Please use a PC Browser to access Register-Tadawul

Northeast Community Bancorp (NECB) Net Interest Margin Above 5% Reinforces Bullish Narratives

NorthEast Community Bancorp Inc NECB | 23.94 | -0.83% |

Latest FY 2025 Results Set the Stage

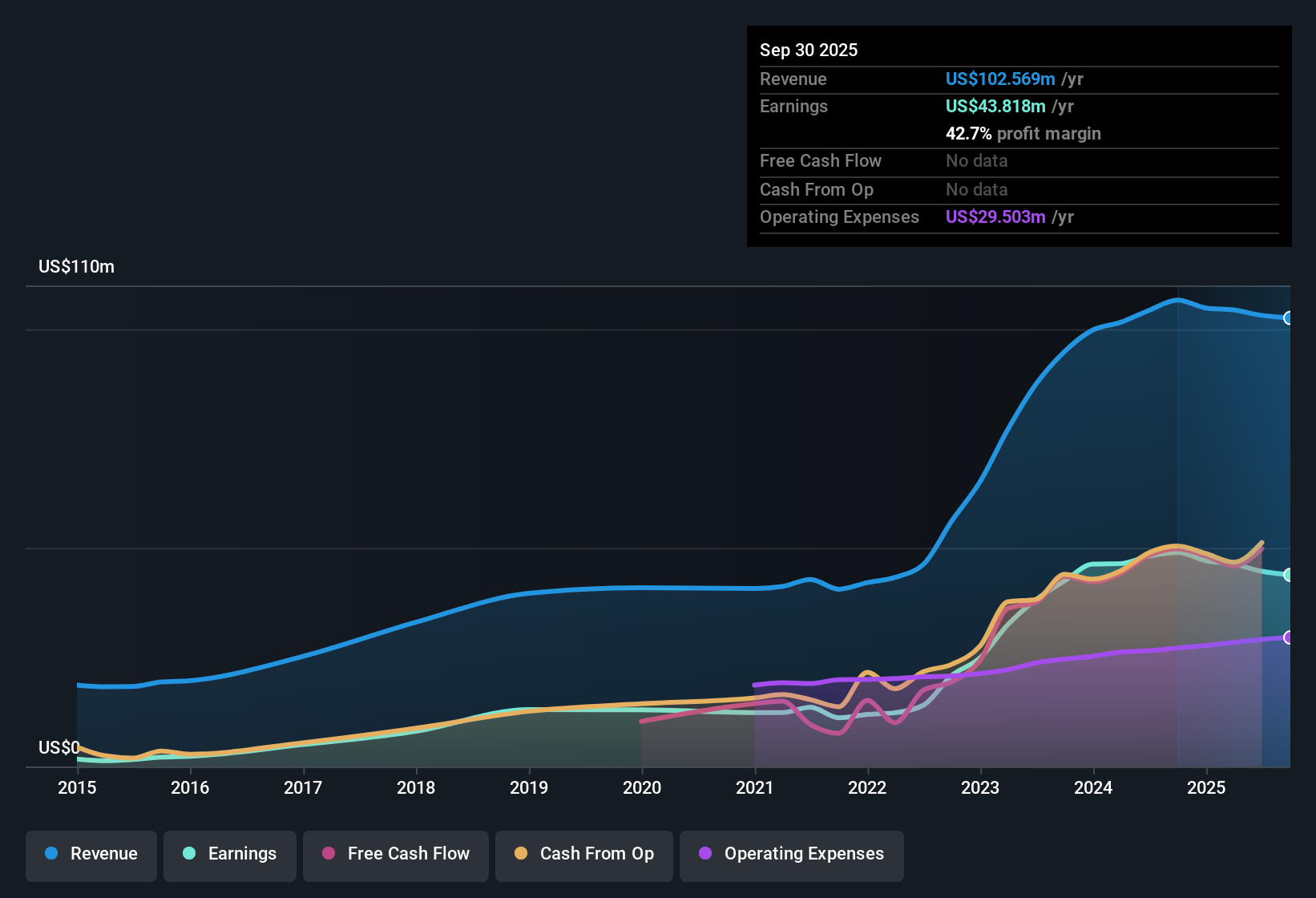

Northeast Community Bancorp (NECB) just wrapped up FY 2025 with fourth quarter total revenue of US$26.8 million and basic EPS of US$0.80, alongside net income excluding extra items of US$10.8 million. The company reported quarterly revenue of US$24.4 million in Q4 FY 2024 and around US$26.8 million in Q4 FY 2025. Over the same period, basic EPS moved from US$0.78 to US$0.80, and trailing twelve month EPS was US$3.34 on total revenue of about US$104.9 million. Taken together, these numbers highlight how profitability and margins remain central to how investors may interpret this result.

See our full analysis for Northeast Community Bancorp.With the headline figures on the table, the next step is to see how these results compare with the widely held narratives about Northeast Community Bancorp, and where the story investors tell themselves might need an update.

5.38% net interest margin supports profitability story

- Across FY 2025, reported net interest margin ranged from 5.11% in Q1 to 5.38% in Q3, with Q2 close by at 5.35%, while the trailing twelve month margin last year was 5.62%.

- What is interesting for a bullish view is that margins above 5% sit alongside a trailing net profit margin of 42.3%, slightly below the prior year's 44.9%. This means:

- Supporters can point to high reported margins as a base for profitability, even though the trailing margin eased compared with last year.

- On the other hand, anyone taking a more cautious stance can highlight that the step down from 44.9% to 42.3% shows profitability is not moving in one straight line.

Loan book around US$1.9b underpins earnings potential

- Total loans were US$1,725.7 million in Q1 FY 2025, US$1,797.6 million in Q2, and US$1,873.6 million in Q3, while the trailing twelve month figures show a similar range around US$1,700 million to US$1,900 million.

- Supporters of a more positive narrative often see a loan book of roughly US$1.9b, combined with a trailing twelve month net income excluding extra items of US$44.4 million, as a solid base. At the same time:

- Past data also show non performing loans of US$4.4 million in earlier periods, which reminds you that credit quality still matters for how reliable those earnings are.

- The combination of a sizeable loan book and high net interest margin is helpful for profit generation, but the slight softening in trailing margins means investors may watch future filings closely.

P/E of 7.4x and 4.26% dividend stand out

- The shares trade on a P/E of 7.4x compared with a US Banks industry average of 11.7x and a peer average of 10.3x, while the company pays a dividend yield of about 4.26% and the DCF fair value provided is US$74.39 versus a current share price of US$23.45.

- What stands out for bullish investors is that the lower P/E and the gap between the US$74.39 DCF fair value and the US$23.45 share price are treated as value signals. However:

- The trailing twelve month EPS of US$3.34, alongside a trailing net profit margin of 42.3% that is below last year's 44.9%, means the valuation gap sits next to slightly softer profitability metrics.

- Earnings are forecast to grow about 6.9% per year and revenue about 9.4% per year, which some bulls see as enough to support the current income stream and valuation, while others may compare those growth rates with broader market expectations before forming a view.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Northeast Community Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While NECB reports high net interest and profit margins, the easing from last year's levels and the presence of non performing loans raise some questions about earnings quality.

If you want exposure to profitability without that credit quality overhang, you can review our CTA_SCREENER_HIGH_ROE_LOW_DEBT to focus on companies that combine strong returns with lower financial leverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.