Please use a PC Browser to access Register-Tadawul

Nvidia Earnings Preview: Goldman Sachs Sets ‘Optimistic’ Price Target at $236, Representing 89% Upside Potential – Full Analysis for You

NVIDIA Corporation NVDA | 175.02 | -3.27% |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 292.04 | -4.20% |

Arm Holdings ARM | 130.89 | -3.86% |

QUALCOMM Incorporated QCOM | 178.29 | -1.64% |

Broadcom Limited AVGO | 359.93 | -11.43% |

Nvidia, the "AI giant," is set to release its Q2 FY2025 earnings report after the U.S. stock market closes on August 28th.

According to market data, Nvidia has surpassed market expectations in 7 out of the past 8 quarters for both revenue and earnings per share (EPS). Following earnings announcements, the stock price has shown an average movement of ±9.03%, with the highest gain being +24.38% and the largest decline being -2.46%. Notably, Nvidia's stock tends to rise on the day of the earnings release.

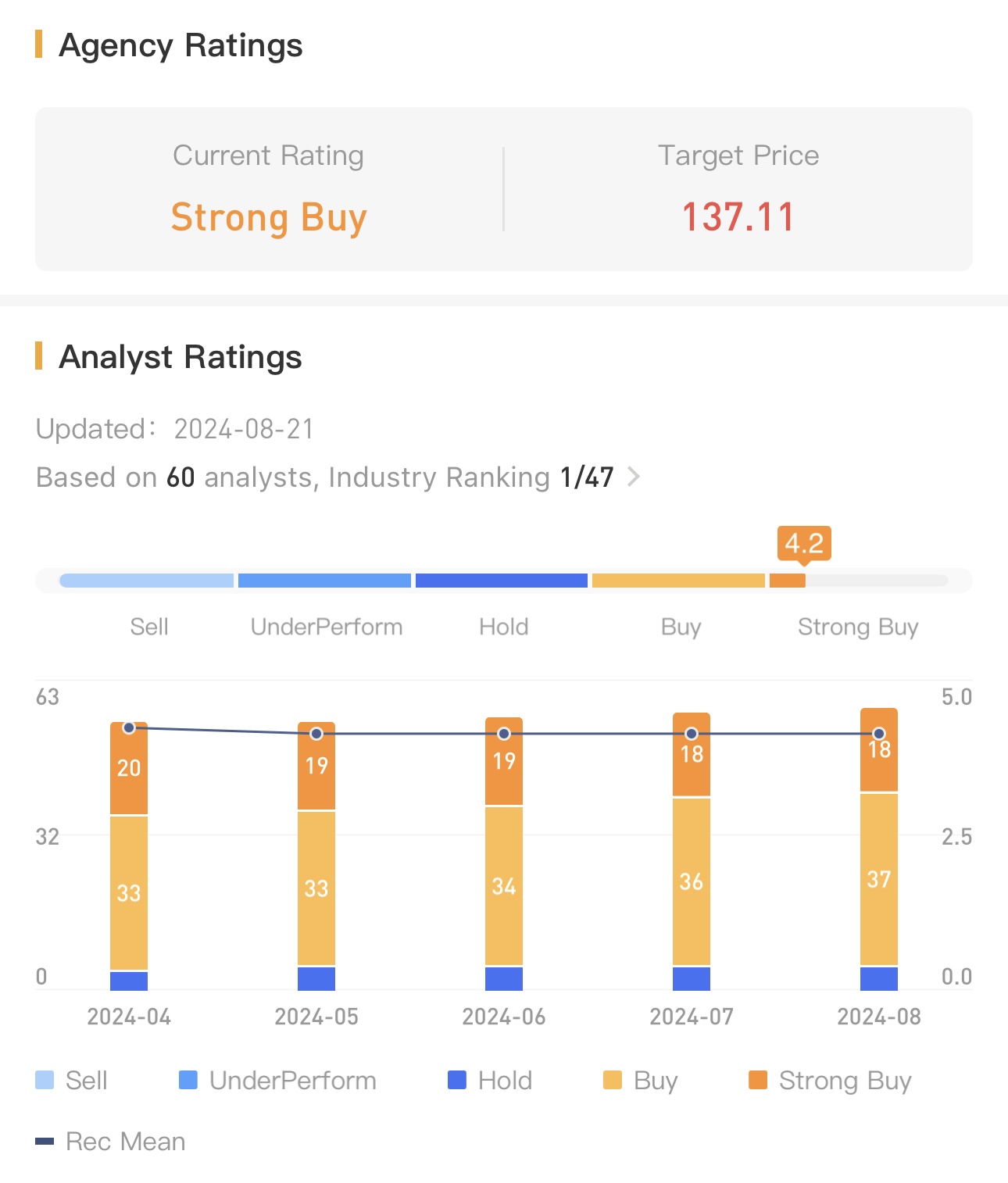

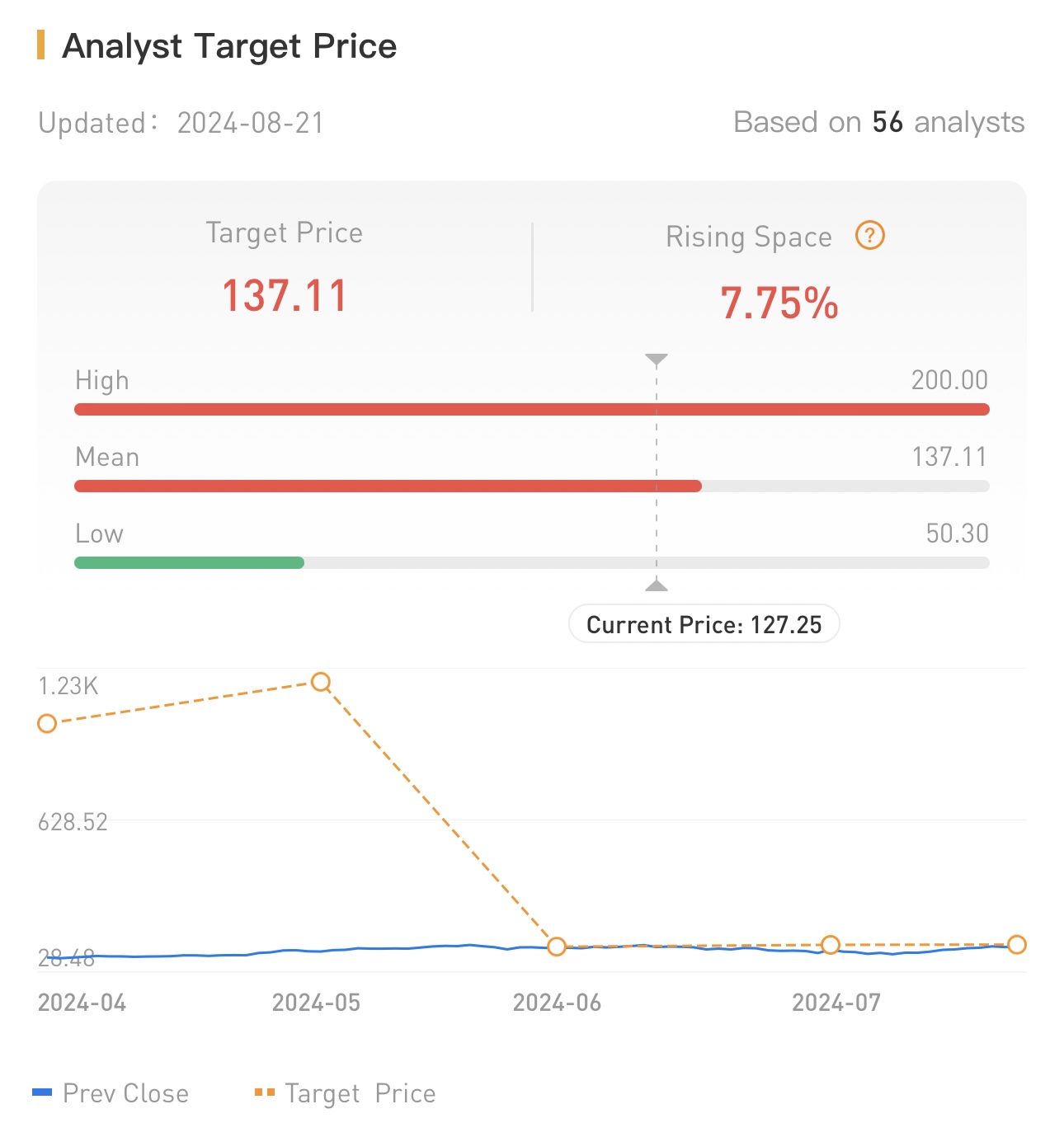

According to Bloomberg analysts, NVIDIA Corporation(NVDA.US)'s Q2 FY2025 revenue is expected to reach $28.69 billion, representing a year-over-year increase of 112%. Adjusted net profit is projected to be $15.9 billion, a 136% year-over-year rise, with earnings per share (EPS) anticipated at $0.60, up 143% from the previous year. Currently, 55 analysts have rated the stock as a "Buy," with an average target price of $137.11.

Last quarter, driven by strong demand for AI chips, Nvidia's data center revenue soared to $22.6 billion, a record high, with a quarter-over-quarter increase of 23% and a year-over-year growth of 427%. The company announced plans to expand its partnerships with Amazon.com, Inc.(AMZN.US) AWS, Google (Alphabet Inc. Class A(GOOGL.US)) Cloud, Microsoft Corporation(MSFT.US), and Oracle Corporation(ORCL.US) to further advance generative AI innovation. During the earnings call, Nvidia's founder and CEO, Jensen Huang, revealed that the next-generation Blackwell superchips are in full production, and significant Blackwell chip revenue is expected this year.

Reflecting on Nvidia's stock performance post-split, the initial delay in delivering Blackwell chips and subsequent market panic led to the stock price dropping to $90.69 per share, a 25.88% decline from its previous peak. However, Nvidia's stock has shown a strong recovery, rebounding over 21% from its lowest point and nearing its previous all-time high. As AI spending continues to surge, will Nvidia's Q2 earnings report sustain this momentum and drive the stock price higher? Let’s delve into further analysis.

Boost from Goldman Sachs: Nvidia's FY2025 Earnings Expected to Surpass Market Expectations

Ahead of Nvidia's upcoming Q2 earnings release, Goldman Sachs projects that the company's revenue and EPS will reach $29.769 billion and $0.68, respectively, exceeding market expectations by 4.1% and 5.9%. Goldman also forecasts Nvidia's FY2025 EPS to surpass market expectations by 11%, supported by strong growth in data center revenue and robust operating leverage.

The data center business, a core growth driver for Nvidia, is expected to achieve significant growth. Goldman Sachs predicts that revenue from this segment will surge from $11.05 billion in FY2023 to $154.25 billion in FY2025, representing a compound annual growth rate of 140%. While the delay in Blackwell chip shipments has caused short-term volatility, management commentary and supply chain data suggest that this delay will not significantly impact long-term profitability. Concerns over the Blackwell delay are expected to ease, with data center growth driven by strong demand for Hopper architecture GPUs (H100, H200), early Blackwell product shipments, and the expansion of networking services.

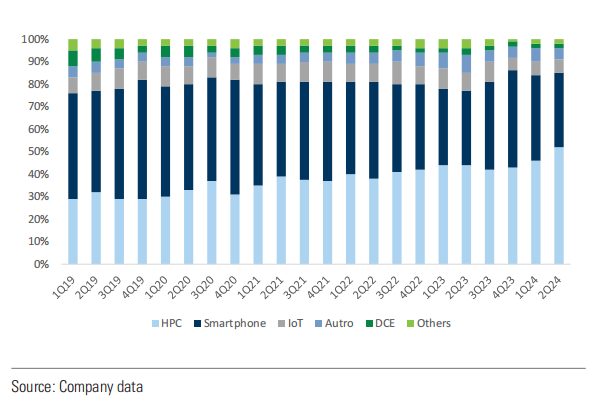

Additionally, major cloud service providers and enterprises continue to demonstrate strong demand for AI infrastructure. For example, Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) has reported consecutive growth in high-performance computing (HPC) revenue, with HPC now accounting for over half of total revenue, signaling strong AI demand.

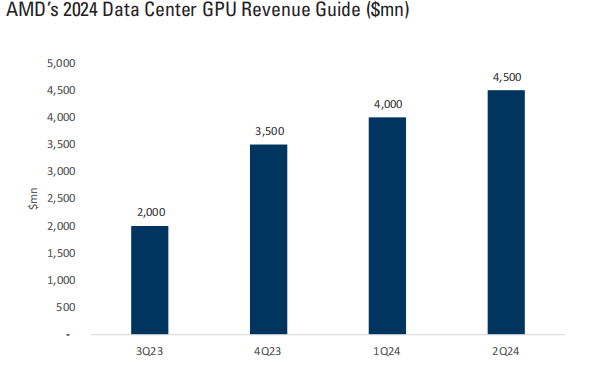

Furthermore, Advanced Micro Devices, Inc.(AMD.US) has raised its revenue expectations for its data center GPU business, reflecting growing market demand for such products. AMD has raised its data center GPU revenue forecast three times over the past year, from $2 billion to $4.5 billion. As a key player in AI hardware, this trend signals a positive industry outlook for Nvidia.

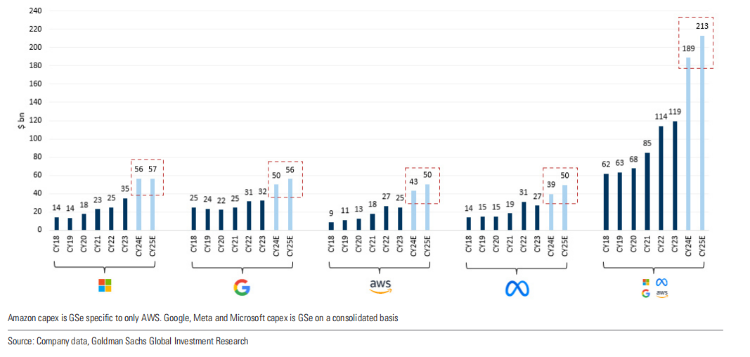

U.S. hyperscale companies have also indicated plans to increase their investments in AI infrastructure. These companies are preparing to ramp up capital expenditures to meet rising AI and cloud product demand, a favorable trend for Nvidia's data center business, given that these companies are key Nvidia clients. For instance, Alphabet plans to increase capital spending in 2024 and 2025 to support AI and cloud business growth. Similarly, Amazon and Microsoft have committed to continued investments in AI infrastructure.

Despite export restrictions, China remains a crucial market for Nvidia. While the delay in Blackwell chips may impact demand in China, overall demand remains strong, particularly for the H20 GPU, which is customized for the Chinese market. The market is keen to hear from Nvidia's management during the earnings call on topics such as evolving customer interest in the H20 GPU, competition with domestic solutions like those from Huawei, and the timeline for the release of B20 (Blackwell architecture GPU) in China.

While Nvidia's data center business has garnered significant attention, the gaming segment remains an important revenue source. Goldman Sachs expects Nvidia's gaming division to achieve double-digit growth in FY2025 and FY2026, driven by the continued transition to and upgrades of the Ada Lovelace architecture, along with advancements in generative AI-related services. Specifically, gaming revenue is projected to increase from $9.25 billion in FY2023 to $14.57 billion in FY2026, representing a compound annual growth rate of 16.4%.

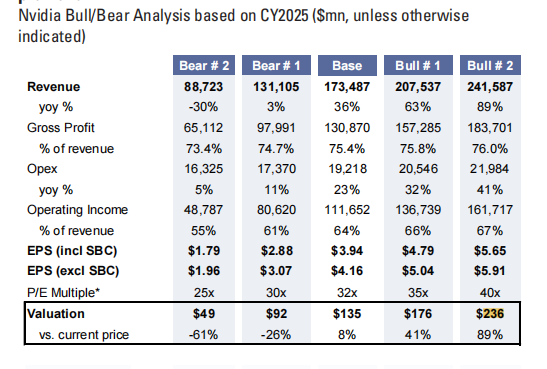

From a valuation perspective, Goldman Sachs believes that Nvidia currently has a favorable risk/reward ratio. The stock is trading at 42 times the consensus EPS (earnings per share) for the next 12 months, with a premium of only 46%, which is significantly lower than the 151% median premium over the past three years.

Based on its latest bull-bear analysis framework, Goldman Sachs estimates that in the most optimistic scenario, Nvidia's stock price could rise by 89% to $236. In the most pessimistic scenario, if data center revenue declines, the stock could drop by 61% to $49.

Investment Focus: Key Stocks and ETFs to Watch Ahead of Nvidia’s Q2 Earnings

As Nvidia's Q2 earnings report approaches, here are some related companies in Nvidia's ecosystem that investors may want to keep an eye on:

- Chips: Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US), Arm Holdings Ltd.(ARM.US), QUALCOMM Incorporated(QCOM.US), Broadcom Limited(AVGO.US), Advanced Micro Devices, Inc.(AMD.US), Marvell Technology Group Ltd.(MRVL.US), Analog Devices, Inc.(ADI.US)

- Semiconductor Equipment: Applied Materials, Inc.(AMAT.US), Lam Research Corporation(LRCX.US), KLA-Tencor Corporation(KLAC.US), Teradyne, Inc.(TER.US), ASML Holding NV ADR(ASML.US)

- Utilities/Power Solutions: Vistra Energy Corp.(VST.US), NRG Energy, Inc.(NRG.US), First Solar, Inc.(FSLR.US), Enphase Energy, Inc.(ENPH.US)

- Servers: Dell Technologies Inc.(DELL.US), Super Micro Computer, Inc.(SMCI.US)

- Software: Microsoft Corporation(MSFT.US), Alphabet Inc. Class A(GOOGL.US), Meta Platforms(META.US), Nutanix, Inc. Class A(NTNX.US), Palantir Technologies(PLTR.US)

- Data Storage: Pure Storage, Inc. Class A(PSTG.US), Western Digital Corporation(WDC.US), Seagate Technology PLC(STX.US)

- Networking: Arista Networks, Inc.(ANET.US), NetApp, Inc.(NTAP.US)

- Electronic Components: Flextronics International Ltd.(FLEX.US), Amphenol Corporation Class A(APH.US)

- Thermal Management/Cooling: VERTIV HOLDINGS LLC(VRT.US), nVent Electric plc Ordinary Shares(NVT.US)

- Copper/Fiber: Southern Copper Corporation(SCCO.US), Corning Incorporated(GLW.US), Freeport-McMoRan, Inc.(FCX.US)

For investors willing to take on higher risk in pursuit of greater returns, leveraged ETFs that are bullish on Nvidia could be a compelling option. The largest and most liquid among them is GraniteShares 2x Long NVDA Daily ETF(NVDL.US), while T-Rex 2X Long NVIDIA Daily Target ETF(NVDX.US) has delivered the most outstanding performance this year, with a return exceeding 418%.

On the other hand, for those looking to bet against Nvidia, there are several inverse leveraged ETFs available, including: T-Rex 2X Inverse NVIDIA Daily Target ETF(NVDQ.US), GraniteShares 2x Short NVDA Daily ETF(NVD.US), Direxion Shares ETF Trust Direxion Daily NVDA Bear 1X Shares(NVDD.US), and Investment Managers Series Trust II AXS 1.25X NVDA Bear Daily ETF(NVDS.US).

- Reporting by Zaid, Sahm News team