Please use a PC Browser to access Register-Tadawul

Not Many Are Piling Into Pulmonx Corporation (NASDAQ:LUNG) Stock Yet As It Plummets 29%

pulmonx LUNG | 2.53 | +0.80% |

The Pulmonx Corporation (NASDAQ:LUNG) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

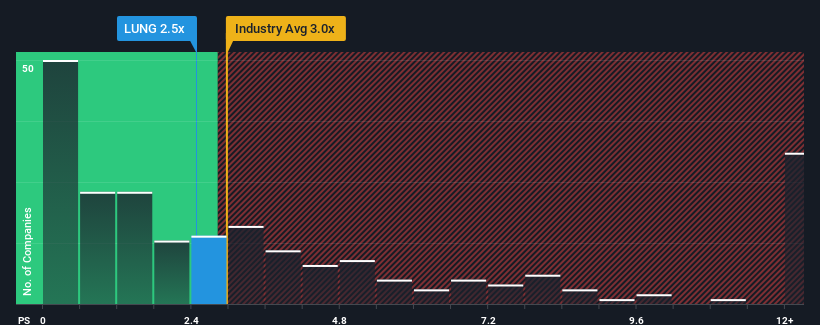

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Pulmonx's P/S ratio of 2.5x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in the United States is also close to 3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Pulmonx's Recent Performance Look Like?

Pulmonx certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Pulmonx will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Pulmonx's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 9.2% per annum growth forecast for the broader industry.

With this information, we find it interesting that Pulmonx is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Pulmonx's P/S?

Following Pulmonx's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Pulmonx currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If these risks are making you reconsider your opinion on Pulmonx, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.