Please use a PC Browser to access Register-Tadawul

Northrop Grumman (NOC): Valuation in Focus After Cygnus Autonomous Docking Breakthrough and Analyst Upgrade

Northrop Grumman Corp. NOC | 724.83 | +3.38% |

Northrop Grumman (NOC) has caught investor attention after announcing successful autonomous rendezvous and docking operations involving its Cygnus spacecraft, Starlab Space Stations, and Voyager Technologies. This advance highlights growing momentum in the company’s commercial space business.

Recent momentum for Northrop Grumman’s share price is hard to ignore, with a 33% gain so far this year and a stellar 21% return over the past 90 days. Major breakthroughs such as the Cygnus autonomous milestone and recent analyst upgrades have put the spotlight back on long-term growth. This is reflected in a robust 20% total return in the last year and an impressive 114% total shareholder return over five years.

If Northrop’s success in advanced space tech caught your attention, you might want to see which other aerospace and defense players are making waves. See the full list for free.

But with shares sitting near new highs and bullish analyst upgrades stacking up, investors have to wonder: is Northrop Grumman undervalued, or is the market already factoring in all of its future growth potential?

Most Popular Narrative: Fairly Valued

Northrop Grumman’s latest close at $623.49 is just above the narrative’s fair value estimate of $615.56. This highlights an unusually tight gap and suggests the stock may be approaching a consensus equilibrium.

Accelerating U.S. and allied defense spending, supported by substantial increases in procurement and RDT&E budgets (for example, a 22% increase in U.S. spending for FY26) and significant new funding for key Northrop Grumman programs (B-21, Sentinel, and E-2D), is expected to drive sustained revenue growth and provide multi-year order visibility.

Want to see what’s fueling this price? One hidden prediction stands out: optimistic revenue growth tied to historic government budgets and blockbuster defense contracts. Wondering which financial dominoes must fall perfectly into place? Find out which numbers could tip the scales and drive this tight valuation call.

Result: Fair Value of $615.56 (ABOUT RIGHT)

However, heavy dependence on large U.S. defense contracts and potential shifts in political priorities could threaten the growth outlook if key programs face delays or cuts.

Another View: What Do Earnings Multiples Say?

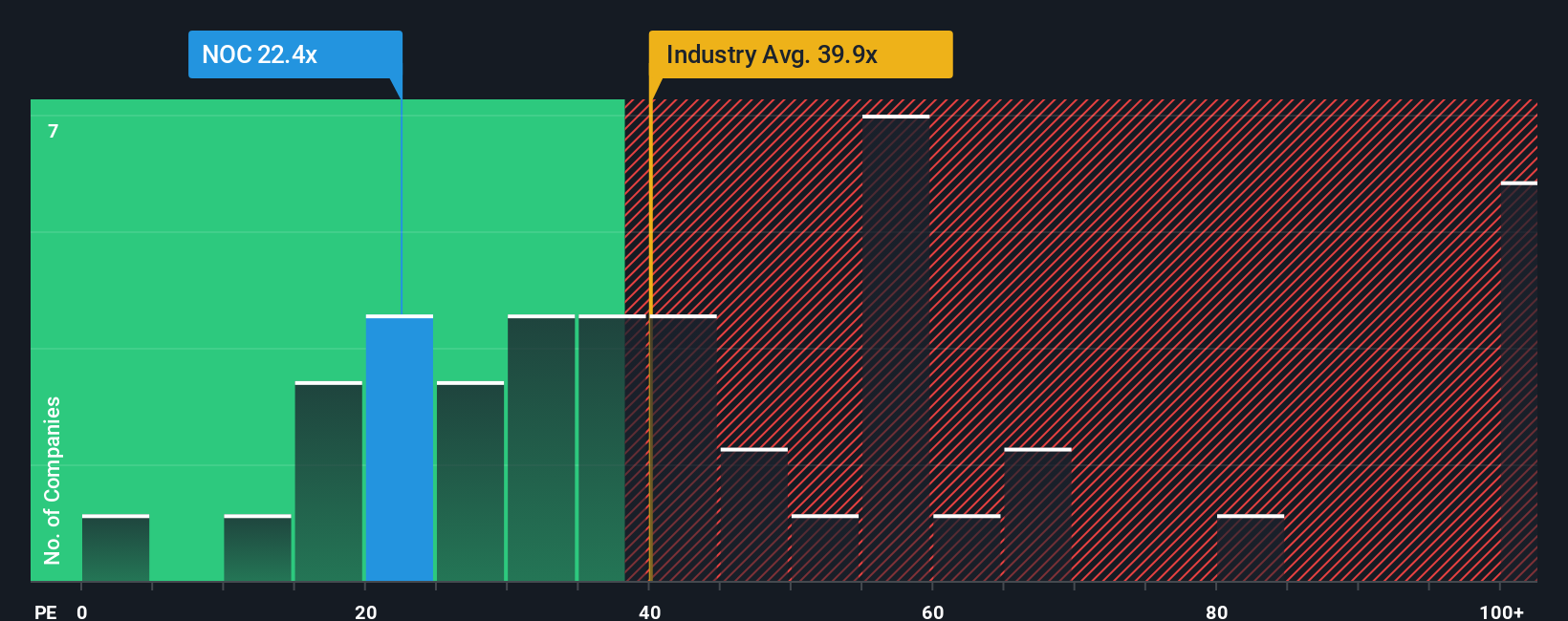

Looking at Northrop Grumman’s value through the lens of its current price-to-earnings ratio, there appears to be a strong case for relative value. At 22.6x, it remains well below the industry average of 39.2x and is less than that of similar peers at 36.1x. It is also under the fair ratio of 26.5x, suggesting that the market is not pricing in the same optimism found elsewhere in defense. This gap could signal either opportunity or caution, depending on whether you believe earnings momentum will continue. Is the market still too skeptical, or is there a catch yet to emerge?

Build Your Own Northrop Grumman Narrative

If you want to check the facts for yourself or have a different take, building your own custom narrative takes less than three minutes. So why not Do it your way?

A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more can’t-miss investment ideas?

Smart investing means staying ahead of the next trend. Act now and tap into powerful opportunities beyond Northrop Grumman with these focused market themes:

- Boost your search for uniquely undervalued stocks by using these 900 undervalued stocks based on cash flows. Rising companies with overlooked potential can be quickly identified.

- Unlock the edge of healthcare innovation by accessing these 32 healthcare AI stocks. This features pioneers leveraging artificial intelligence to transform patient outcomes and reshape the industry.

- Target future income streams and resilient returns by checking out these 19 dividend stocks with yields > 3%. Discover a well-vetted collection of companies offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.