Please use a PC Browser to access Register-Tadawul

Okta (OKTA): Valuation Insights as Pre-Earnings Optimism and Fed Signals Fuel Stock Rally

Okta OKTA | 90.09 | +2.14% |

If you own shares of Okta (OKTA) or have it on your watch list, the current setup may have you leaning in for a closer look. Ahead of its second-quarter earnings announcement, the stock jumped over 3% as investors digested two key factors: fresh optimism around Okta’s upcoming results and a market-wide rally triggered by hints of possible interest rate cuts from the Federal Reserve. Simply put, investors seem energized by the growing buzz that Okta might deliver a strong update and that tech stocks could benefit from a more supportive policy environment.

This move stands out against a year of ups and downs for Okta. After a solid run earlier in the year, shares are up roughly 17% in 2025, despite recent volatility and turbulence surrounding economic data and competition from big names like Microsoft and SentinelOne. Short-term swings have made Okta’s stock anything but a smooth ride, but the combination of double-digit revenue growth, new AI-powered security products, and a strong partner network is fueling some cautious optimism. Investors are especially attentive to the upcoming results and any guidance for the rest of the year.

So, is Okta’s recent pop a real window of opportunity, or has the market already factored in all of its future growth prospects? Let’s dig into the numbers and see where the valuation stands.

Most Popular Narrative: 37.7% Undervalued

According to the most popular narrative by Tokyo, Okta is currently trading well below its fair value. This suggests there could be room for upside if key milestones are achieved. The narrative projects that the company’s stock offers a compelling opportunity but notes that success depends on pivotal decisions in the near future.

Okta has a solid foundation with a technically brilliant solution, a strong market position, and a recurring revenue model. However, to achieve greater success, Todd McKinnon needs to take strategic risks and further develop the business model. Having a superior solution compared to the competition is not enough. The key is to find a business model that addresses a “problem” for customers in such an effective way that they are willing to pay for it—and to do so profitably.

Curious why this narrative considers Okta to be so deeply undervalued? There is more to this story than headline numbers. Important profit assumptions, ambitious future multiples, and a vision for a significant market shift all support the calculation. Interested in the reasoning behind these projections and the essential next steps the market is watching? Explore further to see what informs this new fair value estimate.

Result: Fair Value of $147.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing margin pressure and potential declines in customer retention could quickly challenge the optimistic outlook for Okta’s valuation story.

Find out about the key risks to this Okta narrative.Another View: What Do Market Ratios Say?

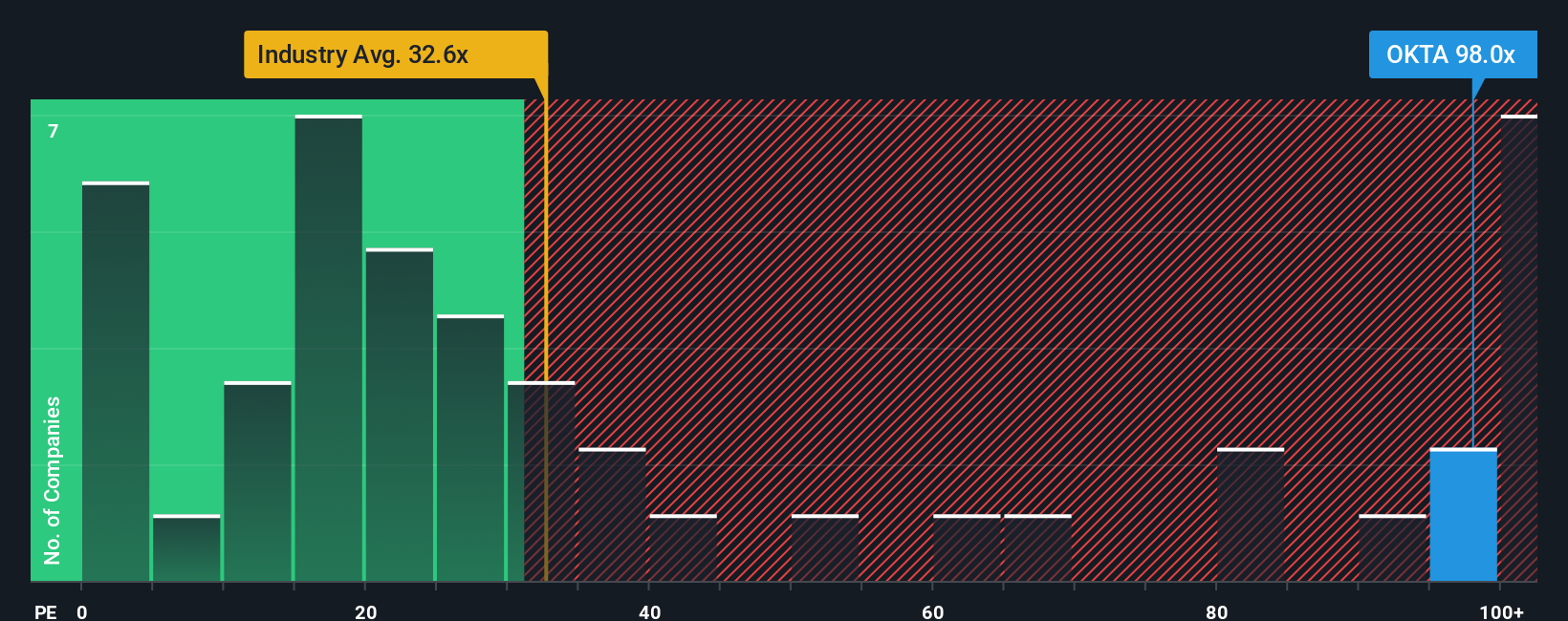

While the narrative suggests Okta is attractively priced, a look through the lens of earnings multiples offers a reality check. Compared to others in the sector, Okta’s valuation based on this measure appears far less generous. This market perspective may reveal risks that models might miss, or sentiment could be holding the stock back.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If you want to take a different angle or see the data with fresh eyes, it only takes a few minutes to build your own view. do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okta.

Looking for More Standout Investment Opportunities?

Why stop at just one stock? Smart investors regularly scan the horizon for tomorrow’s breakout opportunities. Use the Simply Wall Street Screener to explore a universe of compelling stocks with financial strength, rapid innovation, and resilient long-term performance. Here are a few hand-picked ideas you will not want to miss:

- Uncover income potential by targeting companies with reliable yields over 3% through our list of dividend stocks with yields > 3% and build a defensive income stream for your portfolio.

- Catch the next wave of tech disruption by spotting emerging leaders in quantum computing stocks, where quantum breakthroughs could reshape entire industries.

- Ride the momentum of AI in healthcare by seeking out top healthcare AI stocks, harnessing smart innovation for better patient outcomes and powerful growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.