Please use a PC Browser to access Register-Tadawul

Nvent Electric (NVT) Margin Expansion Reinforces Bullish Critical Infrastructure Narrative

nVent Electric plc NVT | 116.87 | -0.01% |

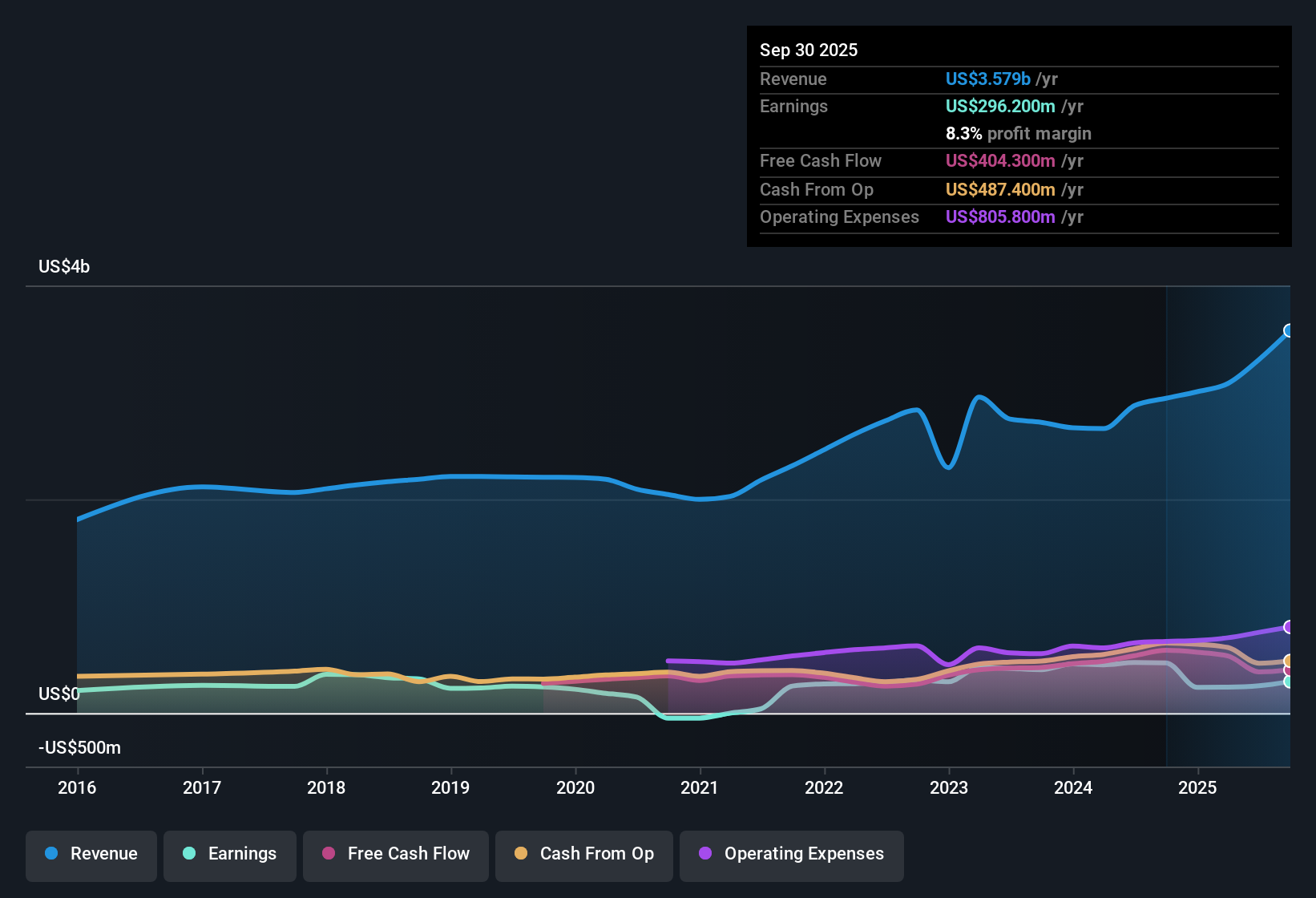

nVent Electric (NVT) has reported a busy FY 2025, with Q4 revenue of US$1.1b, basic EPS of US$0.72 and trailing 12 month earnings growth of 77.9% supported by a net profit margin of 11% versus 8% a year ago. The company has seen revenue move from US$3.0b to US$3.9b on a trailing 12 month basis, while EPS over that same window has shifted from US$1.46 to US$2.64, setting a clear earnings and margin story for investors watching this latest print.

See our full analysis for nVent Electric.With the numbers on the table, the next step is to see how this earnings profile lines up with the big narratives around nVent Electric, and where the recent margin performance either supports or challenges those views.

TTM earnings reach US$428.5m on higher margin base

- Over the last twelve months, nVent Electric generated US$3.9b in revenue and US$428.5m in net income from continuing operations, which lines up with the 11% net margin cited in the summary.

- What stands out for the more bullish view is that this 77.9% earnings growth and 11% margin profile sit within a business often framed as a “critical infrastructure enabler”, supplying connection and protection gear that ties into long term electrification and data center themes.

- Supporters point to multi year earnings compounding of about 19.5% per year and the TTM EPS of US$2.64 as evidence that profit growth has kept pace with that story.

- At the same time, the Q1 FY 2025 net income from continuing operations of US$87m versus US$115.8m in Q4 shows that results can move around within the year, which keeps the bullish argument tied closely to execution each period.

Quarterly revenue climbs from US$809.3m to US$1.1b in FY 2025

- Within FY 2025, quarterly revenue stepped from US$809.3m in Q1 to US$963.1m in Q2, US$1,054m in Q3 and US$1,066.7m in Q4, while quarterly basic EPS ranged between US$0.53 and US$0.74 across those same periods.

- Critics who focus on valuation risks argue that this revenue and EPS profile has to work hard to justify a P/E of 42.4x, which is above both the peer average of 36.4x and the industry’s 34.8x.

- The shares trade at US$112.64 compared with a stated DCF fair value of US$91.02, and revenue is only forecast to grow about 6.4% per year versus a cited 10.2% for the broader US market.

- Those bears highlight that, with earnings forecast to grow around 19.6% per year instead of at extremely high rates, the premium multiples leave little room if future profit delivery does not stay close to those projections.

Discontinued operations add US$281.7m to TTM figures

- Earnings from discontinued operations contributed US$281.7m over the last twelve months, including a sharp Q1 FY 2025 contribution of US$273.7m, compared with US$91m a year earlier on the same trailing basis.

- What is interesting for the more optimistic angle is that even if you mentally separate these discontinued earnings, the business generated TTM net income from continuing operations of US$428.5m on US$3.9b of revenue, which still supports the view of nVent as a “critical infrastructure backbone” rather than a one off story.

- Supportive investors point out that TTM basic EPS of US$2.64 compares with US$1.46 a year earlier, while the net margin moved from 8% to 11% over the same stretch, which heavily supports the bullish case that the core operations are pulling more weight.

- On the other hand, the very large one time boost from discontinued operations in Q1 means anyone leaning bullish still has to separate recurring profit from one off items when they think about how sustainable this profile is.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on nVent Electric's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

nVent Electric’s premium P/E of 42.4x versus peers and its current share price above the stated DCF fair value leave limited room if expectations slip.

If that kind of valuation stretch makes you uneasy, take a look at 53 high quality undervalued stocks to find ideas where pricing and fundamentals may feel more comfortable today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.