Please use a PC Browser to access Register-Tadawul

O-I Glass (OI) Q4 Loss Of US$138 Million Tests Bullish Margin Improvement Narrative

O-I Glass Inc OI | 15.38 | +1.45% |

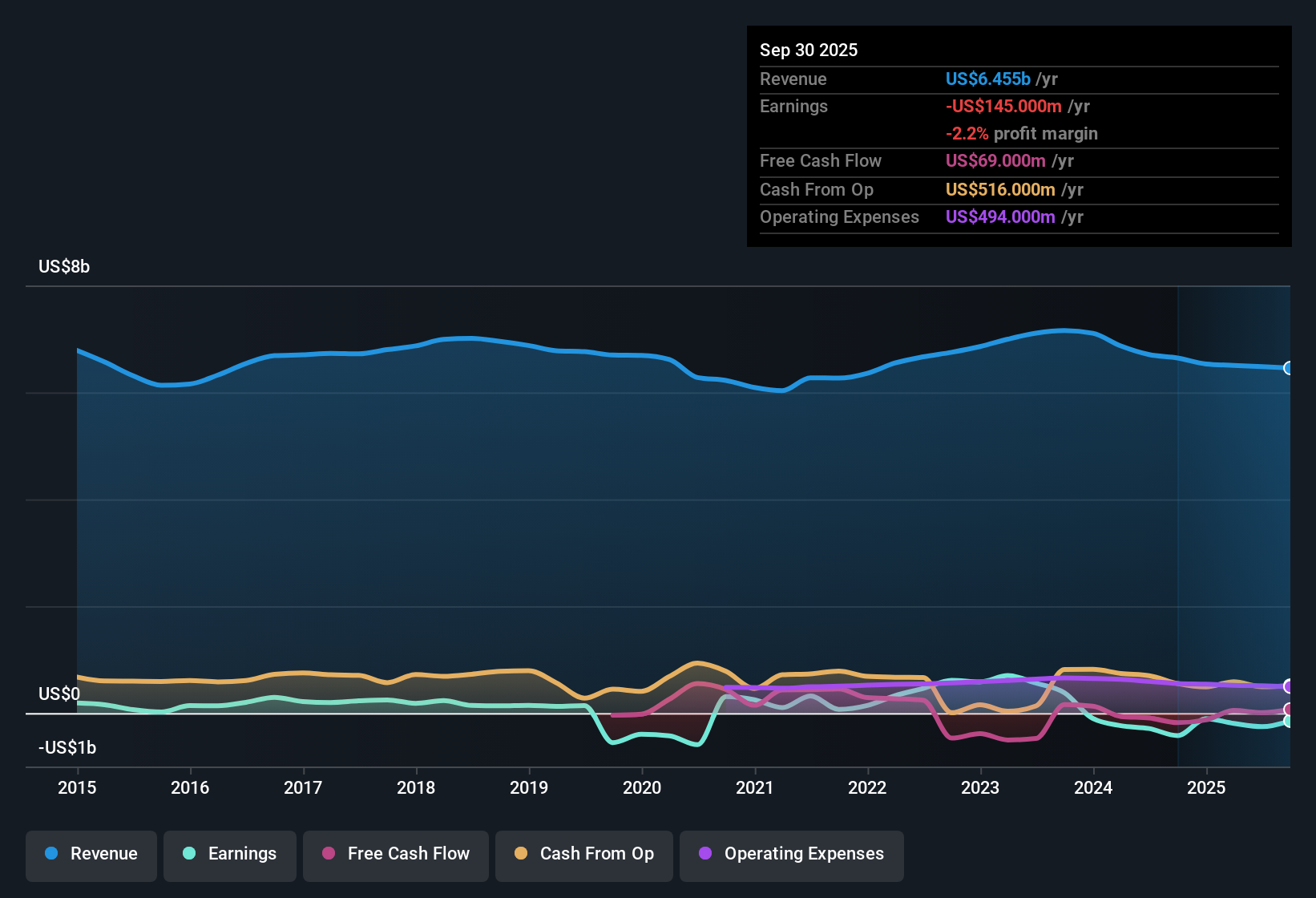

O-I Glass (NYSE:OI) has just posted its FY 2025 results, reporting Q4 revenue of US$1.5 billion and a basic EPS loss of US$0.90, alongside trailing 12 month revenue of US$6.4 billion and a basic EPS loss of US$0.84. Over recent quarters the company has seen revenue move from US$1.53 billion in Q4 2024 to US$1.5 billion in Q4 2025. Quarterly EPS has ranged from a loss of US$1.00 in Q4 2024 to a profit of US$0.20 in Q3 2025, before returning to a loss in the latest period. As a result, the spotlight is now on how much of that revenue is translating into sustainable margins and how quickly those margins might repair from here.

See our full analysis for O-I Glass.With the latest numbers on the table, the next step is to see how this earnings profile lines up against the widely shared narratives about O-I Glass, and where the data pushes back on those stories.

TTM losses still at US$129 million

- Over the last 12 months, O-I Glass booked a net loss of US$129 million on about US$6.4b of revenue, with trailing basic EPS at a loss of US$0.84.

- Consensus narrative talks about cost savings and margin improvement, yet the trailing numbers still show losses:

- Net income over the last four quarters stayed in the red, ranging from a loss of US$194 million to a loss of US$129 million, which sits uncomfortably against the idea of a cleaner earnings base already in place.

- The same narrative expects margins to rise toward 5.7% in a few years. The current loss position means a lot of that improvement still has to come through the income statement.

Quarterly swing from US$30 million profit to US$138 million loss

- In FY 2025, net income moved from a profit of US$30 million in Q3 to a loss of US$138 million in Q4, with basic EPS flipping from a profit of US$0.20 to a loss of US$0.90.

- Bulls point to programs like Fit to Win and premiumization as drivers of steadier margins, but the quarterly pattern is still uneven:

- Within the year, net income excluding extra items ranged from a small loss of US$5 million in Q2 to a US$138 million loss in Q4, which does not yet look like the smoother earnings path bullish views often assume.

- At the same time, Q4 FY 2024 showed a US$154 million loss. Bulls may argue the latest Q4 is at least in the same band while they wait for the expected cost savings to show up more consistently.

Cheap 0.4x P/S versus modest 2% revenue growth

- The stock trades at about 0.4x trailing sales on roughly US$6.4b of revenue, while revenue growth is described as about 2% per year, below the 10.4% pace cited for the broader US market.

- Bears focus on slow top line growth and interest coverage as reasons that a low multiple may be warranted:

- Trailing 12 month revenue has hovered between US$6.4b and US$6.6b, and the company stayed loss making, which lines up with the cautious view that glass packaging faces pressure from substitutes and softer demand in some regions.

- Interest payments are flagged as not well covered by earnings, so even with a low 0.4x P/S and a DCF fair value of about US$40.98 in the data, critics question how quickly the company can move from that modest 2% revenue growth to the earnings levels implied by higher valuations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for O-I Glass on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this story does not quite match your view, shape your own take in just a few minutes and Do it your way.

A great starting point for your O-I Glass research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

O-I Glass is still loss making with uneven quarterly earnings, interest coverage concerns and only modest 2% revenue growth, which keeps risk firmly in focus.

If that mix of ongoing losses and interest pressure feels uncomfortable, take a look at 85 resilient stocks with low risk scores to find businesses built around more resilient risk profiles right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.