Please use a PC Browser to access Register-Tadawul

Okta (OKTA) Valuation Check As PGA Of America Partnership Highlights Its Identity And AI Security Role

Okta, Inc. Class A OKTA | 81.11 | -1.64% |

Okta (OKTA) shares are back in focus after the company expanded its relationship with the PGA of America, a move that ties its identity platform directly to fan and member digital experiences.

Those PGA and AI security headlines arrive at a time when Okta’s short term share price performance has been mixed, with a 30 day share price return of a 4.39% decline and a 90 day share price return of a 3.04% gain. Over a longer horizon, the 1 year total shareholder return of a 9.71% decline contrasts with a 3 year total shareholder return of 16.70%, indicating momentum that has cooled compared with earlier years.

If this identity and AI story has your attention, it could be a good moment to see what else is happening in the space with our screener of 57 profitable AI stocks that aren't just burning cash.

With Okta trading at US$88.18 and screening on some models at roughly a 37% intrinsic discount, plus a gap to the average analyst target, you have to ask: is this a genuine opportunity, or is future growth already priced in?

Most Popular Narrative: 40.4% Undervalued

Okta’s most followed valuation narrative pegs fair value at $147.87 versus the last close at $88.18, a wide gap that raises big questions about what growth and margins that scenario is baking in.

Okta has a solid foundation: a technically brilliant solution, a strong market position and a recurring revenue model. But to be truly successful, Todd McKinnon needs to take strategic risks and further develop the business model. It is not enough to have a better solution than the competition. The key is to find a business model that solves a “problem” for customers so elegantly that they are willing to pay for it, and to do so profitably. CrowdStrike and Okta offer exciting opportunities in this context. A more intensive collaboration or even a merger could strengthen both companies and create a market giant that could have a lasting impact on the security market. The next step is the most difficult, but also the most important. Todd McKinnon and Okta have the opportunity to become a sustainable and profitable company. It is now a matter of seizing this opportunity.

The fair value here leans heavily on rising profitability, expanding margins and a future earnings multiple that assumes Okta earns a premium slot among security leaders. It raises questions about which specific growth path and margin profile underpin that $147.87 number, and how long that ramp is projected to take.

Result: Fair Value of $147.87 (UNDERVALUED)

However, this hinges on Okta sustaining profitability and addressing issues like the net retention rate trend, which could challenge the case for a premium earnings multiple.

Another View: Earnings Multiple Paints a Tougher Picture

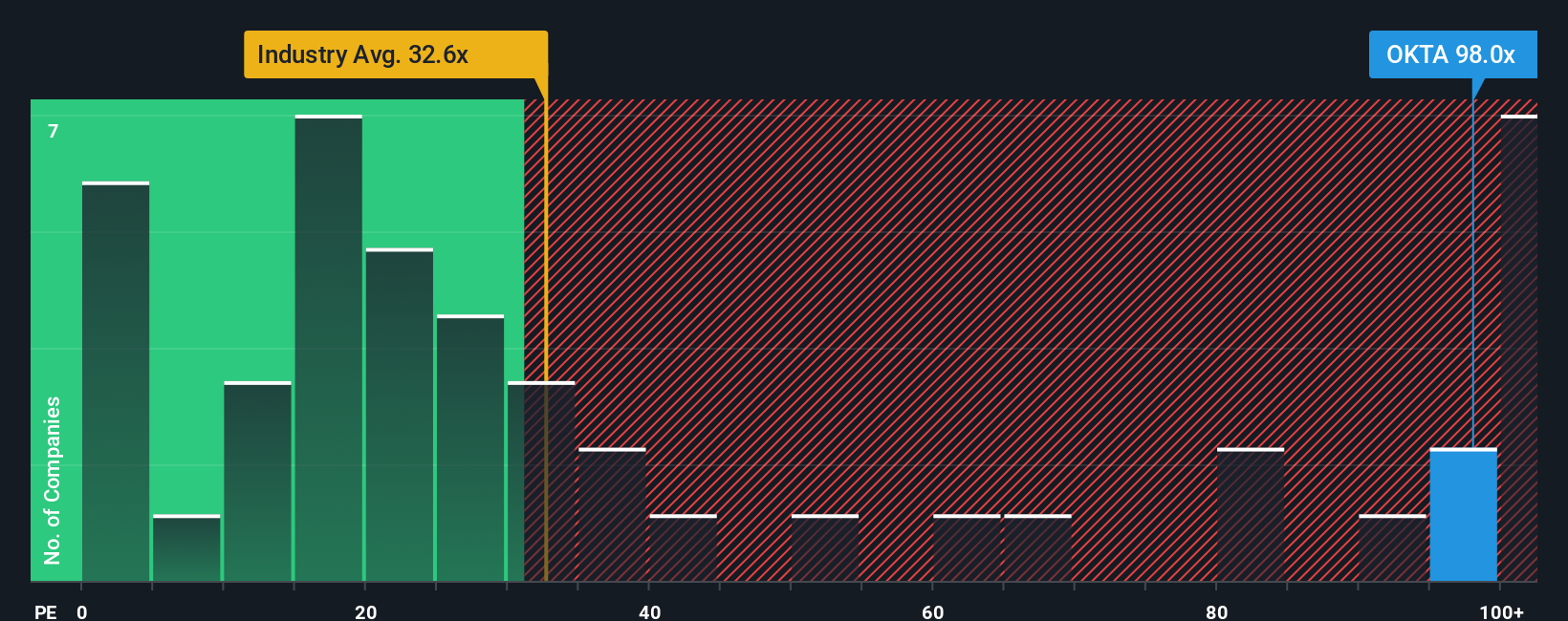

That $147.87 fair value and 40.4% undervaluation story runs into a very different signal when you look at the earnings multiple. Okta trades on a P/E of 80.1x, while the US IT industry sits at 26.6x and peers average 30.6x, with a fair ratio of 35.1x.

In plain terms, the share price already implies a much richer earnings profile than sector norms, which could mean less room for error if margins or growth assumptions fall short. The question for you is whether those extra turns of P/E reflect justified confidence or valuation risk.

Build Your Own Okta Narrative

If you see the numbers differently or want to stress test your own data driven view, you can build a personal Okta story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

If Okta has you thinking differently about your portfolio, this is the moment to line up a few more high conviction ideas before the market moves on.

- Target quality at a discount by checking out our list of 52 high quality undervalued stocks that combine solid fundamentals with prices that may not fully reflect their strengths.

- Strengthen your income stream by reviewing our hand picked 14 dividend fortresses that focus on higher yields with an eye on resilience.

- Reduce potential shocks by scanning our carefully filtered 83 resilient stocks with low risk scores designed for investors who want steadier compounding and fewer surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.