Please use a PC Browser to access Register-Tadawul

NRG Energy, Inc.'s (NYSE:NRG) Shares Leap 40% Yet They're Still Not Telling The Full Story

NRG Energy, Inc. NRG | 161.44 | -5.39% |

NRG Energy, Inc. (NYSE:NRG) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

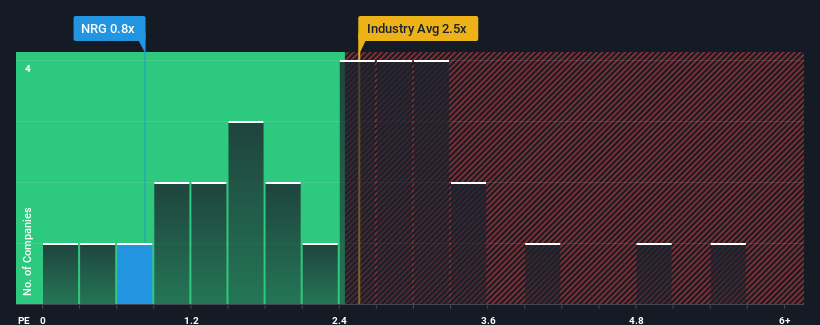

Although its price has surged higher, considering around half the companies operating in the United States' Electric Utilities industry have price-to-sales ratios (or "P/S") above 2.5x, you may still consider NRG Energy as an solid investment opportunity with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

We've discovered 1 warning sign about NRG Energy. View them for free.

What Does NRG Energy's Recent Performance Look Like?

While the industry has experienced revenue growth lately, NRG Energy's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NRG Energy.Do Revenue Forecasts Match The Low P/S Ratio?

NRG Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.4%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.0% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.6% per year, which is not materially different.

In light of this, it's peculiar that NRG Energy's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From NRG Energy's P/S?

Despite NRG Energy's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of NRG Energy's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

If these risks are making you reconsider your opinion on NRG Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.