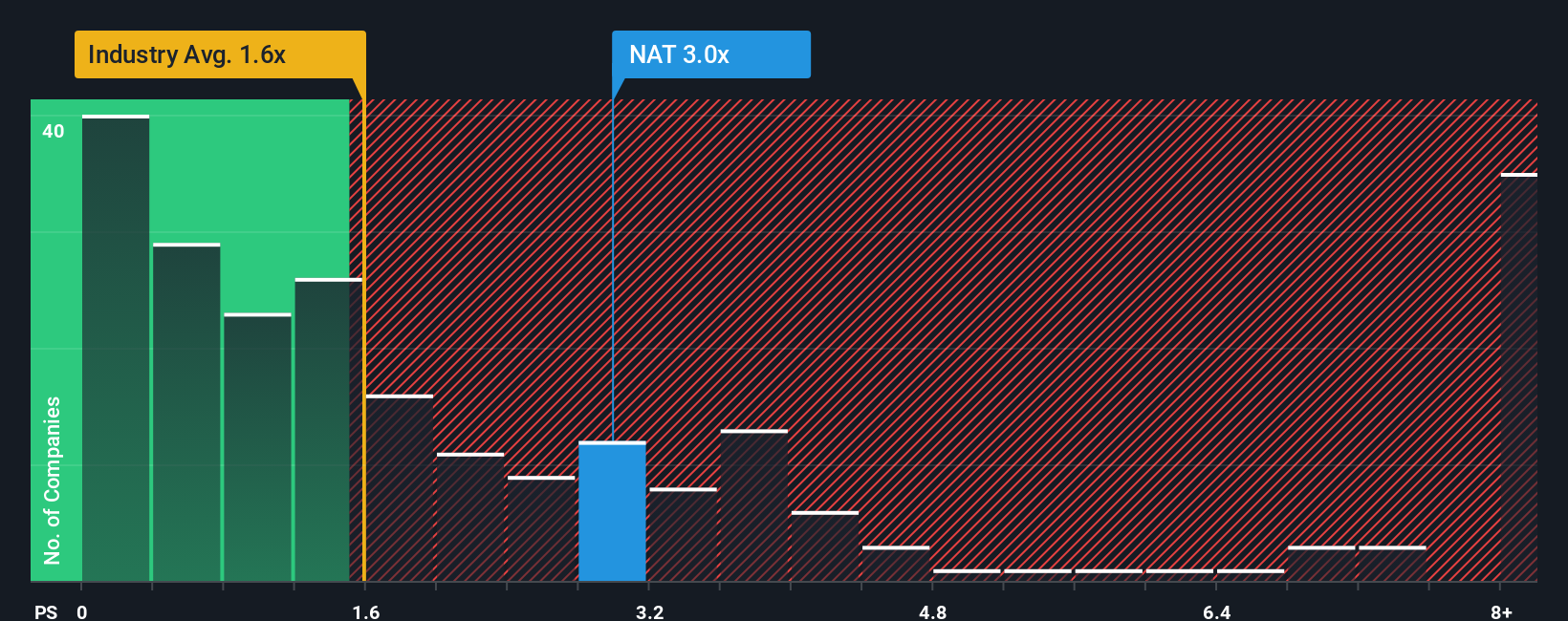

Following the firm bounce in price, given close to half the companies operating in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Nordic American Tankers as a stock to potentially avoid with its 3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has Nordic American Tankers Performed Recently?

While the industry has experienced revenue growth lately, Nordic American Tankers' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Nordic American Tankers will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Nordic American Tankers' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 22% as estimated by the sole analyst watching the company. Meanwhile, the broader industry is forecast to moderate by 9.9%, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that Nordic American Tankers' P/S exceeds that of its industry peers. When revenue shrink rapidly often the P/S premium shrinks too, which could set up shareholders for future disappointment. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

Nordic American Tankers' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Nordic American Tankers' analyst forecasts determined that its even shakier outlook against the industry isn't impacting its high P/S anywhere near as much as we would have predicted. When we see a weak revenue outlook, we suspect the share price is at risk of declining, sending the high P/S lower. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. Unless there's a material improvement in the forecast revenue growth for the company, it's hard to justify the share price at current levels.

Having said that, be aware Nordic American Tankers is showing 4 warning signs in our investment analysis, and 2 of those are significant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.